Beware The S&P 500! There's A Broad Weakening Below The Surface

Mega-cap tech gains are masking the fact that defensive utilities are outperforming and small-caps are lagging badly.

The S&P 500 is still pushing towards new all-time highs, but the rally appears to be both narrow and vulnerable. Prior to last week’s gains, we briefly saw more than half of Nasdaq 100 components trading below their 200-day moving average, the level that generally signals a broader sentiment shift. On top of that, utilities and consumer staples (as we’ll see momentarily) have the highest short-term relative strength right now. Treasuries are confirming the rally in equities for now, but the underperformance of small-caps is not a good sign for market breadth.

The only thing the market will really be concerned about this week is the Fed’s quarterly meeting. There won’t be any movement on interest rates this week, but market watchers will be listening closely for hints about where rates could be headed in 2022. You’ll hear a lot about the Fed Dot Plot report, but I’d encourage you to essentially ignore it since it turns out to be garbage most of the time anyway. The futures market is putting strong odds on the initial rate hike taking place at the June meeting, but March is increasingly looking like it could be in play. Jerome Powell has taken a noticeably more hawkish stance over the past month and seems to be saying that inflation control will be the central bank’s #1 priority.

The futures market is still pointing to a 1-in-3 chance of a rate hike in March, up from a 1-in-5 chance just a month ago. At this point, the Fed almost certainly raise interest rates until it has completed the Treasury bond taper. Powell had originally intimated that the taper would wrap up by June, but he has recently said that a sped-up taper could be warranted. I honestly think the central bank is finally realizing that inflation is beginning to get away from them and they need to start hitting the brakes quickly. The time to begin the taper should have been about a year ago, but at least there appears to be some sense of urgency about doing it now. The Fed continues to act as both the economy’s and the market’s worst enemy throughout the post-pandemic recovery and we may still yet suffer the damage from its misguided policy decisions.

The Fed is set to start the taper at $15 billion a month, but it seems like it’s going to quickly push that number higher, maybe to $30 billion a month, with the goal of wrapping up the taper altogether by around March. Once that is complete, then rate hikes are on the table. Previously, I would have said there is no way the Fed will hike in March and it’s even unlikely it would hike in June. Now, I think there is some degree of genuine urgency to begin normalizing and I honestly think it’s very unlikely that the Fed DOESN’T hike in June. The most likely outcome is that the Fed hikes in June, September and December with a total of 100 basis points in hikes not completely off the table. The problem is I don’t see where a fourth quarter-point hike might occur since a between-quarterly-meetings hike seems unlikely and a 50 basis point hike at a single meeting doesn’t seem like the Fed’s style.

For now, I’m still bullish risk assets through the end of 2020, but I think long-term Treasury rates are also favoring minor gains this month.

