CORRECTION: Weekly Market Prep - 5/6/2024

The markets are lining up for a relatively calm week, but the deteriorating macro picture is impossible to ignore.

CORRECTION: The original title of this post incorrectly stated that it was for the week of April 29, 2024. It is actually for the current week of May 6, 2024 and only the title is misrepresented in the post. All content applies to the week of May 6, 2024.

Apologies for the error!

Welcome back to ETF Focus!

It’s Sunday! That means it’s time to get prepped and ready for the week ahead!

What We’re Talking About This Week!

+ Weekly Market Reset

+ Key Economic Reports This Week

+ Dividend Landscape

+ Market Outlook

Weekly Market Reset

Between the Fed meeting and the latest round of jobs data, there was plenty for investors to digest. The Fed made no change to the Fed Funds rate, as expected, but Powell also made it clear that inflation was no longer progressing towards the 2% target. That validates my belief that the Fed won’t have the justification to cut interest rates until at least December on the basis of inflation trends alone. On the flip side, a lot of the recent data we’ve gotten has confirmed that the U.S. economy is slowing down and that may force the Fed to begin loosening ahead of when they’re comfortable doing so.

Let’s consider the evidence:

In Q1, GDP grew at an annualized rate of 1.6%, missing consensus expectations of a 2.5% reading. That’s well below the 3.4% print of Q4 2023 and the 4.9% number of Q3 2023.

In April, the economy added 175,000 jobs, below expectations of 243,000 jobs. It was also the 2nd fewest jobs added in the past 13 months. The unemployment rate stands at 3.9%, a full half percent above the April 2023 low of 3.4%.

The last three core monthly inflation readings in the U.S. were 0.39%, 0.36% and 0.36%. That translates to a near-term annualized rate of 4-5% inflation and a trend that’s moving sideways, not down. The headline inflation rates and trends look substantially similar.

The ISM services PMI reading slipped to 49.4 in April, well below expectations of a 52 print and confirming that the U.S. services sector is contracting for the first time since December 2002.

We’re probably still in the very early innings, but I think that this is a trend that picks up steam later on this year. To be fair, a GDP growth rate of 1.6% and an unemployment rate of 4% are still pretty solid and not indicative of any imminent danger, but we know that the markets trade on trends. Right now, investors are trading on the potential for rate cuts and monetary easing later this year, but at some point soon, the macro trends become impossible to ignore.

If you’re looking for the bull case in all of this, it’s that the Fed might actually be preparing today for an easing down the road. At last week’s meeting, Powell said that the Fed would “slow the pace of decline” in its balance sheet runoff. Translated, that means that QT will start to ease and this could be another step towards the Fed adding liquidity to the system. I believe that’s a big part of why equities rallied post-meeting last week and could be a bullish catalyst for stocks & risk assets down the road.

