Investors finally got some relief week after a correction that cut nearly 13% off of the S&P 500 (SPY) and more than 20% from the Nasdaq 100 (QQQ). The indices tacked on 6% and 8%, respectively, last week and while they still sit well below their 2022 highs, there are probably a lot of investors out there who believe that this will mark the big turning point that sends stock prices higher again.

I am not in that group.

This was a nice relief rally to be sure and it featured outperformance from all of the areas of the market that have been particularly beaten down in recent weeks - tech, growth, high beta, fintech, blockchain, online retail and others. Treasuries declined again. Consumer staples and utilities lagged. Gold retreated. For one week at least, it was the perfect encapsulation of traditional risk-on behavior.

The catalyst was the Fed’s quarterly meeting, which saw the committed raise interests for the first time since late 2018. Most of the week’s gains came following Jerome Powell’s commentary after the rate hike was announced. His tone was very measured. The big reveal that the Fed planned on raising interests steadily at each of the central bank’s meetings through the end of 2022 helped calm investors and reinforce the notion that the plan was aggressive enough to combat inflation but measured enough that it wouldn’t overshoot and risk future growth.

Here’s where I’m getting tripped up. Did anything the Fed do or say really change the narrative that existed heading into the meeting? I don’t think so. The markets were expecting a quarter-point increase. They got it. Powell said that the Fed was planning six more rate hikes this year. That’s largely been the expectation for much of this year. The Fed didn’t really reveal anything new, yet the markets took it as reason to plow into risk assets again.

In reality, I think the markets were looking for something to instigate a relief rally and the Fed provided it to them. The message was “right down the middle” enough that investors felt it removed a layer of uncertainty and that was good enough. The markets were probably short-term oversold and some kind of mean reversion was in order, but this doesn’t look like the bottom is in to me.

Why do I believe this? Because the bond market isn’t buying it.

Last week, Powell indicated a 25 basis point hike in May and another 25 basis point hike in June. Look at what the Fed Funds futures market is saying though.

Two meetings from now, traders are only pricing in a 16% chance of that happening. The most likely outcome is a 60% chance of a 25 and 50 basis point hike. There’s a non-trivial 1-in-4 chance of the Fed hiking 50 basis points each in May and June. That’s a material difference from the story that the Fed is telling. It’s clear that, for the time being at least, inflation is the Fed’s priority #1 and it’s going to need to attack it hard before it gets much above the 8% level it’ll almost certainly exceed in March. Fed governor Bullard already made the case for a 50 basis point hike in March, so it’s not like there’s no support for such an idea already.

If the market viewed last week’s meeting as somewhat dovish for the markets, it’s likely to view the central bank’s actual path of interest rate hikes more hawkishly. What comes after that? The markets pricing in greater recession risk and a likely further decline in risk asset prices. It may not happen this coming week or even longer, but conditions, in my opinion, still favor another leg lower.

The Treasury yield curve is the other big tell. The 10Y/2Y spread is still declining and now sits at 17 basis points, a strong sign that bond traders are getting progressively more pessimistic. All maturities between 3 years and 10 years are already completely flat and that’s usually a good sign that the 10Y/2Y will eventually get there too. This is another instance of the stock market and bond market telling two different stories.

For my money, I’m betting that the bond market is probably right.

With that being said, let’s look at the markets and some ETFs.

