If You Need Downside Protection, Buffer ETFs Are Having A Moment

Investors haven't been interested in portfolio protection for a while, but conditions have changed.

Investors haven’t seemed too interested in risk management strategies over the past two years when they can get 20%+ returns in a straight S&P 500 index ETF. With large-caps experiencing just a single 5% pullback in 2021 and the VIX rarely getting above the 20 level, the idea of layering downside protection on top of a risk-heavy portfolio hasn’t been much of a priority.

2022 has been a different story. As the Fed prepares to hit the gas on its quantitative tightening program, volatility has picked up and investors have begun to reassess risk assets. The S&P 500 fell 10%. The Nasdaq 100 fell 15%. The Russell 2000 dropped more than 20%. The usual safe haven alternatives, such as Treasuries and gold, haven’t provided any help. They’re down year-to-date as well giving investors precious few options for generating gains in their portfolios lately.

I want to take a little break from the regular macro-focused analysis I typically do and review buffer ETFs. These are the products that use options contracts to protect an investment from a predetermined level of portfolio losses in exchange for capping some upside potential. Buffer ETFs have become big business - more than $11 billion across more than 100 funds currently.

Buffer ETFs come in all varieties. Some offer just a little downside protection (the first 5% of losses, for example) while keeping most of the upside potential. Others protect against as much as 25% losses in an index over a given year, but give up a fair amount of gain potential in the process. There are buffer ETFs linked to the S&P 500, Russell 2000, developed & emerging markets indices and the Nasdaq 100. In other words, if you want to stay invested at all times, but protects you from a certain degree of losses, buffer ETFs are something you may want to consider.

Innovator is one of the biggest issuers of buffer ETFs, so I’ll use them as an example of how they work.

The Innovator U.S. Equity Power Buffer ETF - February Series (PFEB). Its structure provides protection against the first 15% of losses in the S&P 500. Currently, the cap on returns for this product is 10.19%. That would, in theory, be the maximum return a shareholder could receive if held for the entire outcome period.

Four potential return scenarios are illustrated below.

Over the course of the 12-month outcome period (for PFEB, it would be from February 1, 2022 through January 31, 2023), if the S&P 500 returns between 0% and 10.19%, returns in PFEB should be nearly identical to the index. If the S&P 500 returns greater than 10.19%, returns on PFEB would be capped at that level. That would be the upside potential you’d need to forfeit in exchange for the downside protection.

PFEB protects against the FIRST 15% of losses. I emphasize the word “first” because buffer ETFs don’t provide unlimited downside protection. If the S&P 500 were to lose up to 15% over the 12-month period, PFEB would, in theory, be flat. Beyond that, however, in a severely adverse market, the fund would experience 1-for-1 losses below -15%.

Buffer ETFs can be a great option in a volatile market with an uncertain future. If you can avoid the urge to trade the account, buffer ETFs allow you to capture what’s likely to be most or all of the underlying index’s upside, while offering a great deal of protection on the downside. The cap on the upside is what you give up in order to gain that protection. It’s worth noting that these return profiles are what you’d expect to see if you held for the entire 12-month outcome period. If you buy or sell within it, your return profile could be different. Innovator, however, buffer ETFs that reset every month, so you wouldn’t have to wait long.

These products can potentially be a little more complicated, so feel free to comment below if you have any questions!

With that being said, let’s look at the markets and some ETFs.

