Is Capitulation Finally Settling In?

Geopolitical shocks tend to be temporary, but current sentiment is the worst it's been since the COVID recession bottom.

While it feels like global stocks have been falling for a while (and they have for most of the year), last week marked a significant turning point in this correction.

Up until this point, utilities had been outperforming the broader market, but not to a huge degree. Treasury yields have continued moving higher in anticipation of what the Fed’s going to do later this year, not rallying strongly as investors move into safe havens. Gold has famously been perhaps the most stubborn asset class, staying relatively flat despite investors selling stocks and inflation rates exceeding 7%. This isn’t the type of behavior you typically see in a raging bear market.

Last week, however, marked the return of traditional bear market behavior. The S&P 500 fell by more than 1.5%, but look at how the traditionally defensive asset classes performed?

Long-term Treasuries gained more than 2.5%. Gold was up 4%. Utilities stocks returned nearly 5%. The dollar index, which tends to be the beneficiary of market participants seeking out dollar-denominated safe assets, is at its highest level since May 2020. This was a significant move by investors to take risk off the table here and could be an indicator that investors are no longer positioning themselves within risk asset classes. They’re exiting risk assets altogether.

The Russia/Ukraine conflict is the clear catalyst for what we’ve seen in the markets over the past month, but I have a couple of thoughts about where we’re at right now.

Geopolitical shocks are temporary

Adverse economic events tend to drag on for months, if not quarters. Adverse geopolitical events, however, tend to be much more short-term in nature. The immediate pain is often more severe, but the lasting effects tend to be minimal over the long-term.

Take, for example, the March 2021 attacks on Saudi Arabian oil fields. The drone strikes took multiple facilities offline and the initial fear was that there was no idea how long it would take for them to become operational again. WTI crude prices rose quickly from $60 to $66, which, believe it or not, was a really big move at the time. Soon after, the Saudis announced that the fields would come back online in a matter of days and oil prices sunk right back to $60.

It can come as a short-term shock and the immediate pain can often feel intense, but they also tend to resolve themselves quickly. The Russia/Ukraine conflict has taken a little longer to play out and there’s still no clear endgame. It’s important to point out that a traditional economic recession would be a slow boat to turn around. On the geopolitical front, the two sides could announce a cease-fire tomorrow and much of the short-term pain could be undone. Oil prices would dive. Investor sentiment (and likely stock prices) would shoot higher. The Fed would likely become more confident in its tightening plans. Things, such as inflation, would probably take longer to play out, but there would likely be a fairly sharp reversal of what’s happened thus far.

Oil is vulnerable to a significant pullback

This is sort of an extension of what I just discussed. WTI crude has risen from $100 to $125 in a matter of days. Those types of moves are usually overdone and unsustainable. In the near-term, I could see oil prices pulling back as long as governments agree not to sanction the Russian energy sector. In the longer-term, I can see oil prices pulling back a lot once a resolution has been agreed to.

Of course, oil could shoot to $150 if there’s a ban announced on Russian oil. The range of possible outcomes here is pretty wide. In the end, I see this conflict as likely to conclude before too long and that will trigger a return to more normal conditions, perhaps quickly.

The Fed will likely be forced to stay the course

The one fairly remarkable thing throughout this period has been the market’s steadfast belief that the Fed will raise rates aggressively in 2022. If you watch the Fed Funds futures market, the year-end expectations for rates are about at the exact same place as they were a month ago. Even from a week ago, they’re largely unchanged. The only real shift we saw was the expectation for a likely 50 basis point hike at the March meeting being tempered down to a standard 25 basis point hike. The longer-term forecast has remained largely intact.

It sure reads as if the market thinks the central bank will be forced to address inflation, economic or financial market consequences be damned. This is the corner that the Fed has painted itself into thanks to keeping conditions too loose for too long. Now, Jerome Powell is going to be forced to choose one path or another - addressing inflation but possibly ushering in a recession or inflating asset prices but letting inflation run wild - but not both. The markets believe it will be the former.

