By The Numbers! Setting Up For 2022

Here's a breakdown of the major sectors, themes and factors as we head into the new year.

Merry Christmas and Happy Holidays!

I’m not going to be publishing a regular update this holiday week, but I did want to give you some numbers, info and article links as we head into the new year. I’ve been publishing a series providing ETF rankings by sector/theme for 2022 and will continue publishing more throughout the remainder of this and probably January as well.

Of course, you can check out ETF Focus on TheStreet to see everything, but here are links to some of the latest articles.

144 Dividend ETFs Ranked For 2022

138 Small Cap ETFs Ranked For 2022

87 Technology ETFs Ranked For 2022

10 Cannabis ETFs Ranked For 2022

6 Blockchain ETFs Ranked For 2022

Keep watching this newsletter or the site for more of these coming over the next month as leave a comment if there are any groups you’d like to see ranked!

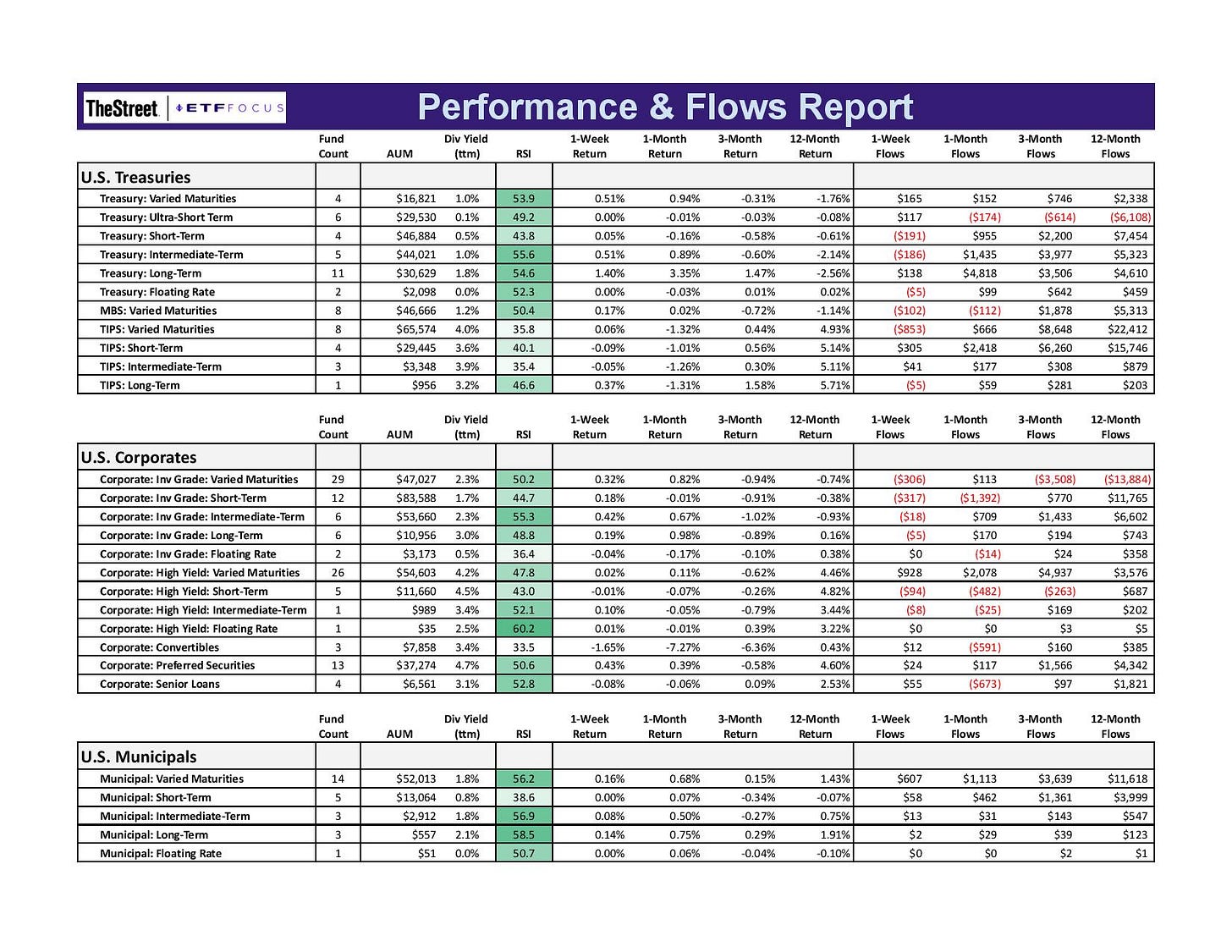

While we often see a Santa Claus rally at this time of year, the markets have instead turned more volatile. The combination of the uncertain trajectory of omicron and the potential impact of the Fed’s new tightening plans have turned investors defensive both in equities and fixed income. Let’s reset where the market is at around along with some brief commentary.

