If You've Gotten Out Of The Market, You'd Better Have A Plan For Getting Back In!

Selling without any plan to buy back again at some point in the future is a recipe for missed opportunities.

The S&P 500 returned more than 9% in July. That’s great news for investors who watched stocks decline more than 20% earlier this year. Many, however, don’t have anything to celebrate because they didn’t capture those returns. They got out of the markets at or around the time when stocks were near their lowest. That, my friends, is the inherent risk of making emotional investment decisions.

Multiple studies have aimed to assess stock market returns vs. actual investor returns. Most of them tell a similar story, including this one.

This one is a little out-of-date, so the short-term returns aren’t indicative of what’s going on today, but you get the picture. Over the long-term, the average investor only experiences about half of the return of the S&P 500.

Why such a disparity between the two? Emotional investment decision making. A lot of investors decide to sell only after losses have been experienced and miss out on the subsequent rebound. I have a family member who decided to sell her entire portfolio and move into cash at the depths of the COVID recession, after stocks had already declined by 30%. She never got back in and is still holding all cash today.

Her quote after missing out on the recovery and the 100%+ returns since the 2020 bottom - “well, it’s probably too late to get in now”. Now that stocks are 15-20% below their highs, it’s another opportunity to get back in at bargain prices, right? Nope. She’s back to panic again. At this point, I have doubts that she’ll ever get out of cash again.

Many investors forget that trading is a two-way transaction. In a situation like this, for every sell, there has to be a buy. If you’re going to sell your stocks, you have to buy back at a level below your initial sell price in order for the trade to be successful. Unfortunately, many investors are quick to hit the sell button and then completely forget about it. If you’re going to sell, you NEED to have a plan to get back in in order to make the sell even worth it in the first place.

This family member of mine sold 100% of her stocks and never thought about it again. She’s turned temporary losses into permanent missed opportunities.

Many short-term traders will establish two price targets for their trades - one is a target for when to buy back in that they think will capture the gain to be had (e.g. 3-5% below the sell price) and a stop loss price, a level above their original sell price at which they’ll cut bait on a losing trade. Both provide firm limits on a trade - a level of acceptable returns and level of limited losses.

The average investor would do well to follow a similar style. If you’re going to sell equities here, establish a price at which you’ll plan to buy back and lock in a successful trade. Using the example above, you can set a buy price of 5% below where you sold and strictly follow it. Sure, stocks may fall an additional 10% beyond that. No one knows where the bottom will be and it’s pointless to try to figure it out. Even if that happens, you’ve effectively avoided 5% in losses. Regardless of what happens next, that’s a successful trade!

The broader point I’m trying to make here is that you should always monitor your portfolio. Shift your expectations as conditions shift. The COVID bear market in 2020 is a perfect example of that. After stocks had dropped 30% very quickly, the government passed a multi-trillion dollar stimulus package designed to support both individuals and businesses. In hindsight, that would have been the trigger point to get back in. The markets love lots of liquidity & ultra-loose monetary conditions and we see what happened to stock prices since that point.

Always remember to think of the long game on any trade. Selling without any plan to buy back again at some point in the future is a recipe for missed opportunities. Stocks are still down 20% from their highs in many areas of the market. Now would be the time to think about what the future could look like instead of the past.

With that being said, let’s look at the markets and some ETFs.