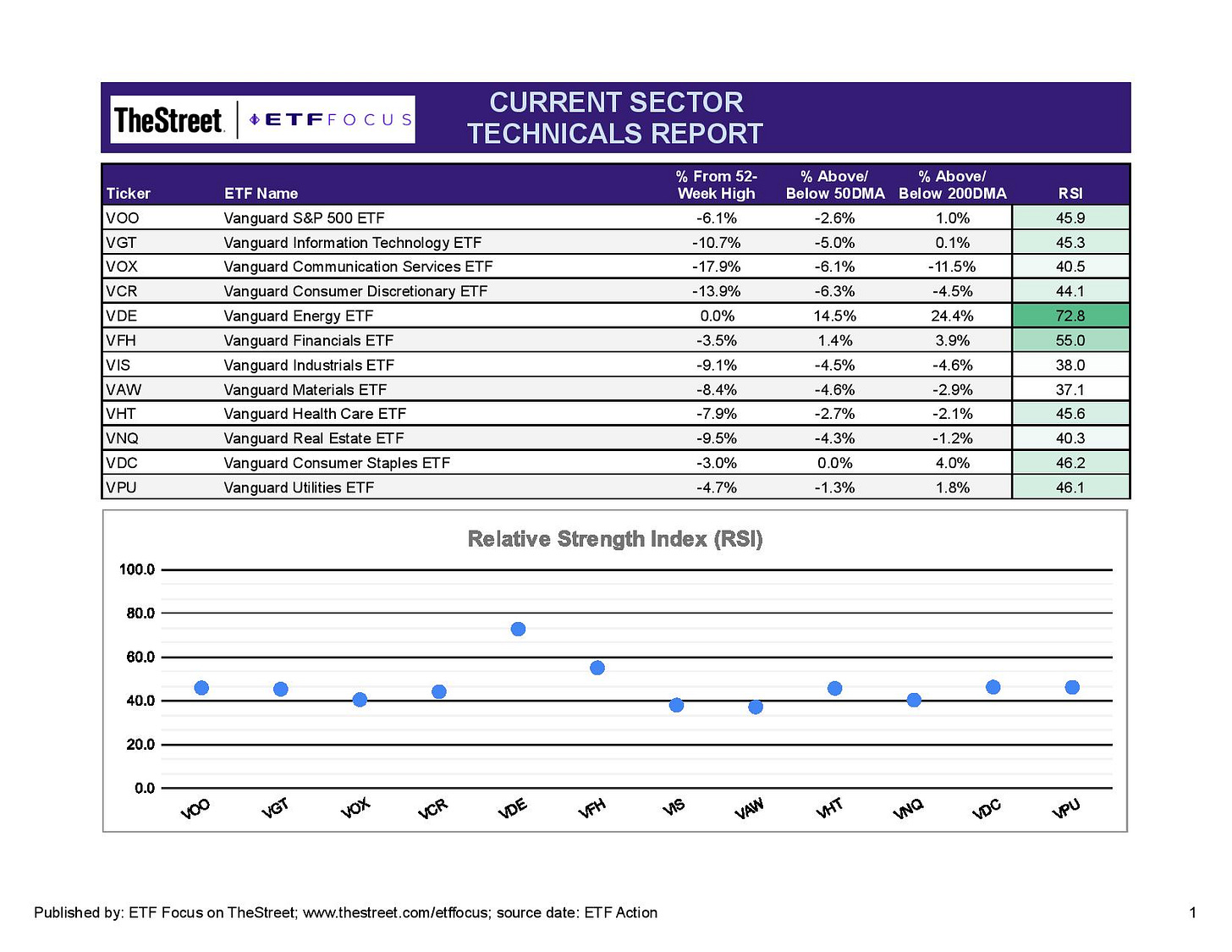

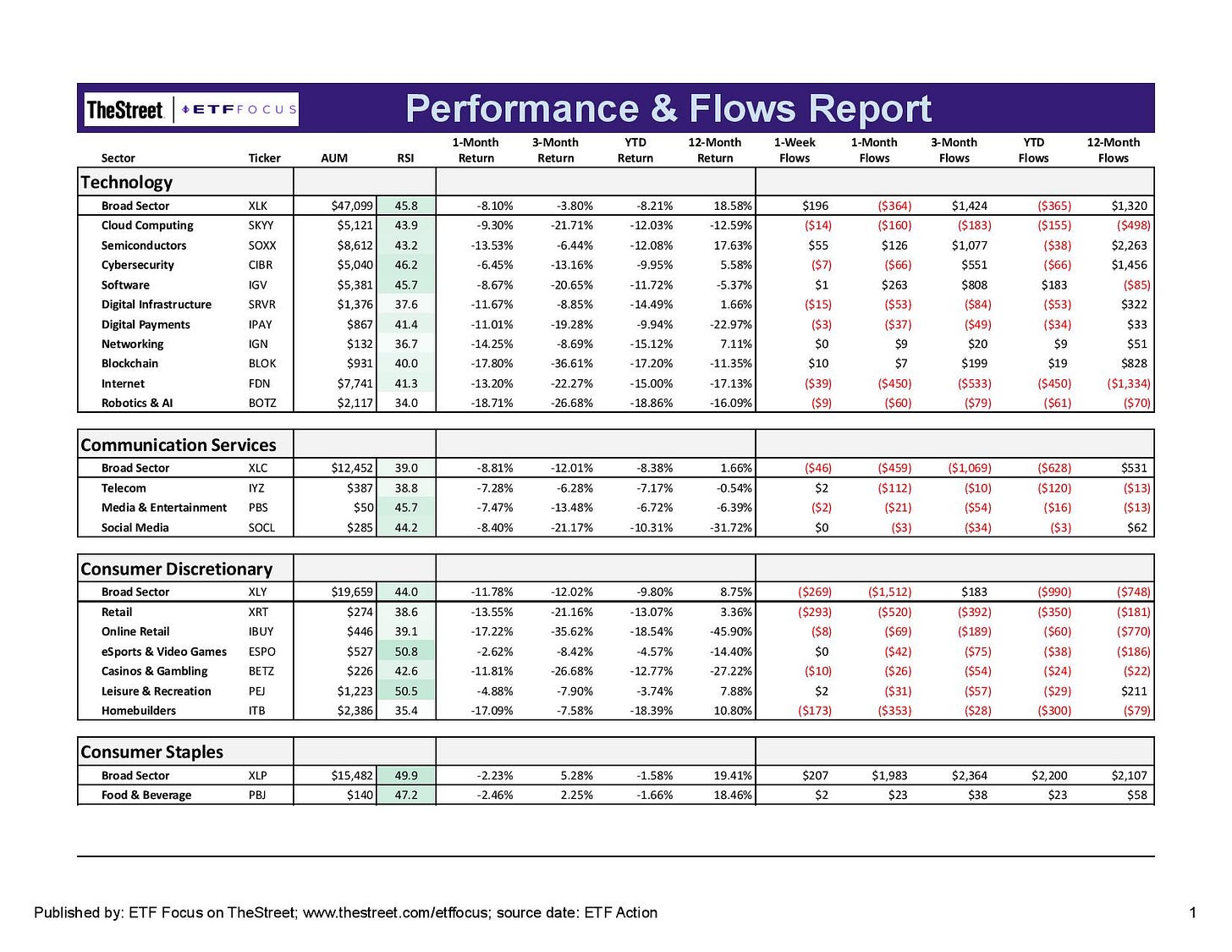

The trend continues of the energy sector significantly outperforming the market, but little elsewhere showing any notable strength. That previously came from defensive sectors, such as consumer staples and utilities, but the pivot back to growth over the past couple of weeks has dissipated much of that short-term strength. We’ve seen performance balance out across growth and cyclicals as the market digests the idea that the Fed Funds rate will be significantly higher a year from now, although the impact from such a move is a little more uncertain.

Overall market volatility still looks relatively modest at the moment, although Facebook, Alphabet and Amazon quarterly earnings results from last week demonstrate that volatility is still high on an individual security basis. Last Friday’s jobs report, which came in far better than expectations, had the short-term effect of driving expectations for the Fed even more hawkish, but the markets mostly took it in stride as merely a confirmation of what we already knew.

Treasuries are still looking bearish here. Rates on government bonds rose all across the yield curve, so this was a move in response to the Fed, not necessarily a huge move back into risk assets (although there was certainly some of that taking place). I think we know mostly what we know at this point and there aren’t many opportunities to catch the markets off-guard prior to the March Fed meeting. A lack of short-term catalysts could mean that equity prices drift higher from here, but the wild card could be whether the Fed raises by 25 basis points or 50 basis points at the March meeting.

Most of the growth-oriented sectors, save for communication services thanks to Facebook’s plunge, have been coming back, but the outperformance has been relatively modest. These stocks are still down quite a bit on the year, but the fact that they’ve bounced off of the recent bottom, save for communication services again, is an encouraging sign. At this point, I think tech and consumer discretionary are positioned well for further outperformance here. Investors have accepted the Fed’s aggressive rate hiking plans and the unexpectedly strong labor market helps ensure that consumers will continue spending, especially as omicron cases come way down.

Consumer staples have turned neutral while trending downward. Defensive equities were popular as the Treasury curve reset and high valuation stocks needed to be repriced. Those immediate concerns look to be alleviated for now and investors are probably less likely to seek out safe havens in the near-term. If the Fed raises 50 basis points in March and continues to sound extremely hawkish, that might be the environment where staples start leading again, but I don’t think the next month looks particularly favorable.