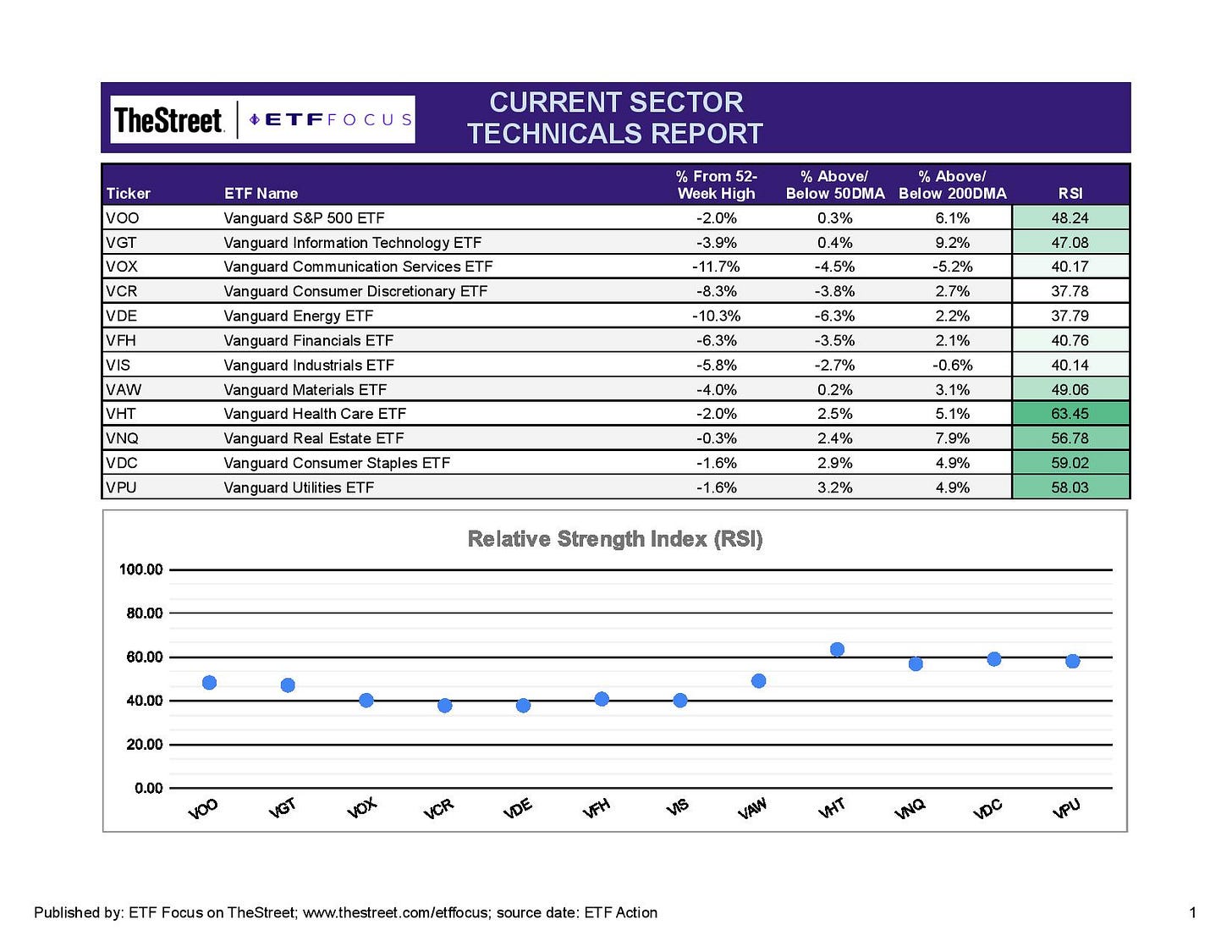

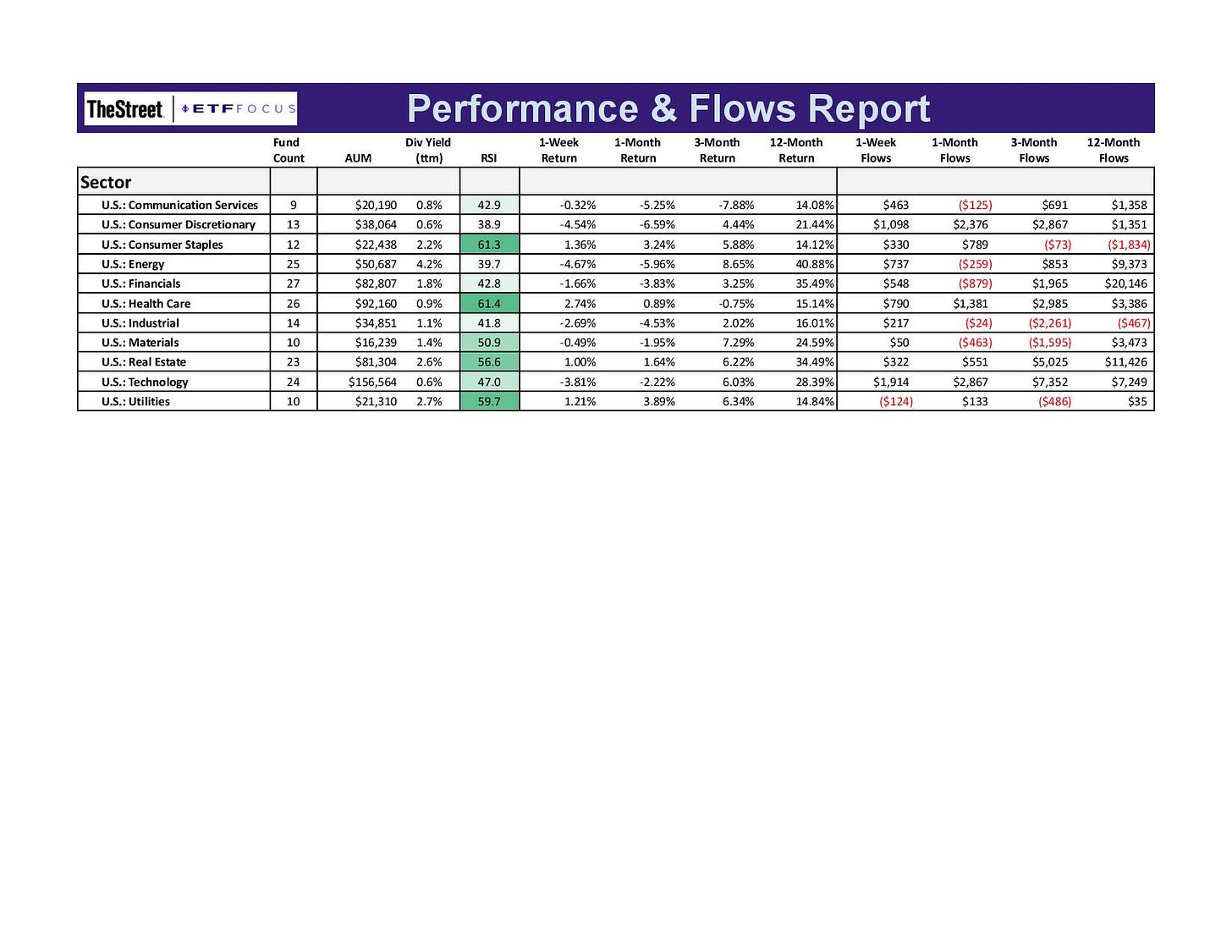

It’s easy to see from a standpoint of short-term relative strength how the equity markets have shifted decisively towards defensive sectors. All four - utilities, consumer staples, real estate and healthcare - have been leading for a few weeks now, although tech is still hanging on. Several sectors have broken below their 50-day moving averages, suggesting an overall neutral market sentiment, while a few move closer to their longer-term 200-day moving average.

Pulling back and looking more broadly at the major sectors tells a similar story, but materials is also still demonstrating some degree of short-term strength. The markets have been mixed over the past month, but money continues flowing in, as it often does at this time of year.