Recession risk in 2023 is high

I’m having difficulty picturing a scenario where the Fed tries to reign in inflation without sending the U.S. economy into a recession. Growth is already slowing. The 10Y/2Y Treasury yield spread is already down to 30 basis points. Plus, the Fed has a huge balance sheet and it hasn’t even made a single quarter-point rate hike yet. Perhaps Powell can pull a rabbit out of the hat here, but I just don’t see how.

With that being said, let’s look at the markets and some ETFs.

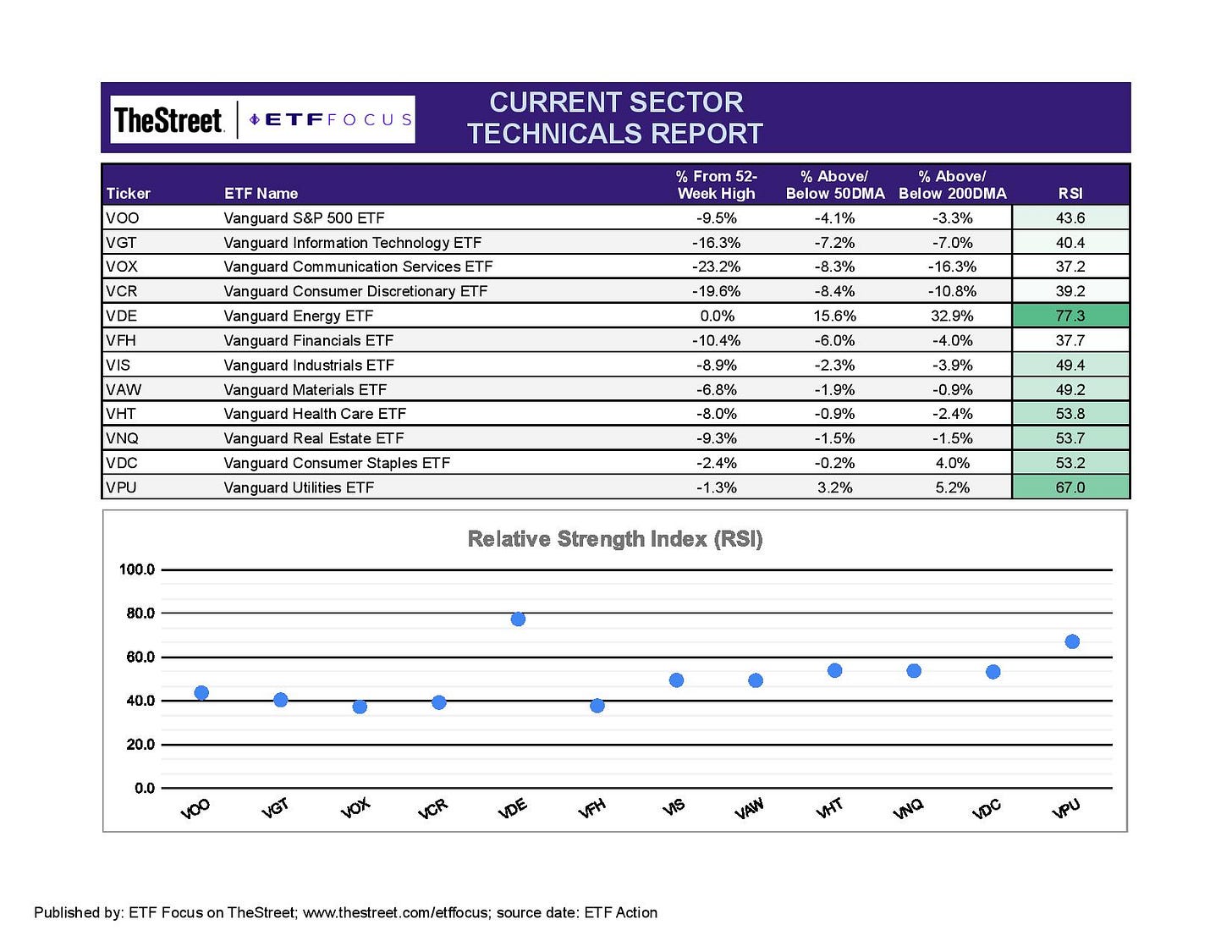

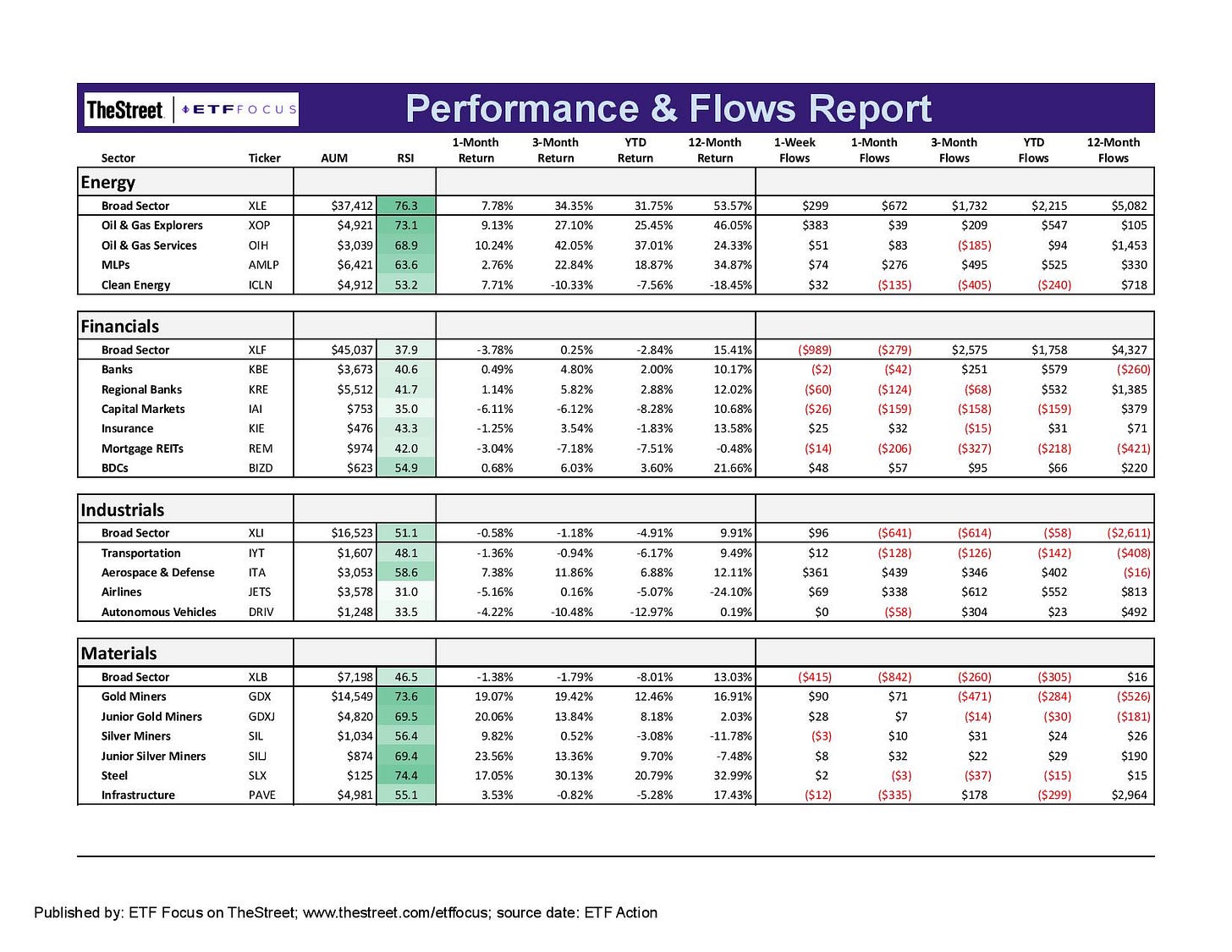

We’ve gotten back to the point where it looks like there’s the energy sector and there’s everything else. Last week’s shift towards defensive assets has strengthened the utilities sector, but most other areas of the market are still hanging out in that neutral zone. Energy stocks are looking very overbought at this point, including the oil & natural gas servicers & producers and MLPs.

The financials sector sold off significantly thanks to developments on the Treasury yield curve. The short end of the curve, particularly the 2-year note yield, has become choppy but is hanging right around that 1.5% level as the markets try to figure out the right balance between political