INTRAWEEK UPDATE: Portfolio Positioning Ahead Of Next Week's Inflation Report

I believe that inflation is going to come in higher than expected and that’s going to trigger a volatile market reaction.

The combination of the November CPI report release and the quarterly Fed meeting could make next week on the most consequential for the markets in 2022.

Equities are hopeful. The S&P 500 is up 11% since its October low. Investors heard from Jerome Powell that it anticipated slowing the pace of rate hikes, probably starting with next week’s meeting. They’re geared up for the big Fed pivot and the latest data, which suggests a still healthy labor market and an expected rebound in Q4 GDP growth, means that the bear market bottom could be in with recession still looking like its a few quarters off.

The bond market is telling a different story. Long-term Treasuries are up 18% from their recent low. The 10-year yield is down roughly 80 basis points in just a month and a half. Treasuries should no longer be considered the toxic investment they were for most of 2022. They’re now a genuine safe haven trade again and bond traders are positioning themselves much more defensively today.

The bond market tends to be right more often than the stock market. I suspect that notion will be proven right again. Next week’s inflation report could give us our answer.

To set the table, here’s where are in terms of inflation in the United States.

The headline inflation rate has been steadily declining since July. Energy and food prices increases have been moderating and this has been driving optimism in equity investors - the idea that the hyperinflation cycle is ending and inflation rates will soon normalize.

The core rate tells me we’re not out of the woods and we may not be for some time yet. It hasn’t declined at all in 9 months. This is the sticky inflation that includes things, such as healthcare costs, airline fares and other durable goods and services. These are the things that are unlikely to see immediate price decreases (if they see them at all) and is likely to remain elevated for a while.

Equities are pricing in a continuing downtrend in inflation. Treasuries are behaving as if inflation and the corresponding economic downturn are far from over. Which one is right?

Economists are expecting another modest decline in both inflation rates. I believe that inflation is going to come in higher than expected and that’s going to trigger a volatile market reaction.

Here’s the case and it’s all based on data we’ve seen so far.

The Atlanta Fed’s GDPNow Forecast Currently Calls For 3-4% GDP Growth In Q4

For as much as we hear about economic growth slowing everywhere (and there certainly are plenty of measures that support this idea), the U.S. still looks like it’s humming right along, at least to the point where recession isn’t an immediate concern.

The GDPNow isn’t a perfect measure, but it tends to be pretty good and directionally accurate over time. And it’s forecasting a number well above the current consensus range of Q4 GDP estimates. If the GDPNow estimate is correct, the economy is currently running hotter than the street expects and that’s probably a catalyst for higher than expected inflation. Good for economic growth, but a net negative in terms of how the Fed would respond. Throughout 2022, a more hawkish Fed has been bearish for both stocks and bonds.

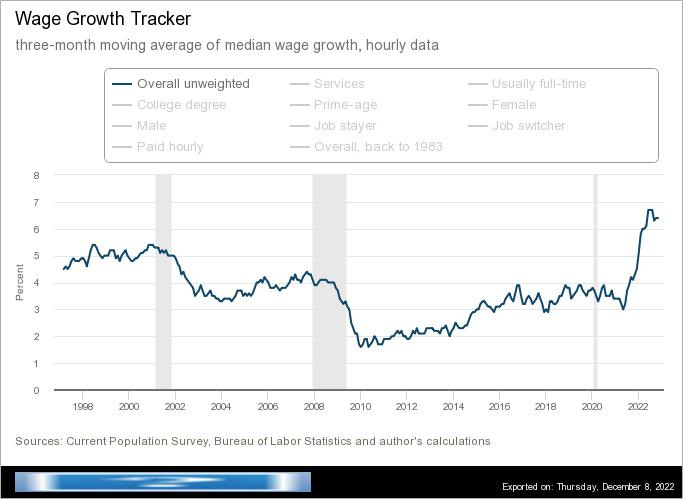

Wage Growth Is Still 6% Year-Over-Year

Let’s get the bad news out of the way first. Consumer purchasing power is declining. Even with 6% nominal wage growth, real wage growth is trending negative with an inflation rate of 8%. Consumer spending patterns have also adjusted. Black Friday sales were up an estimated 2%, but, again, real spending has declined (although Black Friday isn’t quite the same as it has in the past and holiday sales have spread out across a wider time frame, but still).

But at a base level, a 6% year-over-year wage growth figure is very strong and the highest level we’ve seen in decades.

While real purchasing power is negative currently, earnings aren’t as bad as a lot of people think. And consumers are still spending what they have. Look at airfares and travel expenses as an example. The purse strings are tighter today than they were a year ago, but the purse hasn’t closed. Solid wage growth means there’s still money to spend.