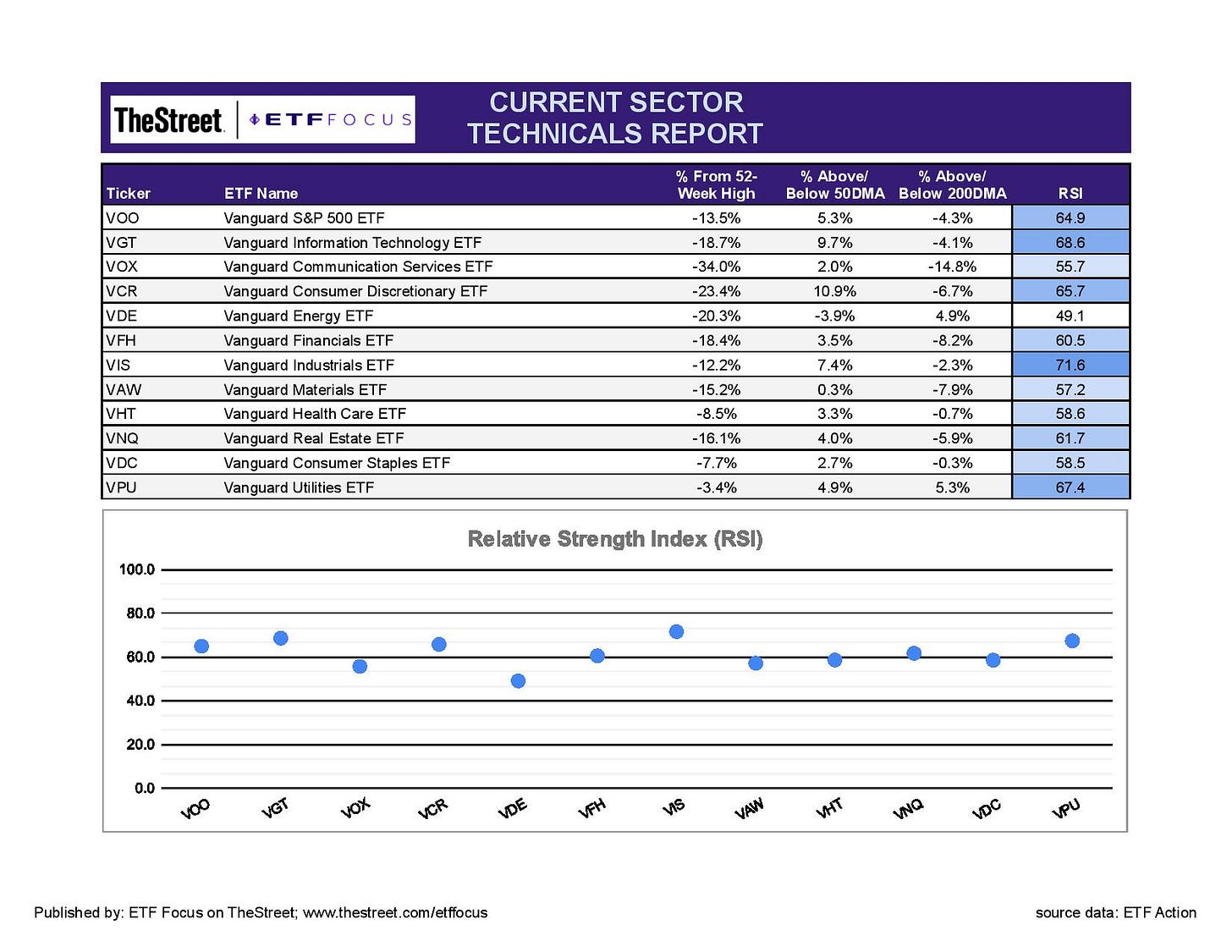

The July stock market rally (which has so far carried into August) has been the rising tide that’s lifted all boats, but it’s the riskiest growth areas of the market that have benefited the most. Tech and consumer discretionary stocks have been the headline sectors leading the markets higher over the past few weeks, but it’s the oft-forgotten industrials sector that is demonstrating the greatest relative strength at the moment. This is probably more a reflection of sentiment than actual conditions. The factory and manufacturing segment of the market is still in positive growth territory for now, but it’s trending lower and probably heading into contraction soon.

The three highest RSIs at the moment are in industrials, tech and utilities. That’s one growth, one cyclical and one defensive sector. It’s a curiosity to see such a diverse trio leading the way and is an indication that there’s some confusion about where the market is headed next. Bonds retreated last week in response to Friday’s jobs report, but it’s been signaling recession for a while now, something that I think equities will begin reflecting sometime again in the near future.