uncertainty the Fed action plan. The long end of the curve saw 10-year and 30-year yields drop 30 basis points in a matter of days. Banks need higher long-term yields in order to improve profitability and as long as we see a continuation of the unrest in Ukraine, I imagine we’re not going to be seeing a lot of progress being made on this front.

The one trend that continues is the underperformance of growth sectors. Over the past two years, we’ve seen tech stocks demonstrate some safe haven behavior, but that hasn’t been the case this time around. Consumer discretionary and communication services continue to badly underperform as investors steer towards quality, low volatility and dividend payers.

The only two areas within the growth sectors that are demonstrating modest strength have clear narratives behind them. Digital infrastructure falls under the broader infrastructure theme, which has done well lately thanks to the rally in cyclicals and commodities. Cybersecurity has gotten a lot of attention over the past couple of weeks as Russia continues to weigh launching cyberattacks against the West.

Retail remains one of the weaker areas of the market. Despite some relatively healthy retail sales numbers over the past couple months, investors continue pricing in the likelihood that soaring inflation rates are going to eventually eat into consumers’ desire and ability to spend. As omicron continues to wane and the labor market strengthens, there will be an underlying degree of support for the economy even though the potential for costlier food and energy will remain an elevated market risk.

Not only is energy sector rolling right now, the clean energy sector, which had been one of the market’s worst performers is now coming along for the ride. I can see the same scenario playing out here that played out in 2020. As the oil market cratered and energy stocks plunged, clean energy stocks posted triple digit returns. While a good chunk of those gains have been given back, there’s a good chance we could see the clean energy sector find some interest again if geopolitical frictions continue to unsettle the crude oil market.

The materials sector is still a bit of a mixed bag, the gold and silver miners continue to hum. Steel stocks are also soaring on the heels of the commodities rally, but all are either in or near overbought territory. Aerospace & defense ETFs, not surprisingly, are performing well here. The airlines ETF is back at a new 52-week low as soaring fuel prices figure to make travel more expensive.