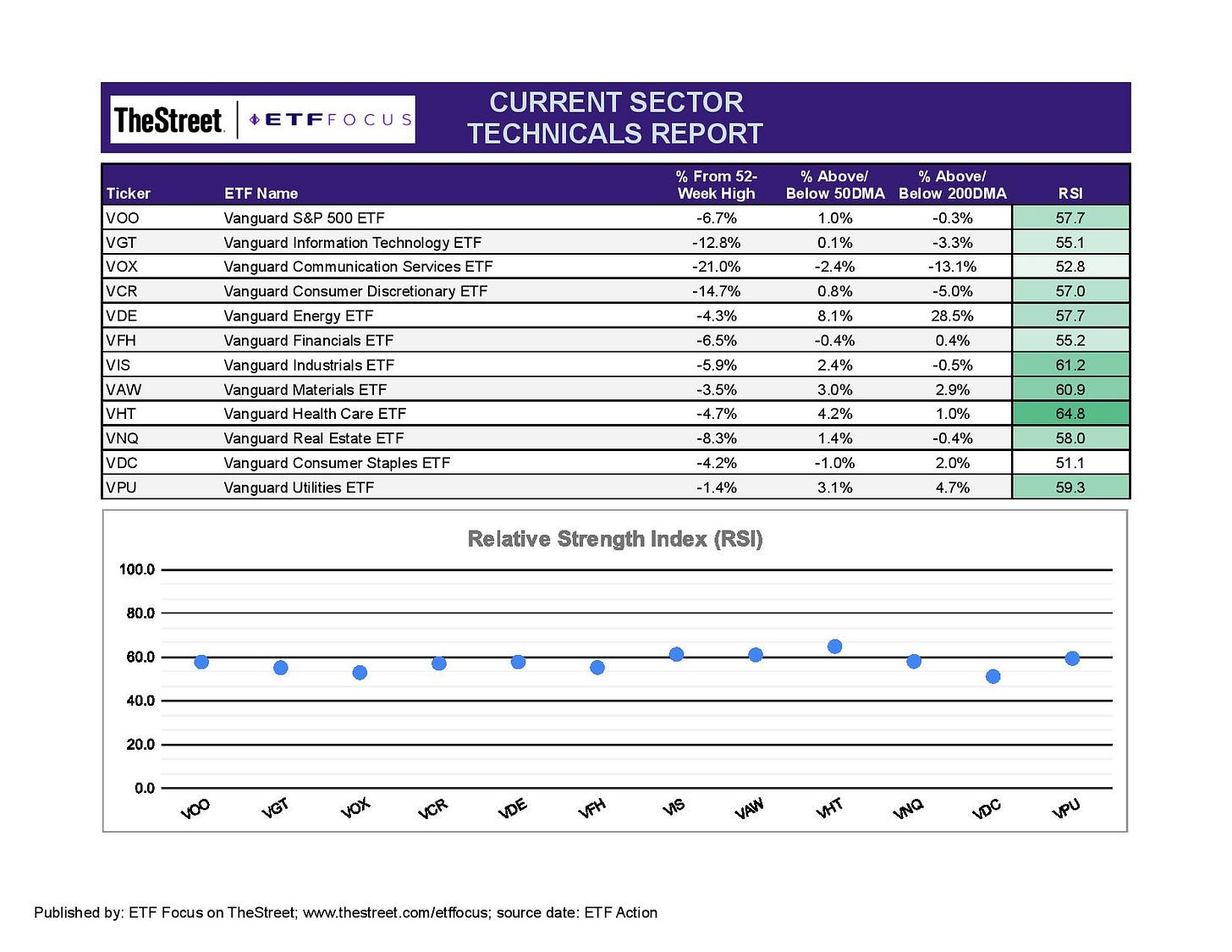

This is perhaps the greatest demonstration of market balance we’ve seen in quite a while in terms of short-term relative strength. Last week’s pullback in energy brought the sector back into neutral territory, while the growth rally pulled tech and consumer discretionary back up. The one sector that has looked a lot stronger lately is healthcare. Pharmaceuticals have consistently been the strongest subsector in this group, but biotechs, which had been a laggard, finally joined the rally. If the defensive and growth segments of this sector can continue move higher together, there’s a case to be made for further outperformance.

My expectation is that the consumer staples, utilities and real estate sectors aren’t done yet. I think investors are a little more bullish at the moment, but the core issues that caused the recent correction are still intact - slowing growth, high inflation and the Russia/Ukraine conflict. I think the markets will eventually come back to that realization and return to defensive stocks. The utilities sector, even with short-term volatility, are still in an uptrend relative to the S&P 500 since November. Last week feels more like the exception than the rule.