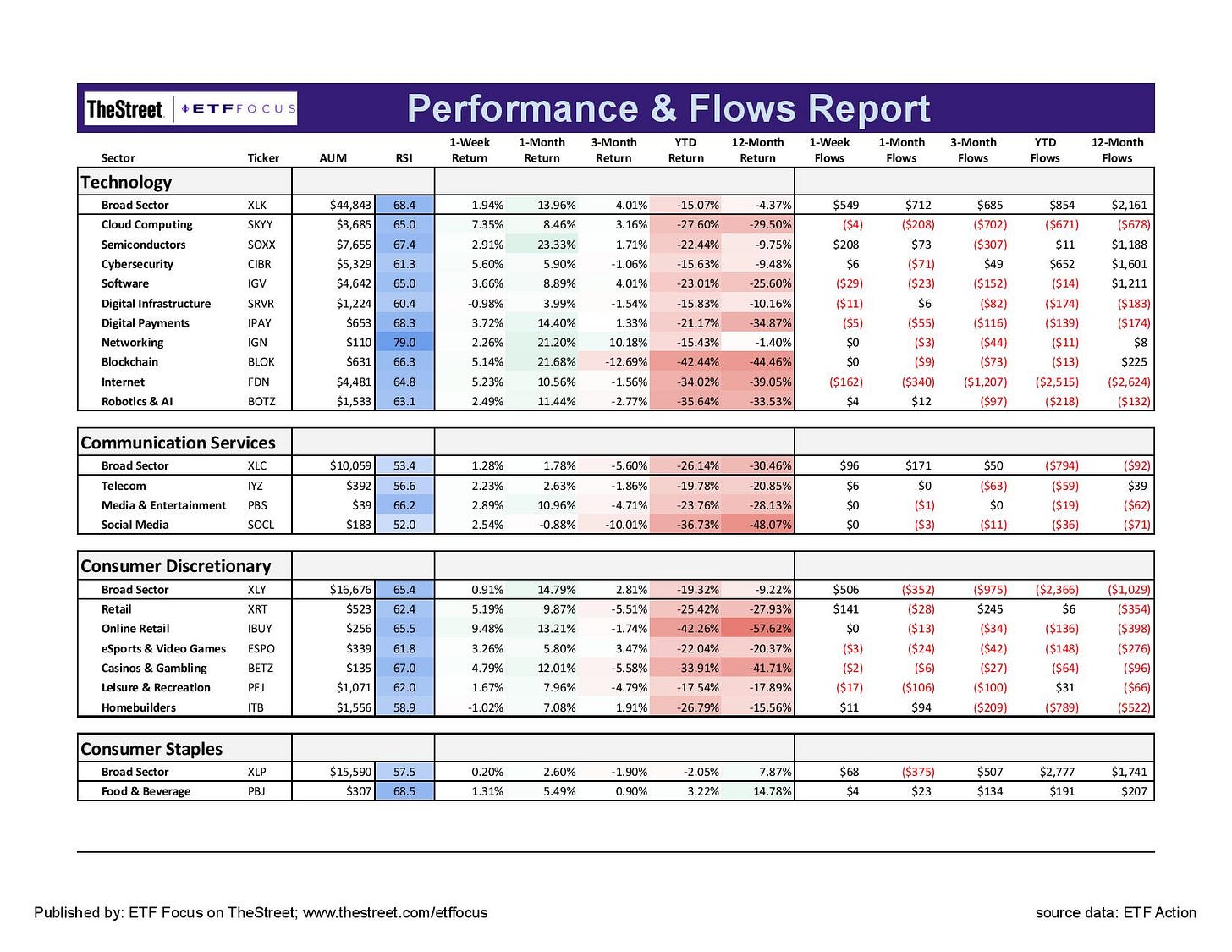

Strength is pretty broad in the tech sector with several groups generating 20%+ gains over the past month. Networking stocks have done particularly well, but are way into overbought territory and due for a pause. The discretionary sector is a little less strong, but still performing well. The wild card has been the online retail space, which has been very volatile and experiencing wide swings on a weekly basis. Nominal sales growth figures seem to be providing some level of support here, but the inflation-adjusted numbers suggest that consumers are cutting back on their spending. The communication services sector is still the weak link. Social media stocks are the big drag, although traditional telecom names have been hanging on.