It seemed quite likely that the Roundhill Ball Metaverse ETF (META) was going to move into the top spot for 1-month inflows and it finally does this week. Not sure how much of that is due to Facebook changing its name to Meta, but this will cross the $1 billion mark soon and probably head towards $2 billion before too long. The other interesting name on the list is the Tuttle Capital Short Innovation ETF (SARK). This is probably the perfect vehicle for those wanting to short Cathie Wood’s ARK Innovation ETF (ARKK). There’s clearly a market for this type of product. The KraneShares CSI China Internet ETF (KWEB) is still consistently drawing money despite miserable recent performance.

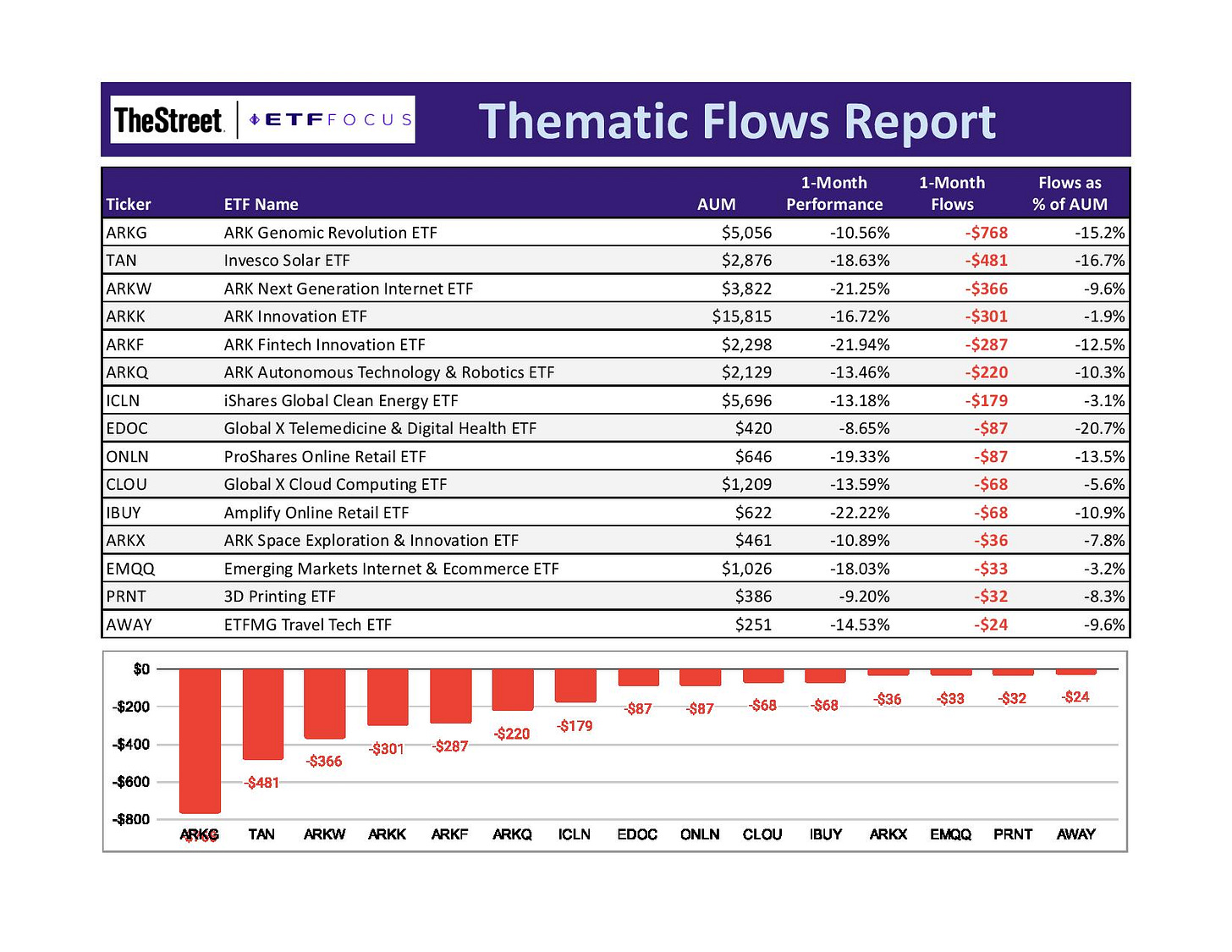

ARK ETFs all across the board again as the bleeding continues. Online retail names have gotten hit hard over the past several weeks as the consumer discretionary sector continues to underperform. The ProShares Online Retail ETF (ONLN) and the Amplify Online Retail ETF (IBUY) are both here.