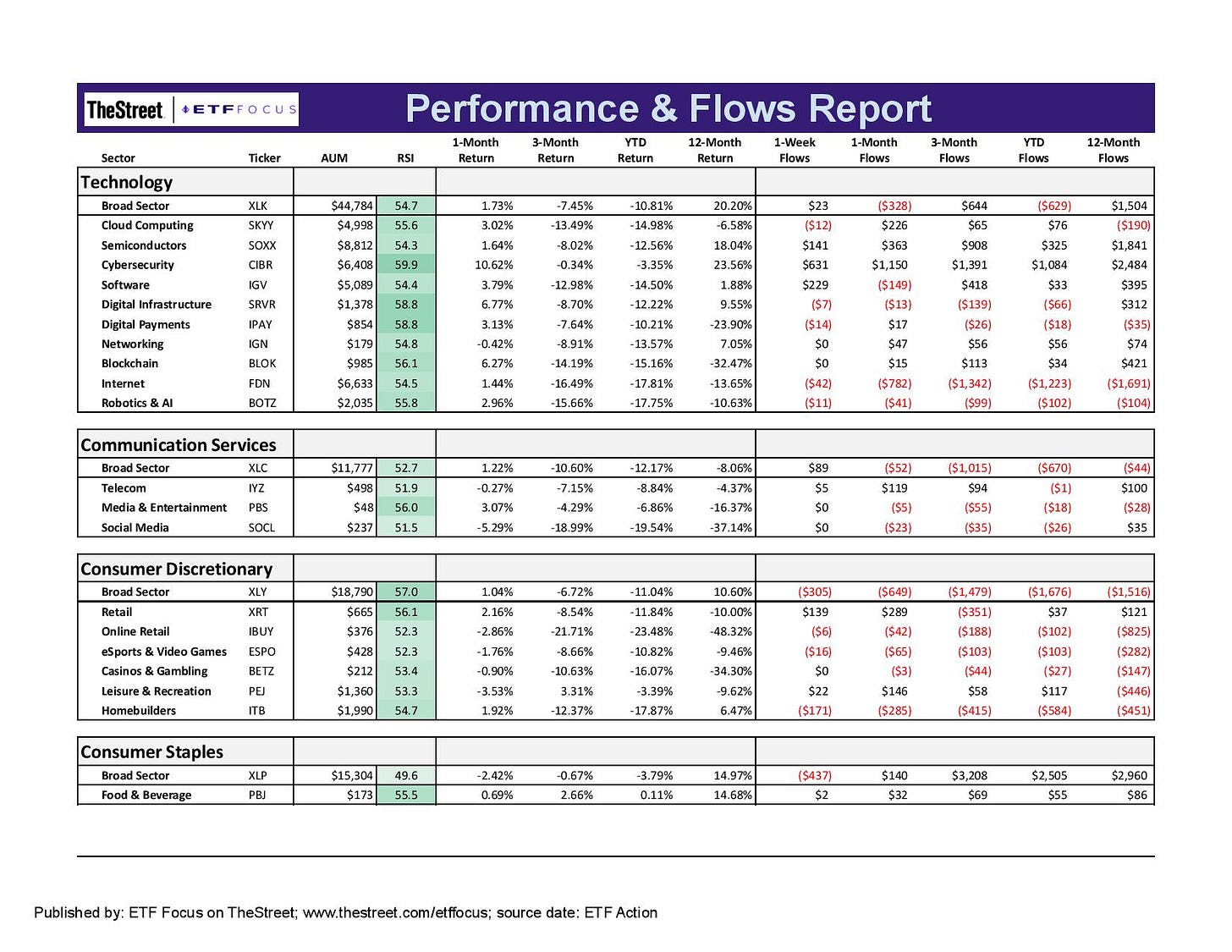

Every subsector listed above is squarely in neutral territory with nothing even approaching overbought or oversold. Cybersecurity continues to pick up some momentum in light of what’s been happening in Ukraine and to a lesser extent China. Blockchain remains highly volatile, but has managed to pick up some steam recently. Digital payments stocks have been doing comparatively better lately

Not many pockets of strength within the growth sectors. Most subsectors are in neutral territory in relative strength terms with only the social media stocks firmly in oversold territory, having lost 20% over just the past month. Cybersecurity and digital infrastructure stocks are doing a little better and are benefiting from the narrative that cutting Russia off from the rest of the world economically could raise the threat of cyberattacks from within the country and its allies.

Many people are anticipating a spike in leisure activity coming in the warm weather months, but most of that expectation is already priced in. In fact, recent activity from the leisure, recreation, casino and airline spaces suggest that investors may be downgrading some of their expectations in light of soaring inflation and fuel prices. A lot of pessimism is showing up in net flow numbers finally as investors beginning abandoning this space in larger numbers.