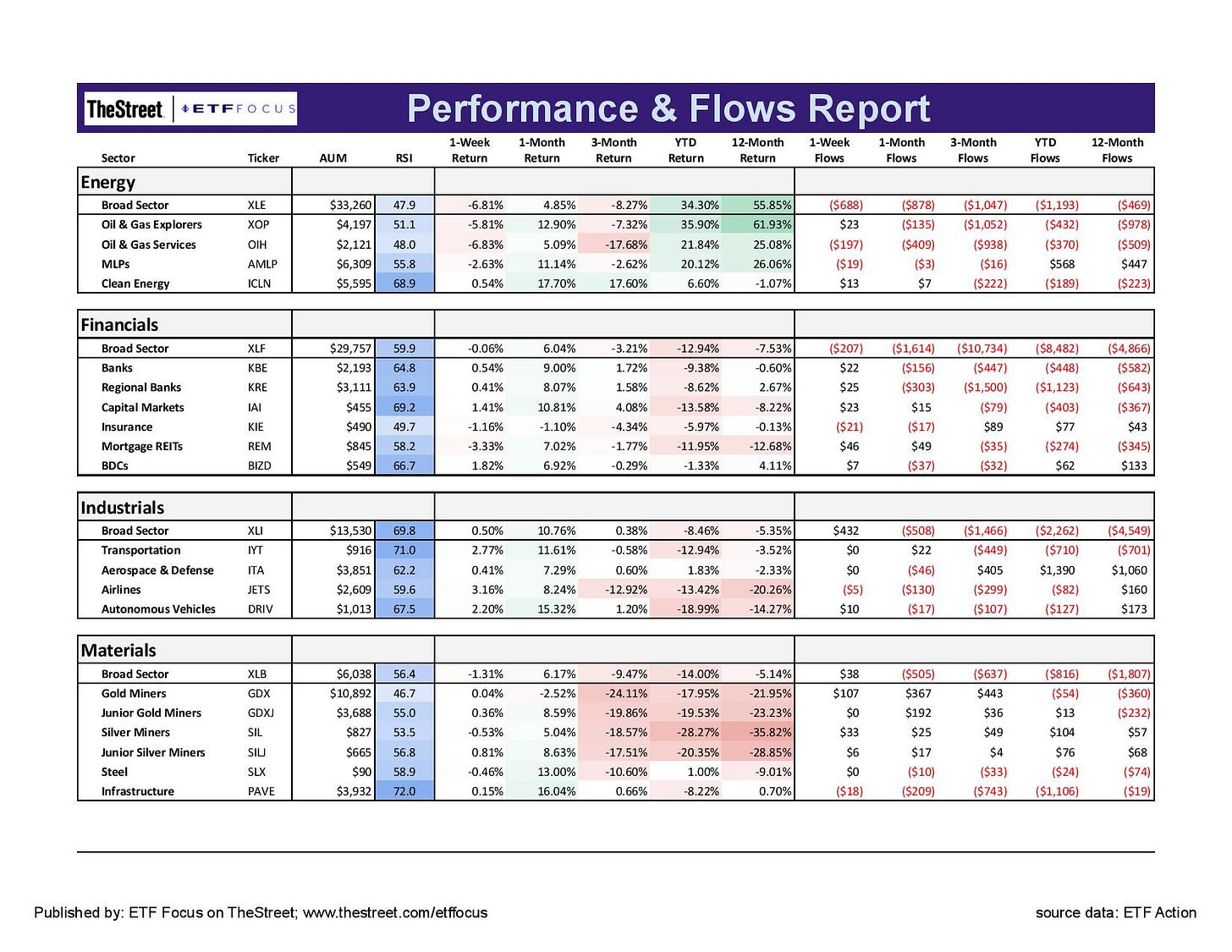

The energy sector continues to be the short-term underperformer among the cyclical sectors and now sits more than 20% below its 52-week high. Oil and gas prices have come way down from their peak and the ongoing economic slowdown will continue putting pressure on share prices. The materials sector has been pretty strongly correlated with the energy sector in recent weeks, although it’s been getting a boost from the miners, an area that’s starting to look especially cash flow heavy and could emerge as a yield opportunity in the future. Again, industrials are looking good, but I’d keep an eye on the airlines as a source of potential weakness.