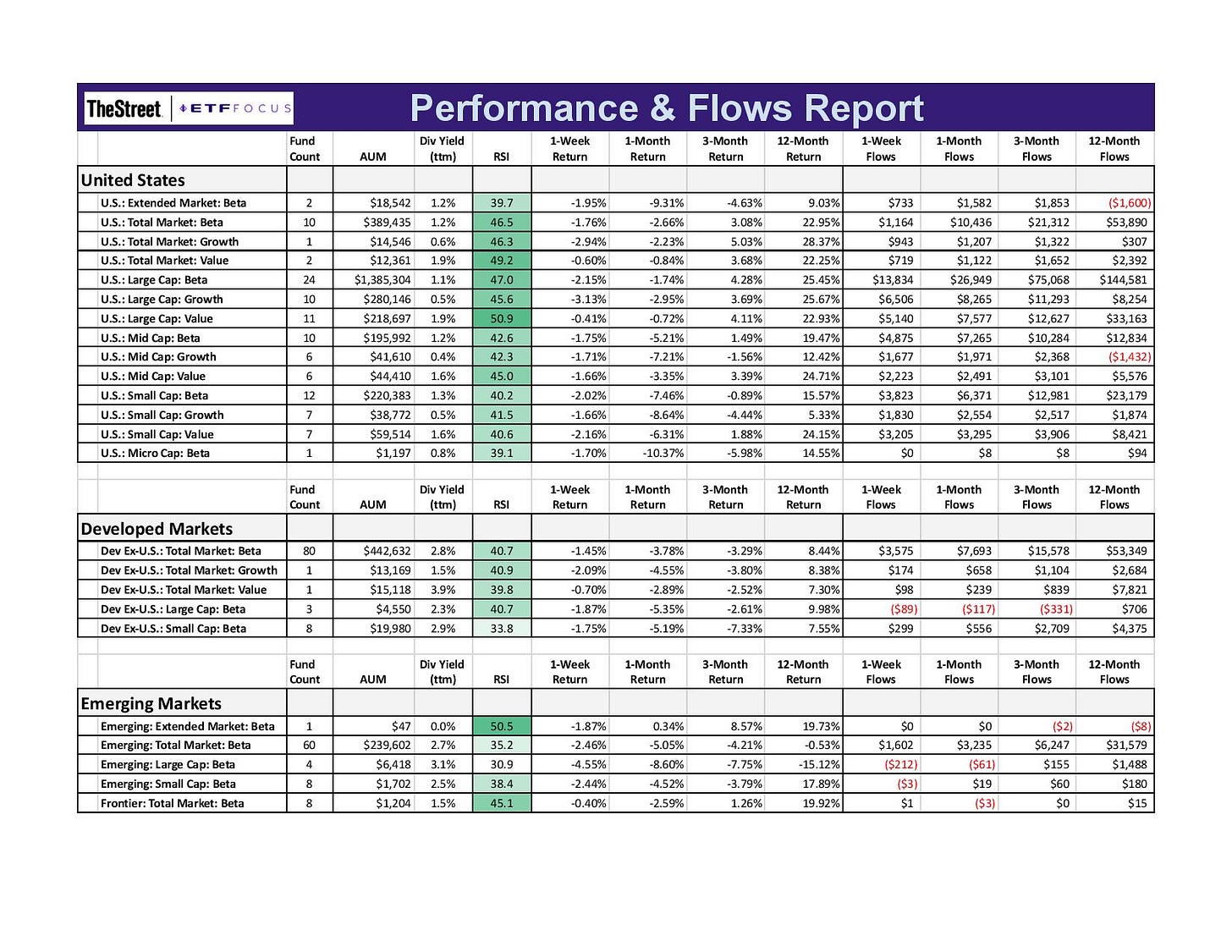

Strength is still favoring large-caps over mid-, small- and micro-caps, but not by much. Both developed foreign and emerging markets continue to lag as they have for months.

As rates continue to fall, long-term Treasuries are still outperforming. It’s interesting to watch short-term and ultra short-term Treasuries both in the red over the past 12 months. I’m not sure these categories have ever had a calendar year of negative returns. Munis are still doing comparatively better at the moment.