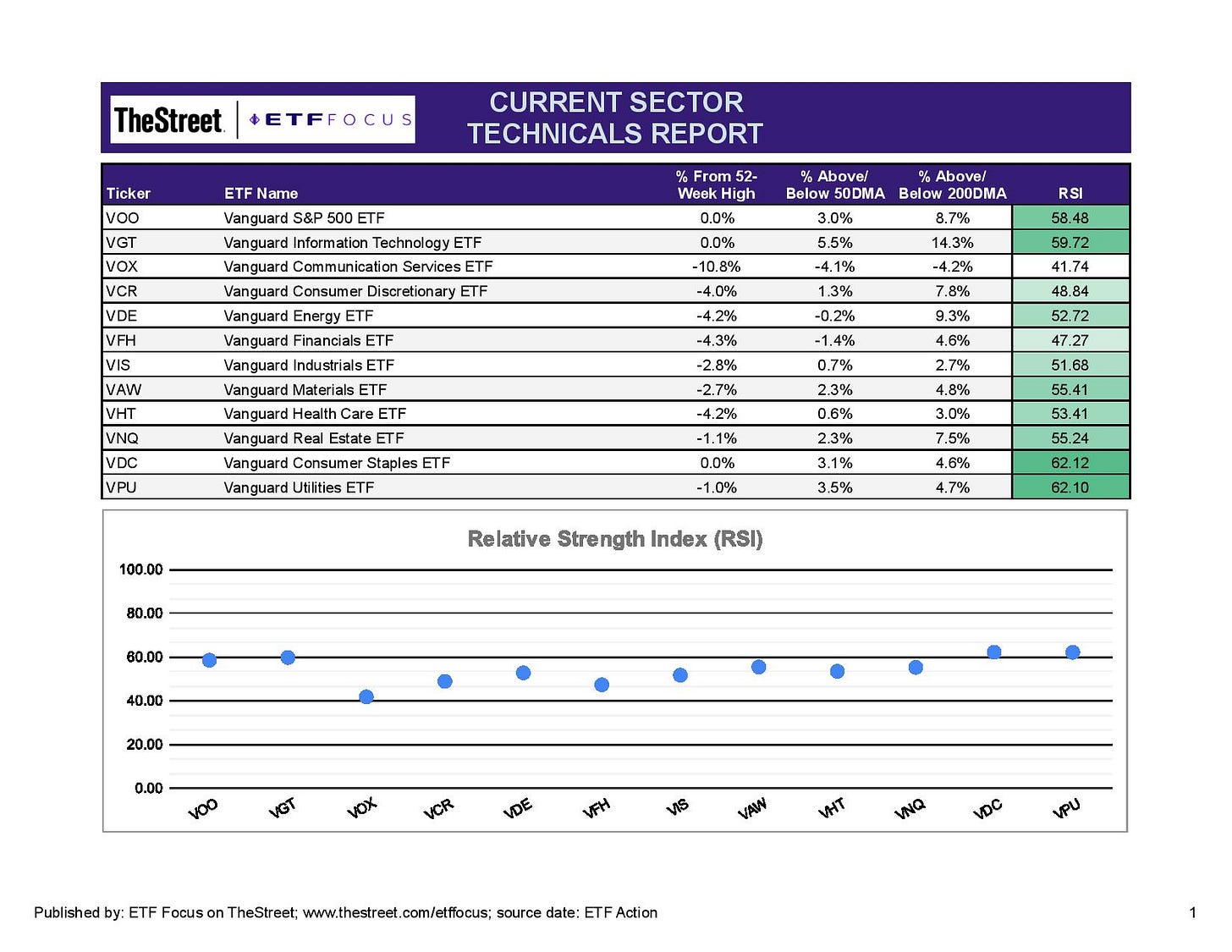

Let’s start our weekly review by taking a look at the primary market sectors.

It’s been a while since we’ve seen utilities and consumer staples as the two sectors showing the most short-term relative strength right now. The complete picture - Treasuries still gaining, small-caps underperforming and utilities/staples leading - shows that this isn’t an aberration and there’s a defensive shift taking place under the surface here. The FAAMG+Tesla names suck most of the oxygen out of the room, so it masks any inherent weakness like what we’re seeing a little more difficult to pick up.

The fact that tech is the other leader right now is a little curious and emphasizes how narrow market leadership is at the moment. The consumer discretionary sector, which tends to be more highly correlated to tech, is looking comparatively weak at the moment. Communication services is a total mess and the only major sector trading below its 200-day moving average.

I expect cyclicals to continue weakening as we get more information on the Fed interest rate and taper plans for 2020. An slowing economy coupled with the headwind of tighter monetary conditions generally aren’t the types of conditions that are favorable to this group. Banks could benefit from higher rates and there’s still support for higher energy prices here as global demand appears strong, but expecting cyclicals to outperform over the next 12 months feels like betting against the odds.