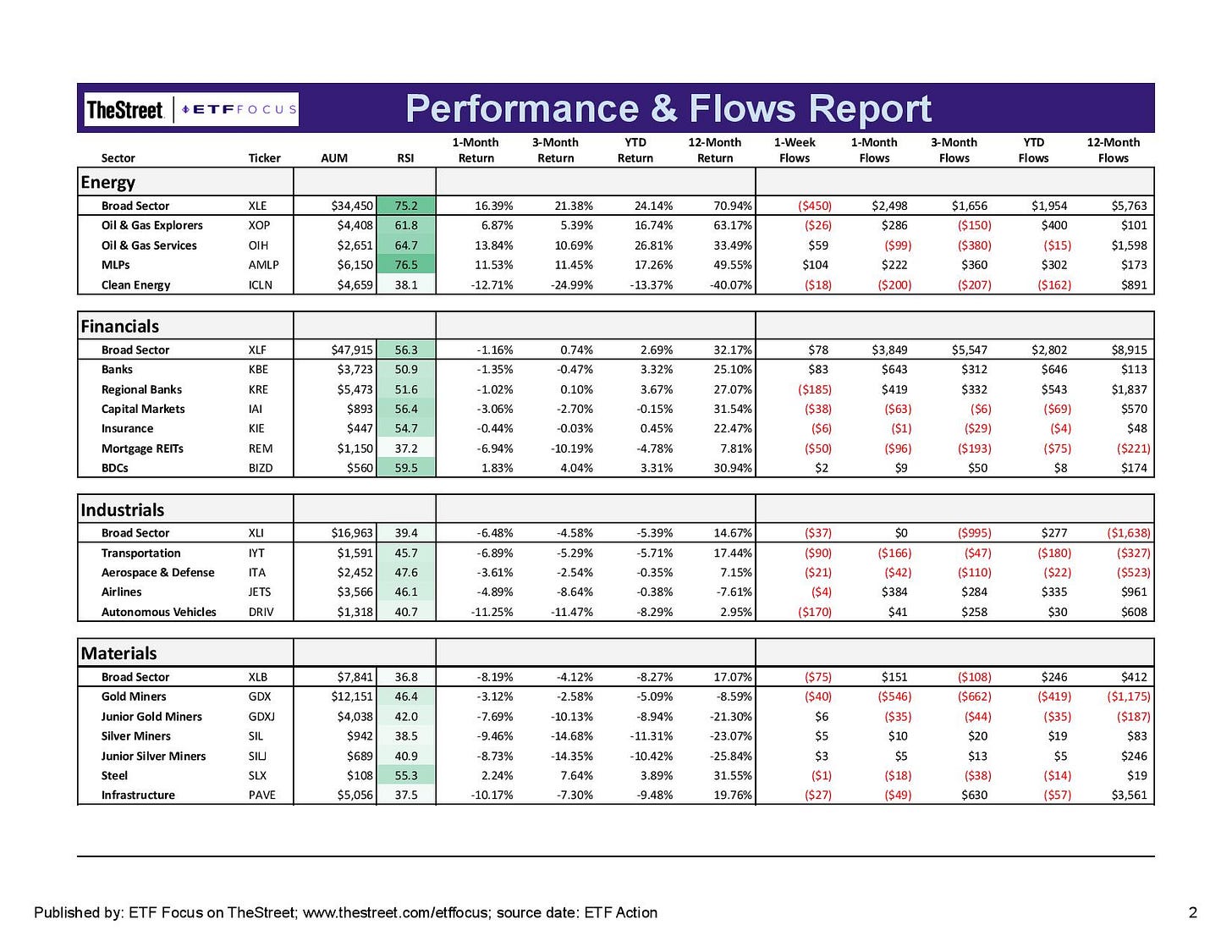

It’s the same story in cyclicals. The energy sector is about the only one demonstrating firm strength, although financials have come back recently as rates have pushed higher. MLPs have the highest current relative strength of all the market groups I track, although there have been broad gains across the board. Financials, of course, are very dependent on the state of Treasury rates and the two have been highly correlated for a while. If you believe the Treasury yield curve is going to continue moving higher, banks and financials are likely to do well.

Industrials and materials aren’t looking nearly as strong. Some of the latest economic data from factories and manufacturing is suggesting some degree of possible as input prices remain high and supply chains are still disrupting production (Ford just announced it was shutting down some production due to chip shortages). Cyclicals look like they’re setting up for a further dichotomy - energy/financials vs. materials/industrials - with the former looking like a better bet to outperform.