Despite some volatility, most sectors are still in the green over the past 3 months. The past month has likely been negative for most investors given the overweight to the tech sector. Energy and financials are still the leaders over the past 12 months owing to significant gains from earlier in the year during the COVID recovery.

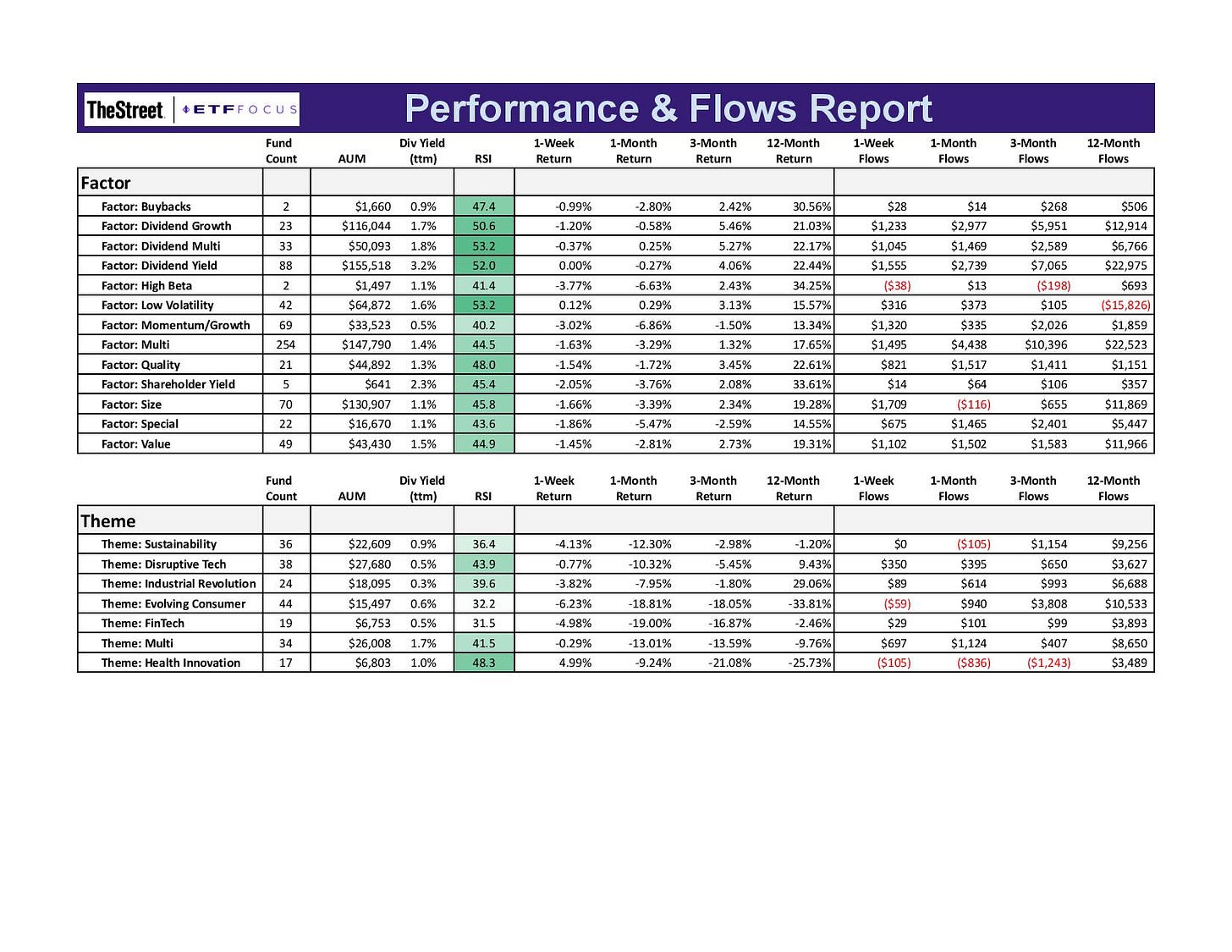

We’re finally seeing a little bit of relative strength from dividend payers and low volatility stocks, two groups that have lagged the market for months. Obviously, an environment of slowing growth as well as a pivot to value/defense would help, but investors remain reticent to commit too hard to more conservative investments.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!