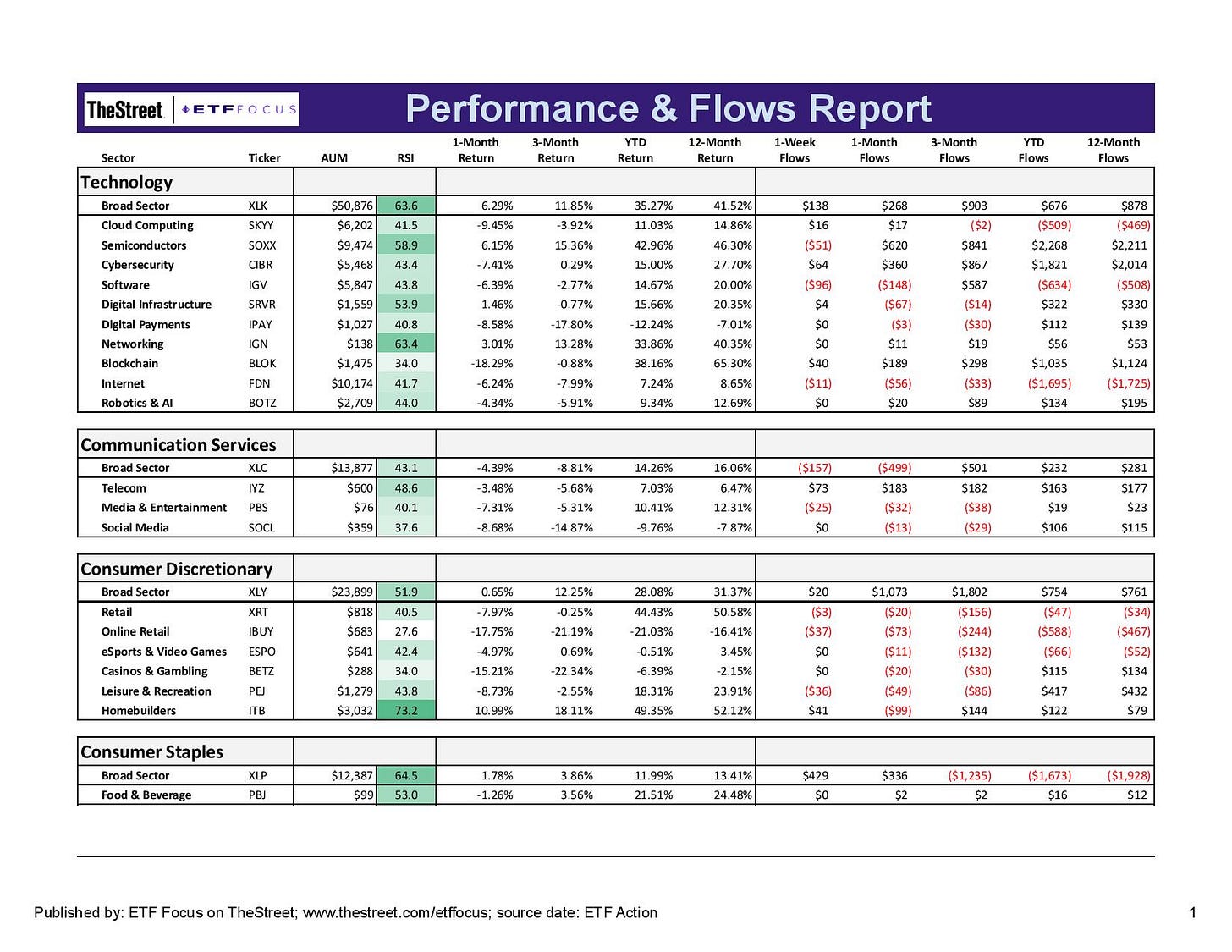

Even strength within the tech sector is relatively narrow. Semiconductor stocks continue to be the best performers of the bunch. We’ve also seen a modest bounce in networking stocks, but most other subsectors are in the red over the past month, emphasizing the fact that breadth is very narrow here. Blockchain, one of 2020’s top performing groups, got blitzed over the past month getting dragged lower by the correction in bitcoin and ethereum. Not much strength to be found anywhere here.

Social media stocks continue to drag the communication services sector lower. Investors had been hesitant to pivot away from this group over the past several weeks, but hundreds of millions in outflows over the past month show that the investor exodus has begun.

Initial holiday sales figures were disappointing, but traditional retail has held up much better than online. Brick-and-mortar has had a modest comeback this year, but the last month has been particularly challenging for these stocks. Other subsectors, such as leisure, online gaming and casinos continue to be impacted by COVID concerns and high inflation rates. The homebuilders are about the only group still looking healthy here.