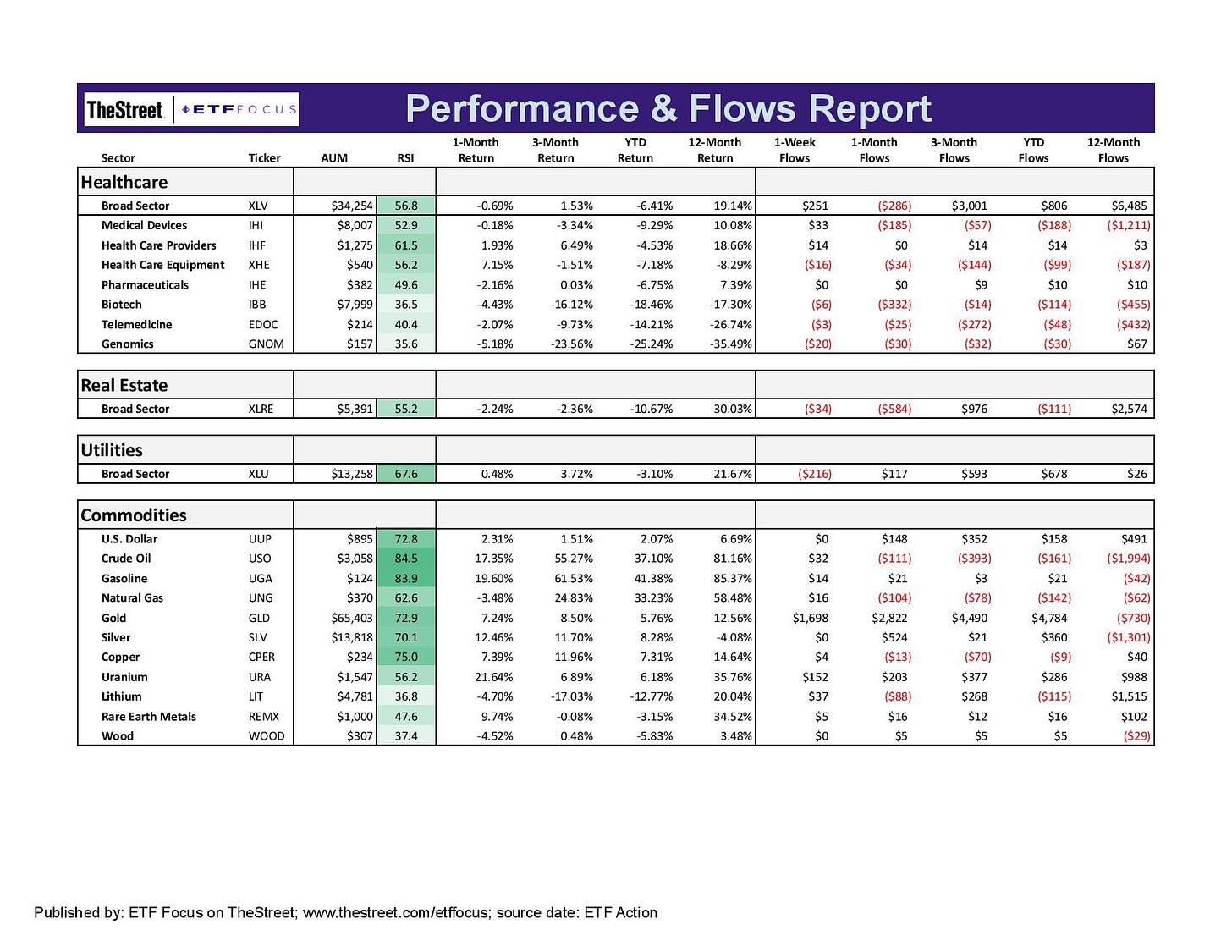

The more defensive areas of the healthcare sector are gaining strength, although the more speculative areas of biotech and genomics are not at all in favor. This has turned into a fairly decisive defensive market at the moment and it does indeed look like we’ll see areas, including the drugmakers and healthcare providers, participate in risk-off pivots. The sharp outperformance from the utilities sector is one of the last dominoes to fall that helps confirm a full-on defensive shift.

The story is the same with the commodities rally. Precious metals, industrial metals and agriculture commodities are all rising rapidly. Wheat, where Russia and Ukraine are both top 5 global exporters, has risen by more than 50% in just the past week as investors brace for a significant supply shortage.

Read More…

Vanguard Dividend Appreciation ETF (VIG) Has Turned Into One Of The Worst Dividend ETFs Of 2022

Top Performing ETFs For February 2022

Russia ETFs Suspend Share Creations; Premiums To NAV Shoot Up To More Than 100%

Top Performing Dividend ETFs For February 2022

6 Higher Yielding Cash Alternatives For Your Portfolio

4 Vanguard Bond ETFs For Every Market

ARKK: Are Investors Moving Back In?

ETF Battles: It’s QQQ vs. SCHG vs. VOOG! Which Growth ETF Is Superior?

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!