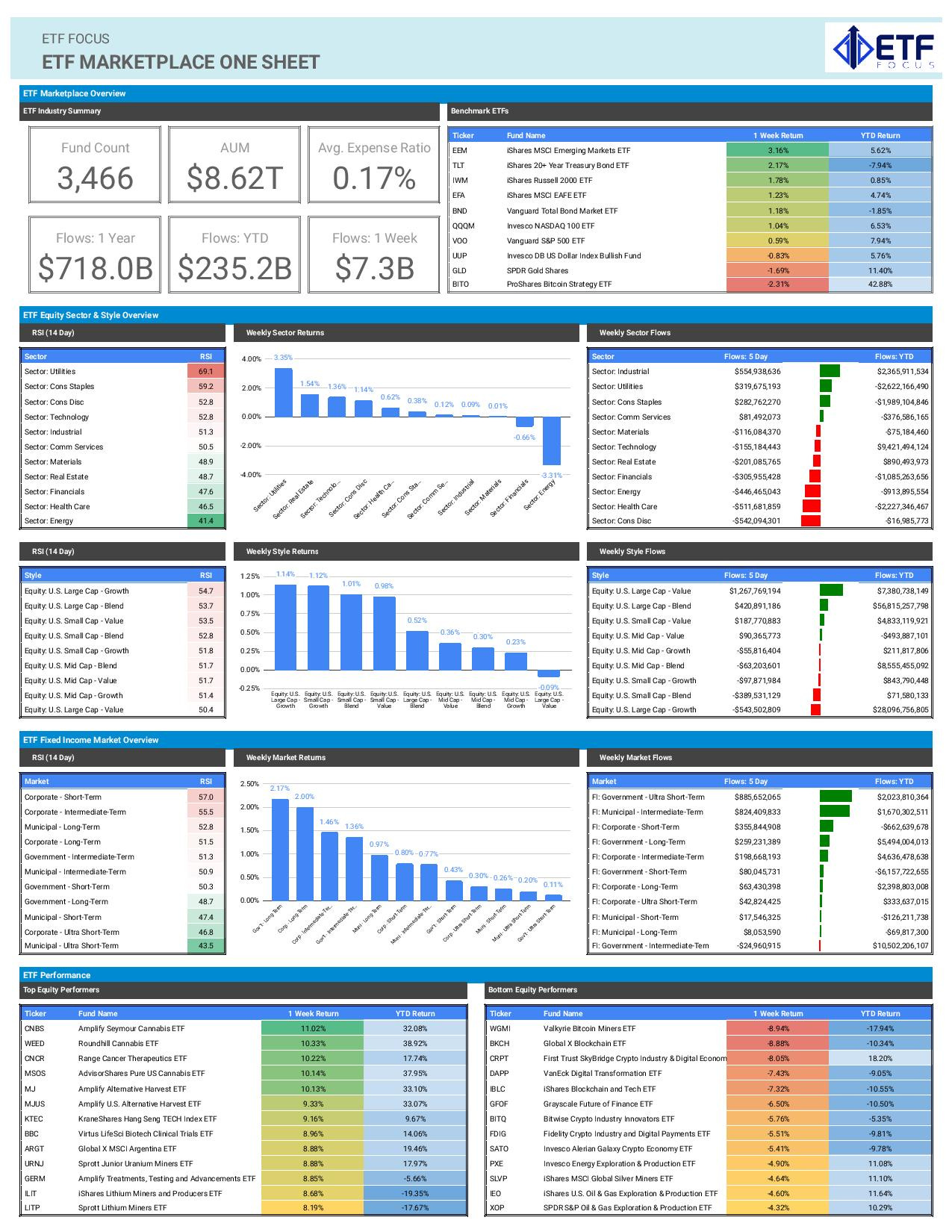

Looking at the present day, ETF investors are positioning themselves more conservatively. Two of the three biggest net sector inflows last week belonged to utilities and consumer staples. In terms of style investing, large-cap value ETFs saw more than $1 billion flow into them. On the fixed income side, it was another big week for Treasury bill ETFs. Gold ETF net flows remain virtually flat, but we know that’s because a lot of the buying is happening on the Asian government/institutional side, which might be a warning sign in and of itself.

Key Economic Reports This Week

The economic calendar looks much tamer than last week’s with the Michigan Consumer Sentiment reading for May being the only major piece of data in the United States.

We also get a couple more central bank decisions from the Reserve Bank of Australia and the Bank of England. It’s very unlikely we’ll see policy rate changes from either, but the BoE decision could get interesting because they’re likely to set the stage for rate cuts this summer. While the ECB is likely to go ahead with its first rate cut this summer, the BoE still may not. Inflation looks like it’s coming back under control and growth rates could use a boost, but there’s still lingering fear that inflation is ready to re-accelerate much as it has in parts of the world already. The overall theme of balancing growth with inflation control is likely to persist throughout 2024 and getting it right will be the difference between recession and a no/soft landing outcome.