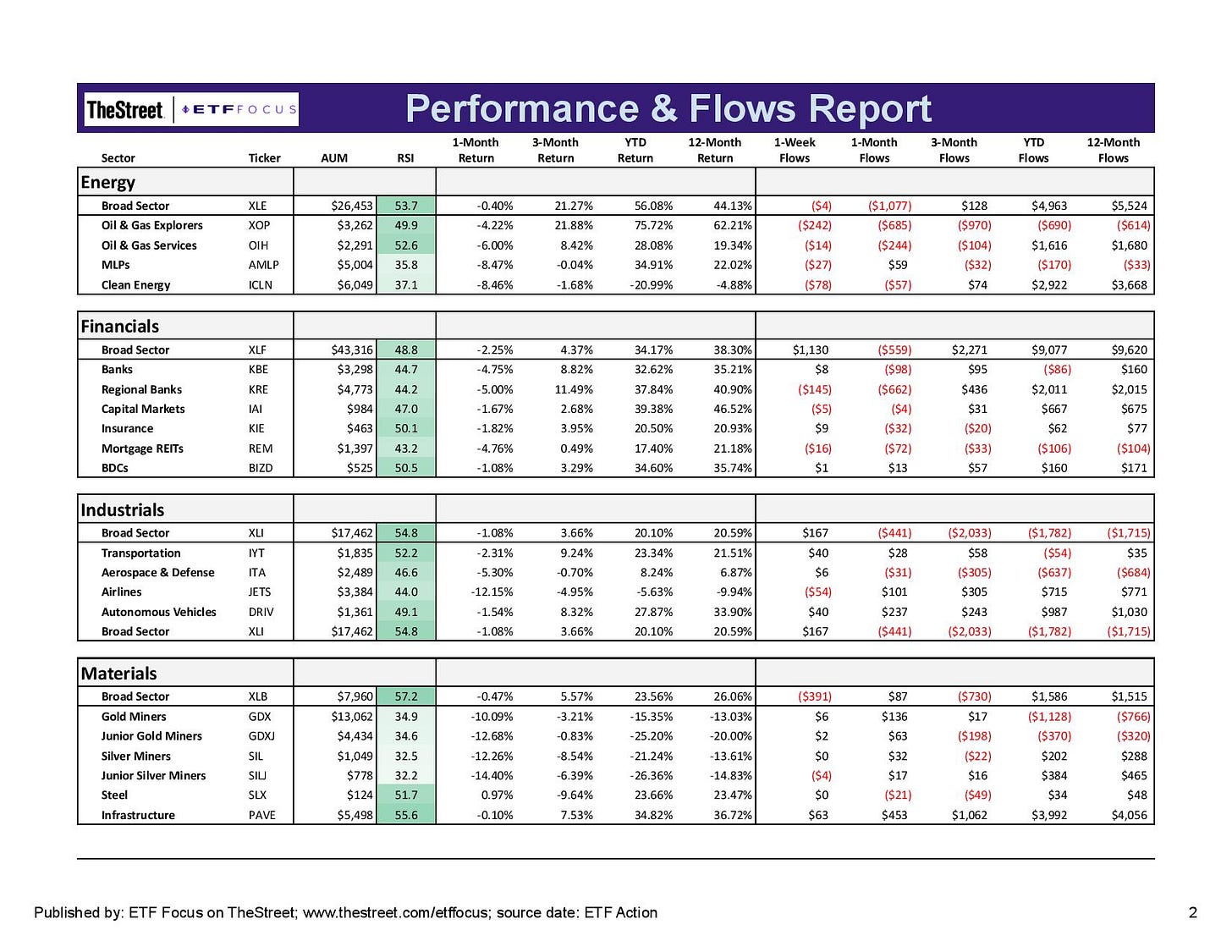

It’s a mixed bag for cyclicals. All four sectors have been trending lower relative to the S&P 500, although energy has had a bit more success in recent weeks. Oil & gas servicers and explorers were two of the market’s best performing groups last week, while clean energy was one of the worst. Energy remains very volatile, but has room to grow as global energy demand remains high and the powers-that-be to this point have refused to fully rectify the supply/demand imbalance in crude oil.

The financials are looking weaker as the trend in long-term interest rates remains lower. The Fed raising rates on the short end could provide minimal benefits and may actually be harmful since they could raise the cost on short-term deposits. Regional banks are only slight underperformers, but have seen significant investor outflows over the past month.

Materials look especially weak here fueled by severe underperformance in both the gold & silver miners. Infrastructure plays continue to have some degree of success, although the immediate benefits from the passage of the bill in Congress look like they’ve worn off. Soaring prices have helped timber stocks, but other industrial commodities don’t look actionable at the moment.