The Unemployment Rate Is Still Under 4%

The jobs market has consistently been the one thing that hasn’t confirmed the idea that a recession is imminent. Recessions rarely begin until we see a meaningful pickup in job losses. As today, virtually anyone that wants a job can find one. There are more than enough job openings still available (although that number is trending downward) that workers can switch jobs and pick up a nice pay hike in the process. Workers are still in the power position. Yes, many tech companies are announcing layoffs and hiring freezes, so conditions are beginning to balance, but the current state of the jobs market will take time to change.

Services Activity Is Actually Picking Up

We hear a lot about how the manufacturing sector is declining, but it’s the services sector that really drives the economy. Last month’s services PMI number shows that this segment of the economy is not just holding on, it’s actually in pretty strong shape.

Any reading above 50 indicates expansion. Outside the beginning of the COVID pandemic, the services sector has been strong and remained strong. Services sector activity is actually as strong today as it was at the beginning of the year. A strong services sector combined with consumers still willing to spend means there’s still upwards pressure on prices.

Taken together, we’ve got an environment where consumers still have jobs and earnings. Services activity is still plenty strong. The U.S. economy as a whole is having a strong Q4. This is an environment that’s more supportive of higher prices than a lot of investors may be appreciating at the moment.

The Market’s Response To Next Week’s Inflation Reading

How the market responds to the November inflation number will be the big wild card. Throughout 2022, a higher inflation rate has led to higher Treasury yields, but we’ve started to see cracks in that relationship. In the first half, higher inflation readings have come with an unknown terminal Fed Funds rate, so it was easy for Treasury yields to adjust higher. Recently, the market has gotten at least some consistency and consensus in the idea that the FFR will top out at 4.75% to 5%. Whether that ends up being the ultimate top remains to be seen, but the level of market uncertainty around it right now is certainly lower than it was.

Let’s take a look at what might be considered the two most likely outcomes of next week’s inflation report.

Outcome #1: Inflation Comes In Lower Than Expected, Stocks Rise, Treasuries Rise

In 2022, stocks and bonds have mostly moved together. In this scenario, equity investors cheer the idea that the inflation cycle continues to moderate and bond yields follow along with the theme that falling inflation will lead to the Fed taking less action. This might be the outcome that the market is expecting the most right now.

Outcome #2: Inflation Comes In Higher Than Expected, Stocks Fall, Treasuries Fall

This is what has happened most often this year and the logic is pretty much the reverse of what I laid out above. If this happens next week, we’re probably looking at the stock market gains of the past two months proving to be just another bear market rally and an indication that the bond market, once again, doesn’t really have the sense that they know when and where rate hikes will stop that it thinks it does.

Either of these scenarios has stocks and bonds moving together again. What happens if the two asset classes disconnect? This is where the real risk lies.

Outcome #3: Inflation Comes In Higher Than Expected, Stocks Fall, Treasuries Rise

This is, I fear, what could happen on Tuesday and it’s probably the big “flashing red warning lights” outcome.

The move in bonds is the key here. If Treasury yields fall in spite of higher than expected inflation, it’s an indication that investors are panicking and running to Treasuries for safety despite the inflation backdrop that has resulted in higher rates all year. This is the outcome that could trigger a potential sharp and severe decline in equities through the end of 2022 and into 2023 because it doesn’t seem to be on the market’s radar right now.

Outcome #4: Inflation Comes In Lower Than Expected, Stocks Rise, Treasuries Fall

This feels like a really low probability. The equity market rise would be understandable if inflation falls again, but the Treasury market move would be curious. I suppose this could be interpreted as bond market capital, especially the money that’s flowed into Treasuries over the past two months, would turn risk-on and move back into stocks. Whether it’s fully justified or not, this would be investors going all-in on the falling inflation narrative.

My Prediction: Outcome #3

I’m in the minority here, but I think that this is most likely of the four outcomes. I’m definitely not saying that this WILL happen, but I think the recent data we’ve seen over the past month and the sequence of returns suggest that this is a real possibility. And I think that the bond market is sniffing this out.

Regardless, investors might want to consider positioning themselves cautiously here. There are some pretty big wild cards at play here and I don’t think the outcome is nearly as certain as the market thinks it is.

Be safe!

FRIDAY UPDATE: Treasuries response to PPI data on Friday could mean that they're ready to go lower, not higher, if CPI comes in higher than expected next week. That would be outcome #2 instead of #3.

I still think #3 is the biggest risk to the markets, but #2 might have edged ahead of it in terms of likelihood. Rising PPI doesn't necessarily guarantee that it carries over to CPI, but it does look like the trend I talked about could be playing out here.