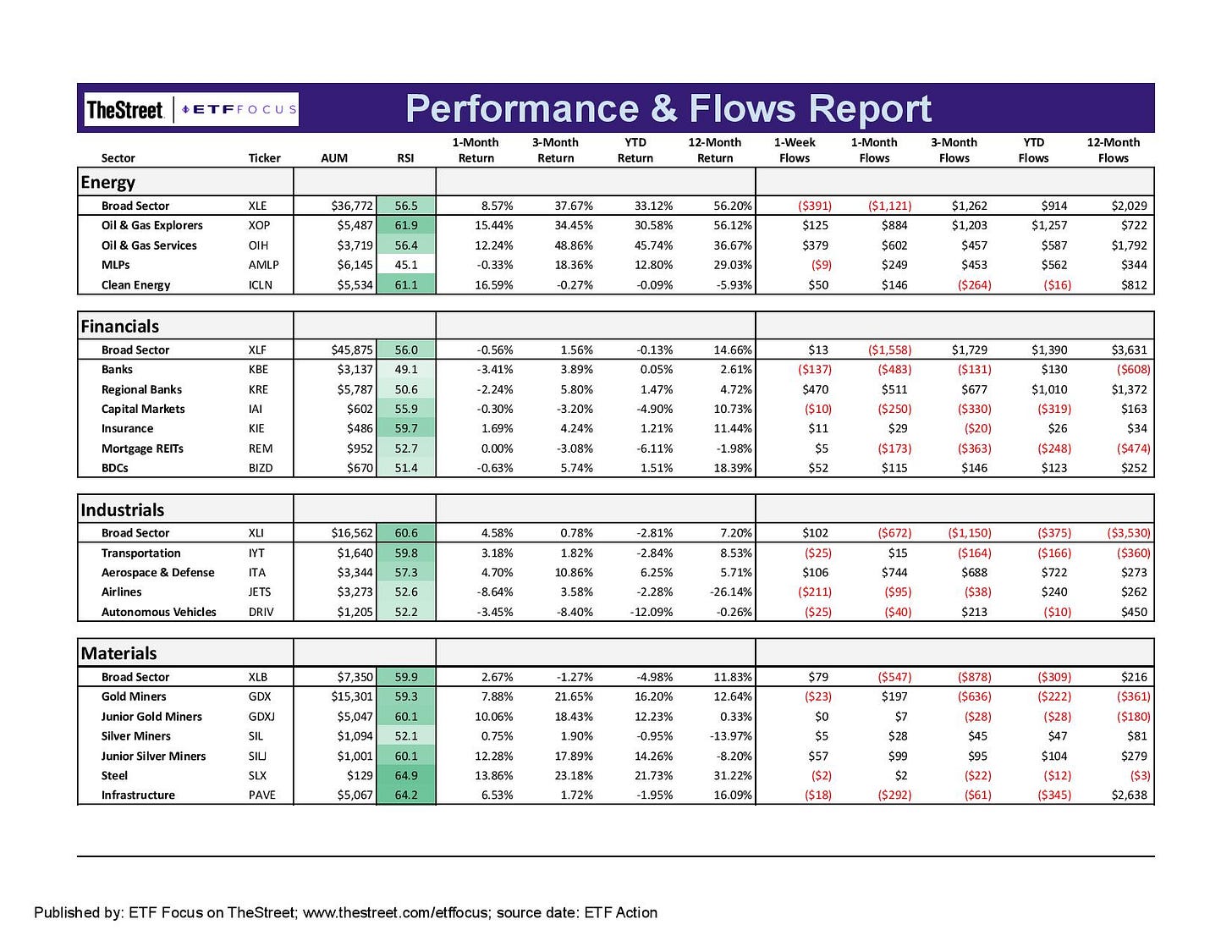

Oil prices remain highly volatility and that volatility is carrying over to energy stock prices. Energy was the only sector that was negative last week, which shouldn’t be that surprising given the run it’s had over the past several months. What’s a little surprising is that the broad energy sector ETF hasn’t seen a significant inflow over the past several months. The largest relative gains are showing up in the oil explorer and servicer ETFs. Flows as a percentage of assets are greater than 20% in many cases with these funds.

Financials have turned mixed over the past month despite the steady rise in interest rates. In a vacuum, rising rates are good for financials, but the sector is also facing the prospect of slowing growth and possible recession if the Fed overshoots its target. Industrials and materials are still hanging tough thanks to elevated commodity prices, but I think rising supply chain risk could make things a bit challenging in the near future. Gold miners have cooled a bit recently as precious metals prices have backed off.