Dividend Landscape

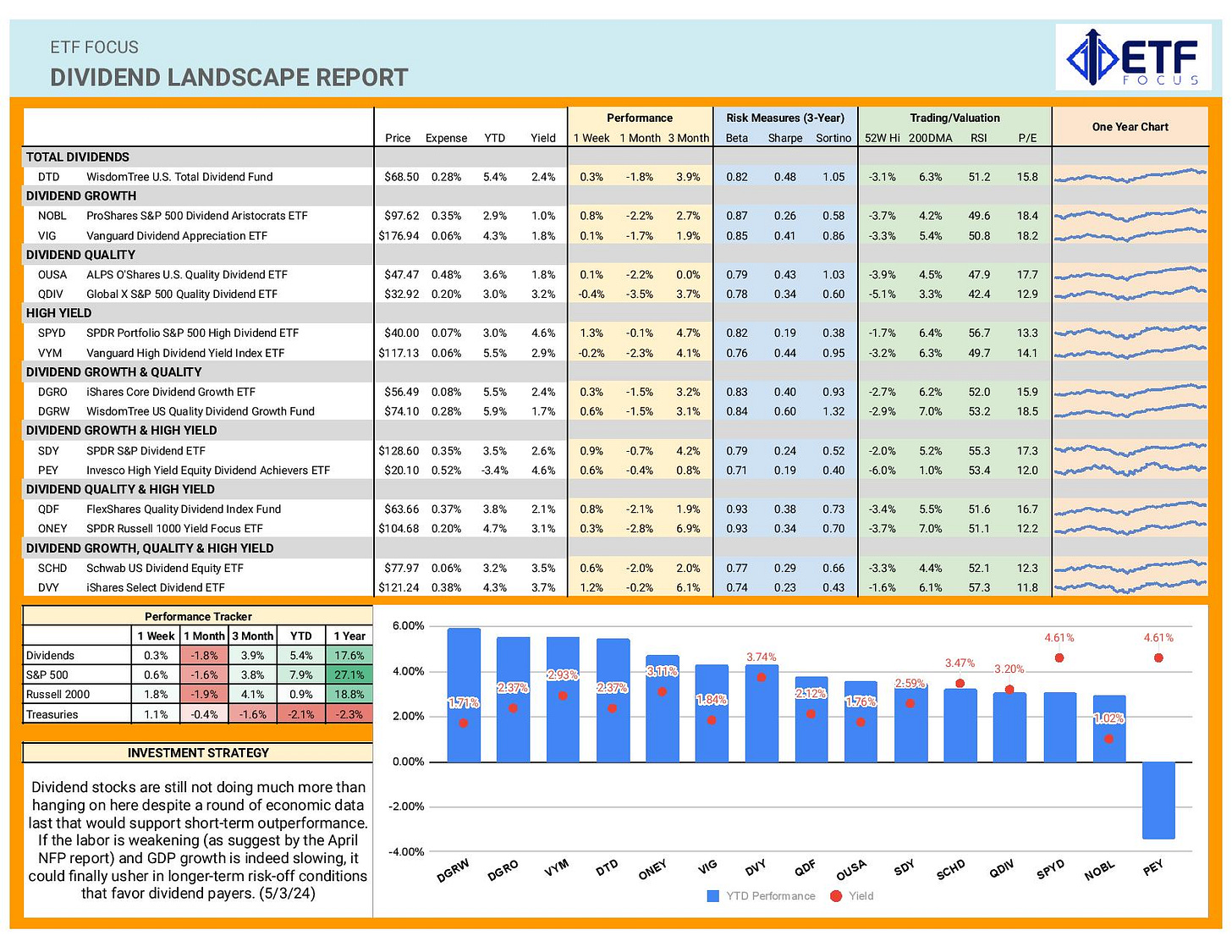

Dividend stocks retreated into the background again last week as the possibility of the Fed adding liquidity to the economy kept investors in a risk-on mood. As I already alluded to above, the underlying macro data strongly supports the idea of dividend stock outperformance over the next 6-12 months.

While the recent rallies in both cyclicals and utilities have helped out the group, the lack of participation from core defensive equities, specifically consumer staples and healthcare, has proven a tough hurdle to overcome. Last week, investors were encouraged by the prospect of a Fed rate cutting cycle getting pulled forward on the calendar. As long as that narrative maintains, it’s going to boost risk assets and likely turn dividend stocks into laggards. If the next round of GDP, labor market and inflation data shows a continuation of the slowing economy trend, expect dividend stocks to see more interest.

Market Outlook

The dynamics that put investors in a risk-on mood are unlikely to change this week given that we really won’t get any new data or catalysts. The major data releases are behind us as are the heavyweight earnings reports from the magnificent 7 stocks. Without any clear stimulus to drive them lower, I expect stock prices to have another positive week.

The thing I’d watch is Treasury yields. The market’s dovish twist has dropped the 10-year yield by roughly 20 basis points, although it could settle around the 4.5% range for now. Again, the markets need catalysts to make a larger move and I just don’t see that on the calendar for at least this coming week.

Looking better for: growth, tech, Europe

Looking worse for: TIPS, consumer staples, value