ETF Focus Rewind: Watch For A Treasury Rally

The expiration of the debt ceiling suspension on July 31st will drive the market's direction this week.

2 ETFs To Consider Buying (And 1 To Avoid) This Week

Next week has the potential for being really interesting and I don't mean in a good way.

After a big drop in equity prices this past Monday, dip buyers quickly swooped in and picked up discounted shares. The buying continued throughout the remainder of the week and pushed the Dow, the S&P 500 and the Nasdaq 100 all to record highs. As of today, we haven't seen a 5% correction in large-caps since early November 2020. It's been quite a while since there's been a time like this where equity investors are just refusing to let share prices head south.

That might change this week though. In my opinion, it has nothing to do with big tech earnings, rising COVID counts, the Fed meeting this week or slowing economic growth. It has everything to do with the government debt ceiling, whose suspension two years ago is set to expire on July 31st. So far, there is little to suggest that either side of the Congressional aisle is willing to budge an inch and this fight could come down to the wire.

Could we possibly see the debt ceiling reached without an agreement to either raise or suspend it again? I think it's a very underappreciated possibility that could send equity prices and Treasury yields diving this coming week.

I posted this chart on Twitter over the weekend of 10-year Treasury yields in 2011, the last time we had a big debt ceiling battle in Congress that ended up with Moody's downgrading the U.S. government's credit rating.

The debt ceiling in 2011 would have been reached on July 31st, but Congress managed to agree to raising it just two days before the deadline. You can see that Treasury yields had been plunging in the lead-up to this date as investor confidence quickly eroded.

Yields continued to fall even after the new debt ceiling deal and further still following the official downgrade that took place on August 5, 2011. The 10-year yield ended up falling 200 basis points from top to bottom.

Have Treasury yields been falling in the lead-up to the debt ceiling expiration in 2021? Yep. Are they poised to continue falling as we approach the July 31st deadline? Certainly seems reasonable. What if the deadline passes with no agreement? I'd expect the 10-year to move towards 1% and probably quickly.

Is this a possibility or a probability at this point? I would imagine some type of agreement would be reached right at or possibly immediately after July 31st because there's too much potential political damage for both sides if it doesn't happen. Will that be enough to push investors to safe haven assets regardless of what happens? Maybe. Investors have shown much willingness to quickly buy risk assets as soon as there's any type of good news.

Keep an eye on this one as the week progresses since the narrative could quickly change as conditions change.

With that out of the way, here are three ETFs I'm going to be watching this week and the narratives that go along with them.

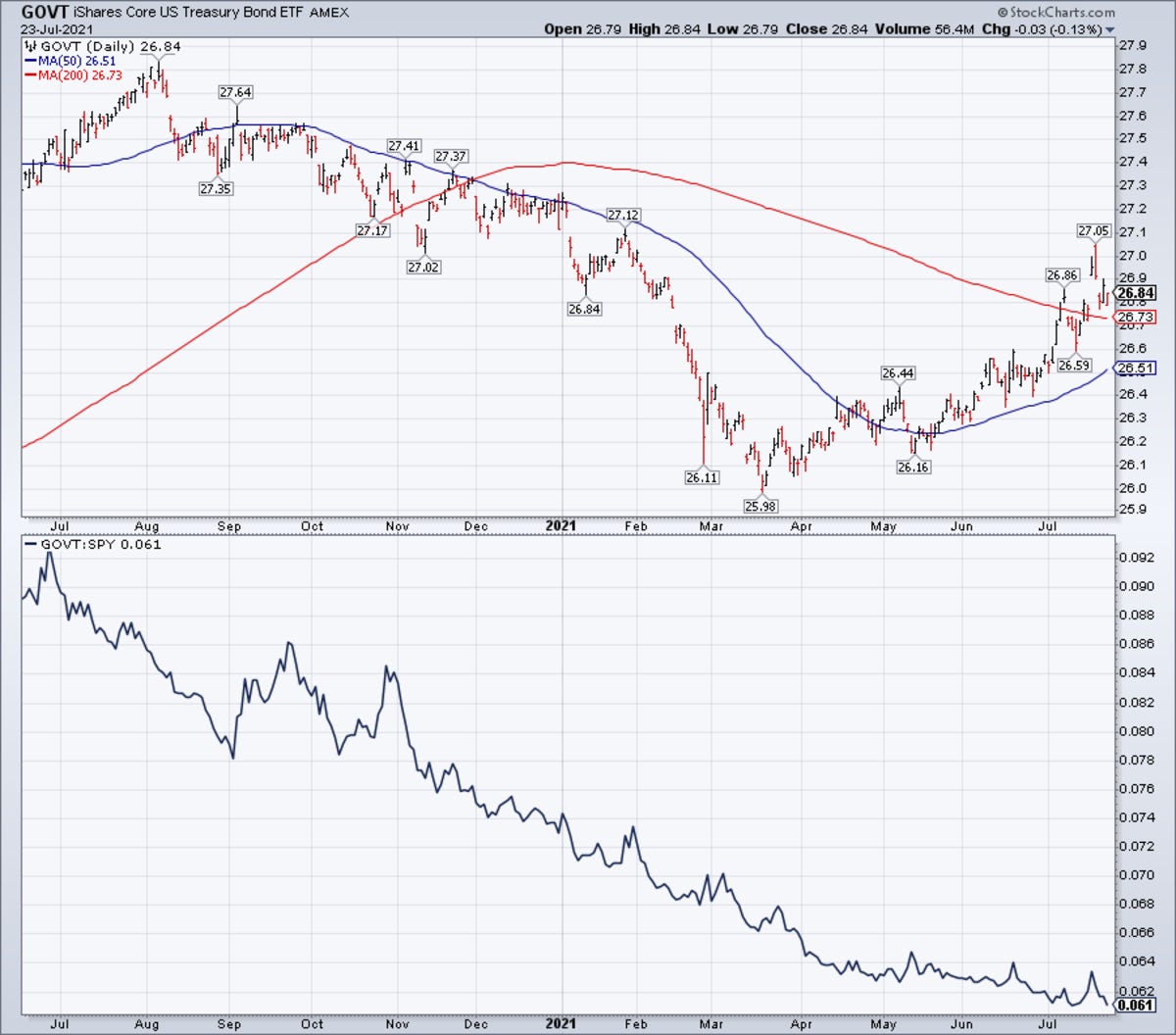

iShares U.S. Treasury Bond ETF (GOVT)