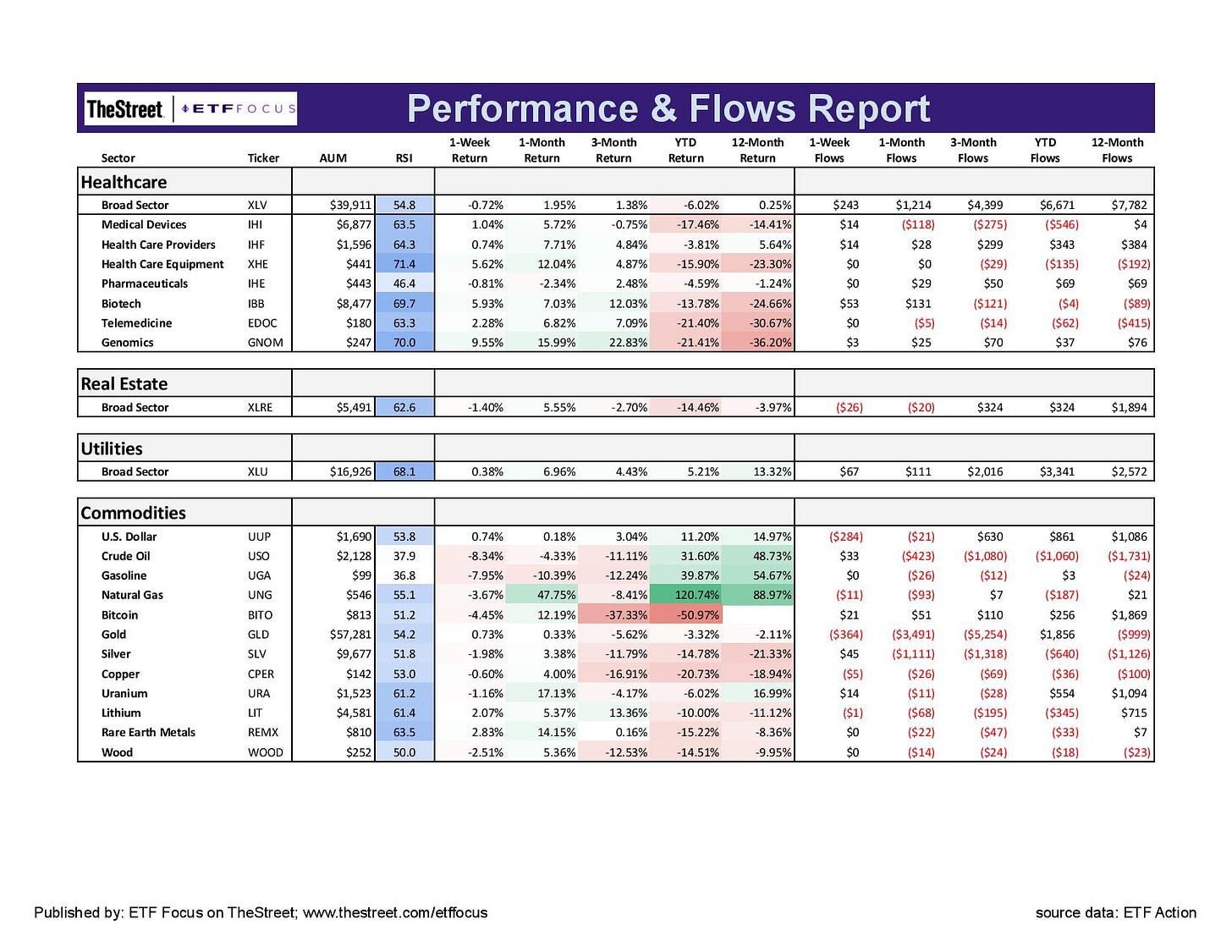

Healthcare, which had been one of the market’s best-performing sectors throughout the 1st half, has been lagging badly over the past month as investors pivot back to growth. We’re still seeing mixed strength among the other defensive sectors, including real estate, so I wouldn’t write this off as broad defensive sector underperformance yet.

Within the commodities space, precious metals are looking better here and I think reflective of the recession risks that are starting to build. Lumber is still the big loser and a troubling signal for those expecting a big comeback in the economy. The dollar has been more balanced over the past 2-3 weeks, but the July jobs report could give it the strength to make another move higher. The narratives in Europe, Japan and China are well-entrenched and the U.S. economy is going to look much better in comparison here.

Read More…

QQQ vs. QQQM vs. QQQJ: What To Expect From The Big 3 Nasdaq ETFs

VTI vs. ITOT: Comparing The Vanguard & iShares Total Market ETFs

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!