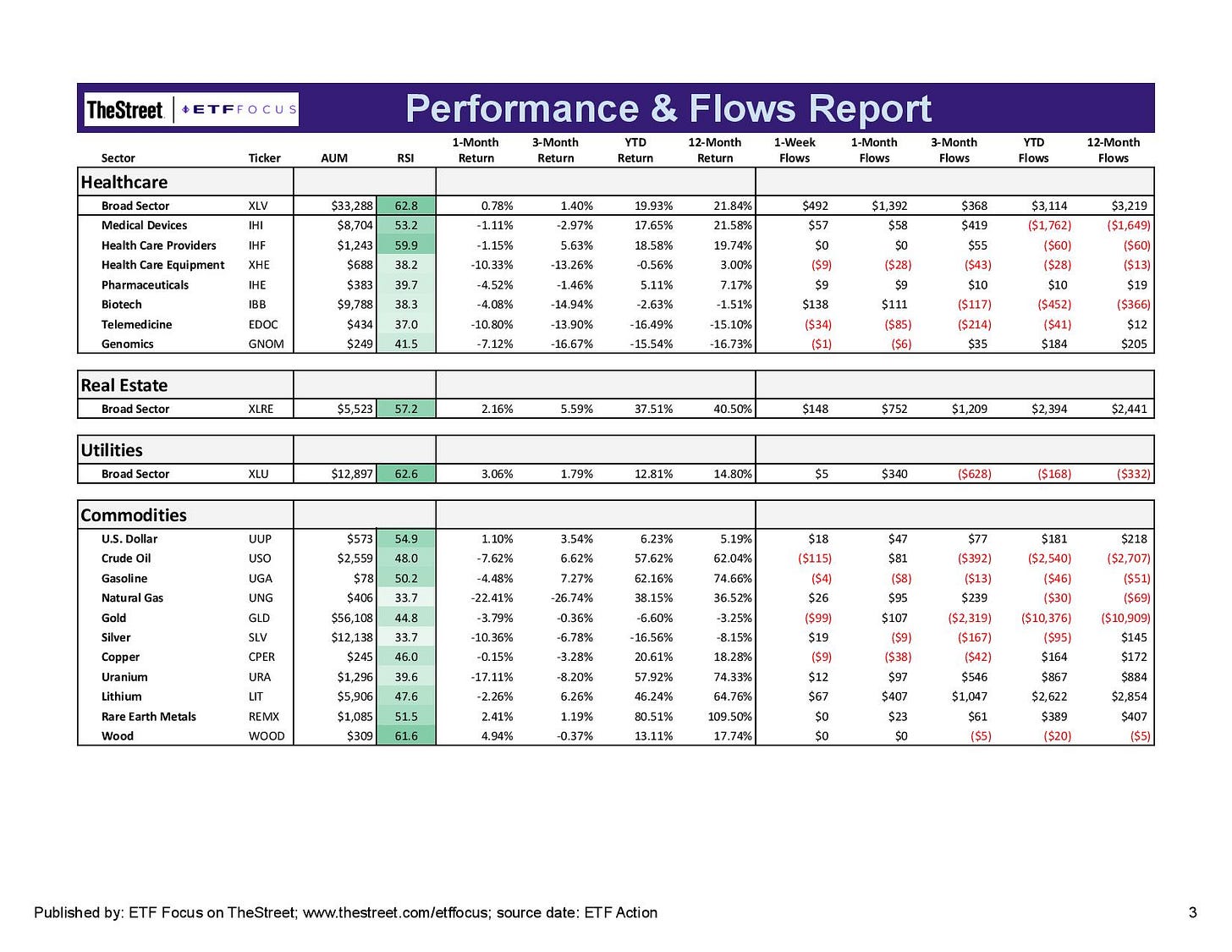

Healthcare is looking better here. The big mega-caps have been pulling the group higher, but it’s a story of the haves and have-nots below the surface. Biotechs remain a big drag on the group along with genomics, which continues struggling to build any momentum. Investor net flows have actually been quite significant here, a sign that investors may look to pivot into this group should there be a broader shift to risk-off in the weeks ahead.

Utilities have had a good month and have quietly been one of the market’s best performing groups. Real estate, however, is drawing the biggest flows as investors continue to play the hot housing market along with rising rental rates.

On the commodities side, lumber has been the strongest of the industrial commodities, doubling in price in just the past month. Crude oil, gold and copper look fairly balanced, while natural gas, silver and uranium remain on the weak side. The dollar is still hanging to recent gains against the euro and other European currencies, but the Asian currencies continue holding the advantage.

Read More…

Roundhill Launches A Meme Stock ETF

87 Technology ETFs Ranked For 2022

ARK Transparency ETF To Launch: Here's What You Need To Know

ETF Battles: ARKK vs. GTEK - Which Is The Best Growth ETF?

Worried About The New COVID Strain? 5 ETFs To Consider Buying Today

Why The 3rd Bitcoin ETF Is Better Than The First Two

Invest In The Metaverse? There's An ETF For That!

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!