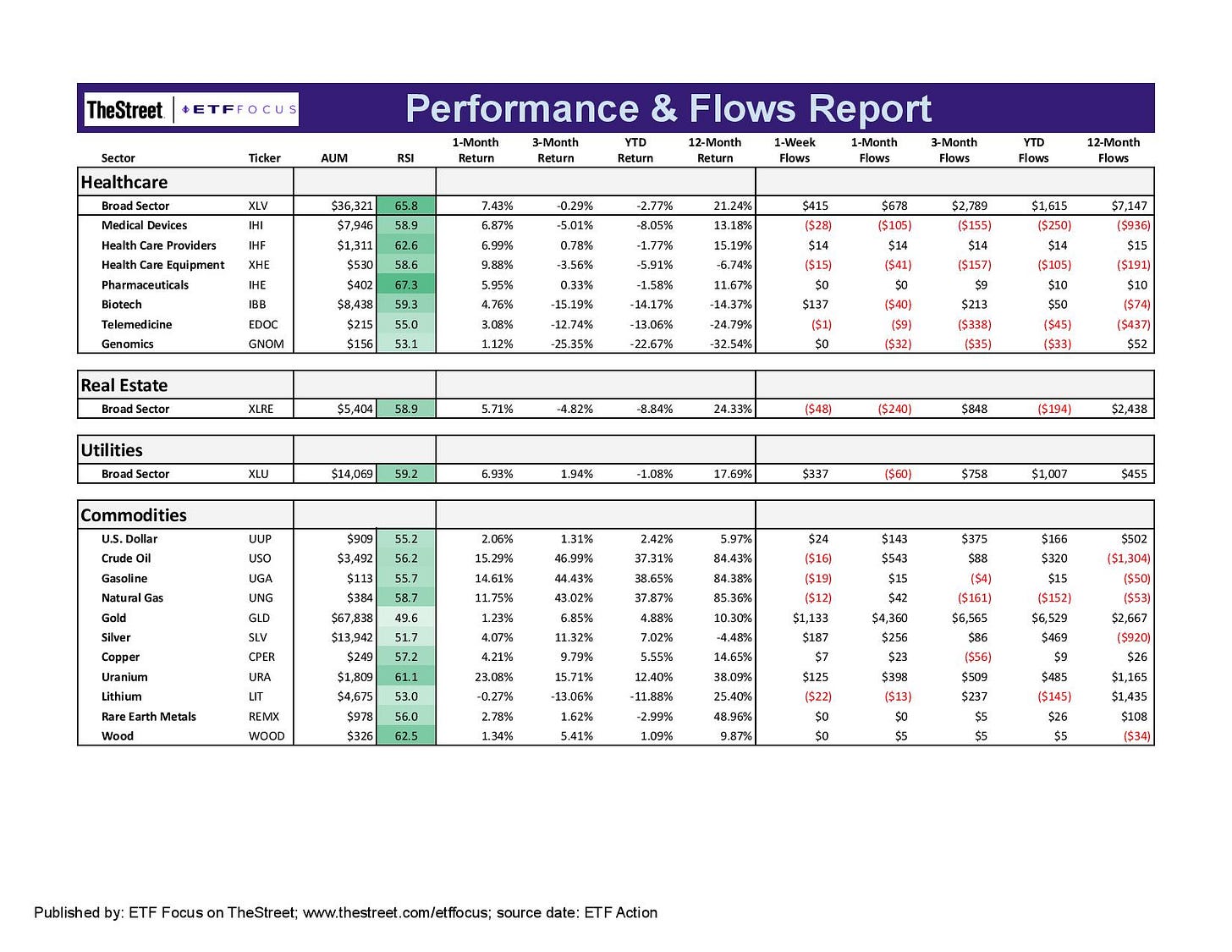

The healthcare sector reflects the strength in pharmaceuticals and healthcare providers stocks. Biotech is making a nice move higher here, although I question what kind of legs it has. I suspect the riskier asset classes are susceptible to give back some of those gains.

Crude prices are swinging wildly, hitting $130 before pulling back to the mid-$90s and back up to $105. It looks like prices well into the triple digits may be off the table in the near-term, but it sure looks like the market hasn’t yet figured out where it wants to settle.

Read More…

The Fed Tightening Cycle Is Here, But Will It Work?

SPHB: The Real Damage Isn’t Done Yet

ETF Battles: What's The Better High Income Dividend ETF? JEPI vs. NUSI vs. DIVO

Vanguard Dividend Appreciation ETF (VIG) Has Turned Into One Of The Worst Dividend ETFs Of 2022

Top Performing ETFs For February 2022

Russia ETFs Suspend Share Creations; Premiums To NAV Shoot Up To More Than 100%

6 Higher Yielding Cash Alternatives For Your Portfolio

4 Vanguard Bond ETFs For Every Market

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!