This pick is probably obvious. If I think there's a chance that Treasury yields head sharply lower this week, it makes sense to load up on government bonds. I'm sticking with an all-maturity government bond ETF because it's far from a sure thing that Congress won't reach some type of deal that would no doubt bring risk seekers back into the markets. Using a fund, such as the iShares 20+ Year Treasury Bond ETF (TLT), could offer a home run swing, but it could also exposure investors to extra downside risk.

Even without the debt ceiling narrative in place, Treasury yields have been heading down for four solid months. Last week offered a modest degree of newfound stability, but the trend is still down for yields. Even as Treasury bond prices move higher, so are stock prices. Bond buyers haven't been gaining any ground even though I believe sentiment is still in favor of fixed income. Given that I expect volatility to tick up this week, there's some boom/bust potential here. I'd be on the side of T-bond buyers personally.

SPDR Gold MiniShares Trust (GLDM)

Gold is considered by some to be a defensive hedge. It's an inflation hedge to others. The bottom line is that it hasn't done much of anything in 2021. It's been modestly volatile, but investors have largely stayed away choosing to use things, such as Treasuries, utilities and even cryptocurrencies as hedges. I still think there's some potential for gold this week.

Gold should, in theory, be rising as inflation has pushed north of 5%, but that just hasn't happened. Investors appear to be buying into the Fed's "transitory" narrative and, therefore, have shown little interest in adding precious metals exposure. This could be another good example of how gold has essentially no correlation to stocks and could go up or down regardless of conditions. If the debt ceiling story I mentioned above plays out as I think it might, gold could get some ancillary defensive interest as well. I think Treasuries are the better play for this, but there's a chance for a short-term rally if it can get above those moving averages.

Schwab U.S. Dividend Equity ETF (SCHD)

SCHD is one of my absolute favorite dividend ETFs out there, but sometimes you just have to call it like you see it. SCHD simply isn't a buy right now.

If you're not familiar with how SCHD works, it targets companies with long histories of paying dividends, demonstrate high quality characteristics, such as strong cash flows and modest payout ratios, and have high yields. It's one of the few dividend ETFs out there that targets growth, quality and high yield. But that means it also leans heavily into currently out of favor sectors to find those characteristics. The combination of financials and industrials account for around 35% of the portfolio right now with consumer staples/healthcare comprising 26% of the fund. Of SCHD's top 5 sector holdings, only tech qualifies as a growth industry at the moment.

This lack of "in favor" exposure has been evident since the beginning of May, where returns have been virtually flat and the fund has significantly lagged the S&P 500. I still believe that SCHD is terrific as a core long-term portfolio holding, but if you're looking to add to positions in the current environment, it doesn't look like conditions are ideal.

Chart of the Week

I’ve never been a huge fan of the Fear & Greed index since it’s based on nothing more than how investors are feeling at any particular moment. For the most part, it tends to follow the direction of the equity markets pretty closely, but there are the occasional moments where sentiment diverges from equity prices and identifies a potential disconnect in the markets.

Since the beginning of 2020, we’ve seen a few instances where a drop in investor sentiment has preceded a fall in equity prices. It happened initially during the COVID pandemic recession. It happened again during the late summer of 2020 when the markets took a breather from the risk asset rebound. We’re seeing it again today, but to a much larger degree.

Today, we’ve seen the Fear & Greed index dip below 40, traditionally an area that indicates more bearishness than bullishness. That shouldn’t necessarily be surprising given how commodities prices have plunged and Treasury prices have been steadily rising. This is occurring, however, even as the Dow, S&P 500 and Nasdaq 100 are hitting record highs. We’re certainly overdue for at least a modest pullback - large-caps haven’t fallen by 5% since November 2020 - and it makes sense that we could see one soon. Treasuries are indicating a more bearish sentiment under the surface and sentiment readings suggest that investors are feeling the same. What happens over the next week or two could be critical for the equity markets and I wouldn’t be surprised to see a relatively sharp pullback in equity prices by the end of this summer in the neighborhood of 5-10%.

Read More…

A Big 1st Week For The New Cleaner Energy Crypto Mining ETF

The Two Types Of ETFs You Should Be Avoiding Right Now

4 ETF-Based Portfolios Give You The World For 7 Basis Points Or Less

6 Safe Haven ETFs For An Increasingly Dangerous Market

Treasury Yields Plunge: A Look At Government Bond ETFs

2 ETFs To Consider Buying (And 1 To Avoid) This Week

ETF Battles: QQQ vs. MTUM - Which Growth Stock ETF Is The Right Choice?

Thanks for the article, Dave. Yes, a most interesting week to be sure. It's an interesting environment we find ourselves in, isn't it. As I have written in my articles, cash is trash, and bonds aren't much better at the present time.

So, folks pile into equities, because there doesn't appear to be any other option. But then equities themselves begin to get stretched in valuation. It is potentially a recipe for a somewhat bumpy road ahead.