ETF Focus Rewind: Risks Remain, But Pockets Of Opportunity Still Exist

Infrastructure REITs, dividend stocks and China are all on the radar this week.

2 ETFs To Consider Buying (And 1 To Avoid) This Week

There's a sense of apathy I feel that's growing in the financial markets that could lead to a strong downside response in risk assets if not addressed. I summed up my short-term concerns in a recent tweet.

I'm still worried that there's almost no concern or even attention being paid to the debt ceiling expiration and its potential ramifications. The deadline to reach a new debt ceiling passed over the weekend, which means the government can no longer issue new Treasuries. On the long end of the Treasury curve, the impact will probably be minimal for now since much of the issuance happens on the short-end and the Fed continues to lap up any current supply.

The Treasury bill market could become a little more hairy. In the short-end, that could lead to a supply/demand imbalance that has the potential of pushing yields negative. As we approach the soft October-ish date where the government's cash reserves run out and we approach a real crisis point, Treasury yields could begin soaring since default risk rises, even if ever so slightly. Yes, the government will eventually strike a deal to raise the debt ceiling and new borrowing will continue.

We saw a somewhat interesting pivot back to cyclicals last week at the expense of growth stocks. Cyclicals have been incredibly out of favor for weeks, so a modest bounce back isn't a surprise, but I'm not sure there's a great deal of sustainability here. The upcoming Friday jobs report may not do much to help the group regardless of the final number. A disappointing report could raise questions of the recovery's progress, while a beat could be viewed as hawkish for future Fed policy. One thing that has been consistent throughout 2021 is the willingness of investors to keep bidding up stock prices in the face of potential negativity.

The first part of the week is looking pretty good though. More earnings reports will drop throughout the week and those I expect will be generally supportive of stock prices. There may not be a potential stumbling block that I see until Friday's jobs report. With volatility low and utilities and consumer staples still receiving only modest interest, there's a setup here for more gains in stocks.

With that being said, here are three ETFs I'm going to be watching this week and the narratives that go along with them.

Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR)

Real estate has been one of the market's best performing sectors in 2021, but there have still been some pockets of weakness within it. One of those areas is data centers & infrastructure REITs. The group held up relatively well during the worst of the COVID bear market, but has been a steady laggard since the March 2020 bottom. Sentiment has shifted away somewhat from retail REITs, which led during early stages of the rebound, but has since seen commercial REITs picking up some slack. Infrastructure REITs have been getting knocked down pretty consistently on any sign of cyclical weakness.

The government infrastructure package is the play here. Congress was meeting over the weekend to try to push the deal over the finish line and the general consensus now is that it will eventually get done in some form or fashion. Infrastructure stocks have probably pushed too far, too fast in anticipation of a stimulus package. I think the Global X U.S. Infrastructure Development ETF (PAVE), for example, is fully valued, but SRVR, which targets the data center REIT segment specifically, could be due for a catch-up rally.

SPDR S&P Dividend ETF (SDY)

Investors who have leaned into equities for dividend yield probably aren't very happy with their choices. Even high yield ETFs, such as the Vanguard High Dividend ETF (VYM), aren't even reaching the 3% level at the moment. SDY, which targets a combination of dividend growers with above average yields, has been another option, but yields only 2.5% itself. It's had a fairly good 2021 so far, returning about 18% year-to-date, but its high yield focus has made it prone to cyclical underperformance.

Like many high yield ETFs, it leans heavily into financials and industrials for dividend opportunities (energy is another popular sector for yield seekers, but SDY has a comparatively low 4-5% allocation here). SDY's performance relative to the S&P 500 has been heavily impacted by cyclical underperformance over the past two months, but the chart suggests maybe there's some bottoming here. Your opinion of SDY should be dependent on your opinion of cyclicals. If they can get a boost when an infrastructure bill gets passed, there's potential here, although watch out for that Friday jobs report.

WisdomTree China Ex-State Owned Enterprises ETF (CXSE)

We've all seen what the Chinese government's crackdown on many areas of its economy has done to stock prices. The iShares MSCI China ETF (MCHI) is off about 26% from its recent high, but the real damage has been done in the tech sector. The KraneShares CSI China Internet ETF (KWEB) has lost more than half of its value in the past six months. At this point, trying to buy the bottom in China stocks is like trying to catch the proverbial knife. I looked at CXSE to see if investing in China but avoiding state-owned enterprises produced any better results, but it looks like the answer is no.

