Investing Strategy: Using BTAL To De-Risk Your Equity Portfolio & Generate Better Risk-Adjusted Returns

Over its history, BTAL has been able to improve risk-adjusted returns by nearly 20% relative to a SPY/QQQ combination.

If you've followed my work over the past several years, you know one of my favorite ETFs is the AGF U.S. Market Neutral Anti Beta ETF (BTAL). It's designed to be a risk hedge that goes long low volatility stocks with half of its portfolio and shorts high beta stocks in the other half. In isolation, it's probably going to perform poorly since the 50% short position will probably lose money more often than not. When paired with an equity portfolio, including the S&P 500 (SPY) and Nasdaq 100 (QQQ), it's proven that it can significantly reduce portfolio risk and greatly improve risk-adjusted returns.

AGF U.S. Market Neutral Anti Beta ETF (BTAL)

BTAL is an actively managed fund that takes long positions in low beta U.S. stocks; offset by short positions in high beta U.S. stocks. It will establish these positions using stocks from the Dow Jones U.S. Thematic Market Neutral Low Beta Index, which consists of the top 1,000 eligible securities by market cap, including REITs. The index identifies approximately the 20% of securities with the lowest betas within each sector as equal-weighted long positions and approximately the 20% of securities with the highest betas within each sector as equal-weighted short positions.

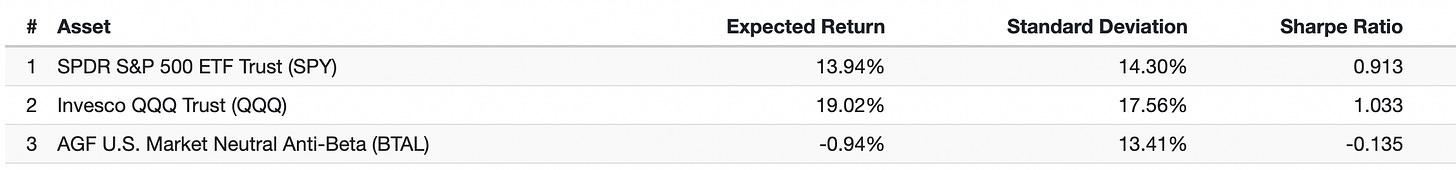

If we start by putting BTAL side-by-side with SPY and QQQ, we can see the significant differences in both returns and risk.

Note: BTAL was launched in 2011, so risk and return comparisons will go back only to about 2011.

QQQ has obviously produced the biggest returns, but it's come with higher risk than SPY. On a risk-adjusted basis, QQQ holds the edge, but not by a wide margin over SPY.

BTAL has lost about 1% annually since inception, which is consistent with what you'd expect from a 50/50 long-short strategy. The overall volatility demonstrated by BTAL is lower than both of the major equity indices due to some risk being offset by the long and short positions.

The asset correlation, however, is where BTAL's biggest advantage comes from.

Its roughly -0.6 correlation with both QQQ and SPY means it will cancel out a lot of overall portfolio risk when paired with one or both of these funds.

The SPY/QQQ Portfolio

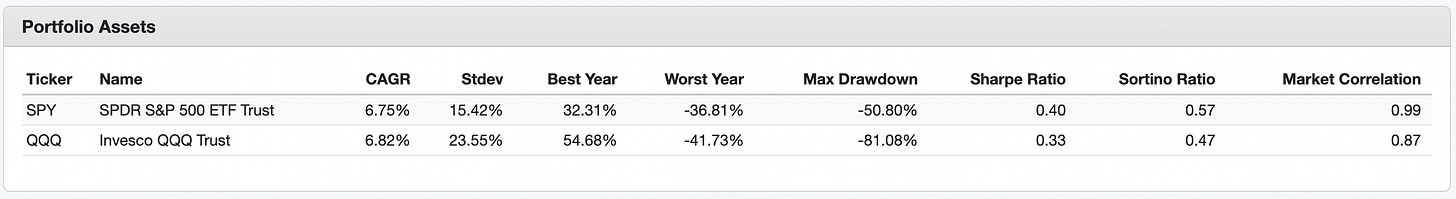

Let's start with a really basic portfolio consisting of 50/50 allocations between SPY and QQQ. Going back to 1999 when QQQ officially launched, the SPY/QQQ portfolio generated solid returns, even considered it lived through the tech bubble, financial crisis and COVID recessions.

The portfolio generated roughly a 7% average annual return, but the combination did relatively little to improve risk-adjusted returns. With correlations almost exclusively north of 0.90, overall volatility and returns of SPY/QQQ tended to be almost at the mid-point of both ETFs. It did, however, add just a slight bit of extra return based on market timing factors.

Adding BTAL to SPY/QQQ

So we want to add the portfolio risk hedge BTAL to an existing equal-weight portfolio consisting of SPY and QQQ, but what's going to happen. We know that overall portfolio risk is going to come down, but it's going to come at the expense of some return. The question is how much BTAL is needed to achieve the ideal risk-adjusted return portfolio?

Using Portfolio Visualizer's tool for generating the efficient frontier, we find that the ideal portfolio allocation (historically speaking at least) includes much more BTAL than we might have thought.

When we speak of the risk-reducing benefits of diversification, this is a prime example of how it works. BTAL is the least volatile of the three ETFs with a standard deviation of returns of nearly 13.5%. In the right combination, however, total portfolio volatility can be reduced all the way down to less than 9% overall. The negative correlation of BTAL to SPY and QQQ enables the components to interact in a way that offsets a lot of short-term risk.

It turns out that (again, historically speaking), the ideal portfolio allocation that maximizes risk-adjusted returns would have involved investing 37% of the total in BTAL.

That might seem like an extraordinarily high number on the surface, but remember that we're talking optimal risk-adjusted returns, not absolute returns. The former can involve any allocation between 0% and 100% for any asset within the portfolio. It's simply all about finding the optimal portfolio allocation that gives you the most bang for your investment buck.

Allocating 37% of this hypothetical portfolio to BTAL is clearly going to reduce returns and risk by quite a bit, but it also does a much better job of giving you more return for every additional unit of risk.

The original 50/50 portfolio would have generated about 5% more return annually than the one including BTAL, but it also would have been 77% more volatile. The question of whether or not that trade-off is worth it is entirely up to the investor, but the alternative is also attractive. A Sharpe ratio of 1.17 indicates that portfolio performance can improve by 17% on a risk-adjusted basis by applying BTAL as a hedge to broader market equities.

Conclusion

I should make the caveat right off the bat that this exercise was done using past performance and that, of course, is no guarantee of how these sample portfolios might perform in the future. Setting your portfolio to very specific allocations probably isn't very useful, but this example does demonstrate how much better a portfolio can perform on a risk-adjusted basis by adding an alternative strategy to your portfolio, such as BTAL.

Which path to choose is entirely an individual decision. If your goal is return maximization, something like the 50/50 SPY-QQQ portfolio might be better over the long-term. There will be higher highs and lower lows along the way, but equities over time have historically produced the best returns.

If you want to squeeze the most return out of your portfolio for every unit of risk you're taking, adding BTAL to an equity portfolio is worth considering. Even if you're not necessarily interested in maximizing risk-adjusted returns, adding BTAL in even a small allocation can help temper overall portfolio risk. For some, that could be very useful heading into what looks like a very uncertain economic environment.