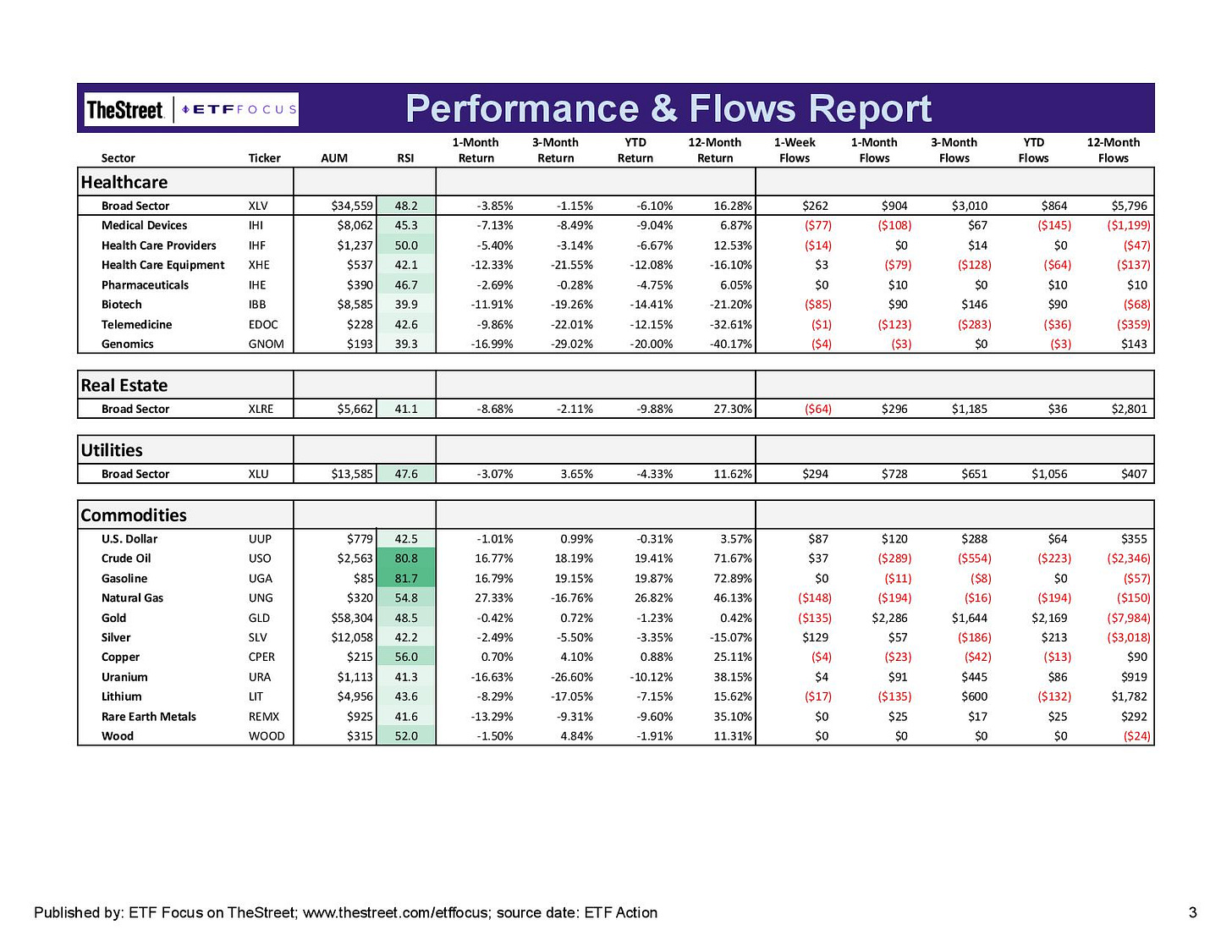

The utilities sector is still drawing interest from investors judging by net flows, but it looks like it’s finally breaking down based on recent performance. Real estate has turned noticeably lower as interest rates rise sharply all around the world. Healthcare looks confounding, as it has for much of the past several months. It hasn’t really followed any one specific pattern and correlations to specific themes have been low. Some of the volatility has been the result of the riskier areas of the sector, biotech and genomics, significantly underperforming the more defensive areas, providers and drugs. It might be advisable to separate those groups depending on what you want your healthcare exposure to be.

Energy commodities remain the biggest winner and it looks like it may only be a matter of time before oil hits $100. I keep thinking about the built-up energy demand likely to come as omicron wanes and the summer travel season nears. This bull rally might not be over.

The dollar decline is notable. Most of this is due to the spike in the euro resulting in the European Central Bank suddenly pivoting hawkish after deciding that inflation might be a problem after all. The idea that the ECB is looking for reasons to keep interest rates near zero despite an economic cycle that has peaked and is back on the decline again is confounding. It’s bad enough that most central banks around the world have been way late in finally tightening conditions (it just took inflation rates of 7% and higher to do it), but the fact that the ECB still thinks this is no big deal is bordering on negligent.

Read More…

Facebook Nabs META Ticker From Metaverse ETF

Top Performing Dividend ETFs For January 2022

Top Performing ETFs For January 2022

The Fed May Be Forced To Stop Before It Hits 4 Rate Hikes This Year

ETF Battles: Which Dividend Income ETF Is Better? JEPI vs. SCHD vs. XYLD Face Off!

Quick Take: Powell Gets More Hawkish & The Market Doesn’t Like It

Why I’m Buying Shares Of ARKK And ARKF

Why The VIX Says It's Time To Buy, Not Sell!

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!