Excluding state-owned enterprises could be an advantageous strategy to investing in overseas markets because it helps avoid some of the government bureaucracy and interference as well as offers some higher growth potential. The government crackdown it appears has affected all areas of the market equally. I'd suggest treating this ETF like all other China ETFs and wait to see some sort of bottom in place before proceeding.

Chart of the Week

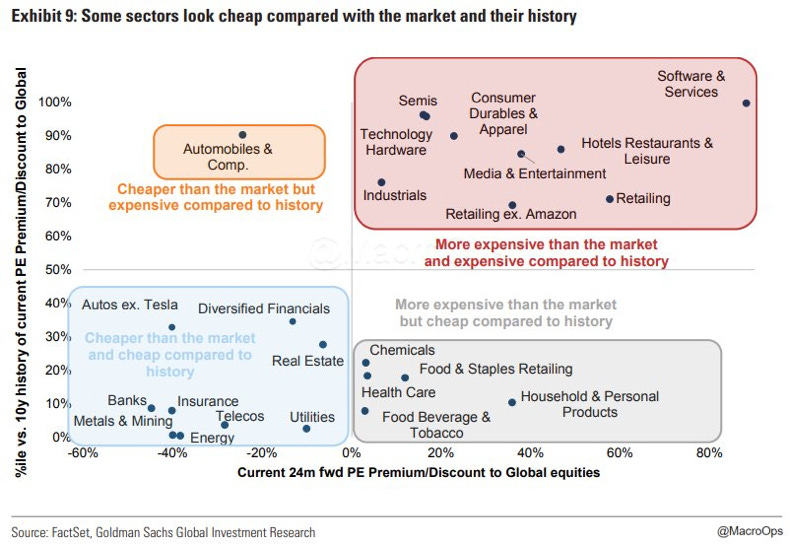

Value is something there isn’t a lot of in today’s markets, but relative value is still there.

It won’t be surprising to see that all of the growth sectors - tech, communication services and consumer discretionary - are in the upper right quadrant. The fact that the hotel & leisure sector is up there is more a function of the low earnings base effect that comes with an industry crash and recovery in such a short period of time. Is the sector as overvalued as is suggested here? Probably not, but it’s being priced as if a robust recovery is a sure thing. With the delta variant spreading rapidly, it’s not.

Seeing industrials up there is a bit of a surprise since it’s such an outlier from the other cyclical sectors. This sector is more of a proxy on the broader manufacturing and factory industries. We know that this sector led the way on the initial recovery from the COVID recession, so there’s some residual effect from that. I suspect we’ll see some of the relative valuations balance out and don’t consider it overvalued at the moment.

The real “value” lies in those economically-sensitive sectors, but there are challenges involved in investing here. Banks & financials are struggling as interest rates fall and continue falling. Energy stocks will be a function of global energy demand. That was anticipated to be strong coming out of the recession, but a lot of questions exist today. Utilities will usually be cheaper than the broader market in normal conditions, but investors’ insatiable appetite for risk assets makes them especially undervalued in the short-term.

The better short-term bets might be in real estate and precious metals miners. Gold prices haven’t risen in the way you might expect given higher inflation rates, but if the market is buying into the Fed’s “transitory” narrative, then it makes more sense that gold prices haven’t budged much. Miners are looking especially undervalued at the moment and the fact that they’re generating positive free cash flows again means that there is a degree of financial strength finally backing them.

The infrastructure bill will likely provide a degree of optimism for the markets, but the upcoming debt ceiling fight in Congress has the potential for creating an unstable market over the next couple of months. I still believe that the 10-year Treasury rate is headed back to 1% eventually.

Read More…

The ARK ETFs Loaded Up On Robinhood; That's A Mistake

ETF Battles: YOLO vs. MJ vs. MSOS - Which Cannabis ETF Is Best?

Robinhood IPO: 3 ETFs The Stock Could Soon Show Up In

China ETFs Getting Pounded Amid Government Crackdowns

QQQJ vs. QQQN: A Comparison Of Two Nasdaq Next Gen ETFs

The Two Types Of ETFs You Should Be Avoiding Right Now

4 ETF-Based Portfolios Give You The World For 7 Basis Points Or Less

6 Safe Haven ETFs For An Increasingly Dangerous Market

Questions, Ideas, Thoughts?

Feel free to check in by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!