Are JEPI Investors Learning The Hard Way What This ETF Actually Is?

Investor interest in one of the industry's biggest success stories is already beginning to stagnate.

The JPMorgan Equity Premium Income ETF (JEPI) has undoubtedly been one of the industry’s biggest success stories of the past couple years. After languishing in obscurity for most of the first year of its life, JEPI spent 2022 and 2023 blowing up into a $29 billion behemoth and, in the process, becoming one of the 50 largest ETFs in the 3,200+ ETF marketplace.

This accomplishment is even more impressive considering it’s succeeded in an area of the industry that has enjoyed relatively limited success - actively-managed ETFs. Its 0.35% expense ratio is pretty reasonable for an active covered call strategy, but it’s not nearly the blueprint - ultra-low cost cheap beta ETFs - that has made Vanguard, BlackRock and State Street the heavyweights of the industry.

What Has Made JEPI A Huge Success?

It’s important for investors to understand that JEPI is not a pure equity ETF, it’s a covered call ETF, which generates a high yield by selling call options against holdings within the portfolio. The downside of such a strategy is that it caps a lot of, if not all, share price appreciation potential because in a rising market, the call options would be exercised by the buyer at below market prices.

That gives covered call ETFs a bit of an uneven return profile. In a bull market, investors hope that the extra yield more than offsets the share price underperformance. In a bear market, the fund will experience all of the downside of the underlying equity portfolio, but the high yield helps offset some of the losses. It’s a bit of a narrow target to hit, but income investors appreciate these funds for their often much above average dividend yields and lower risk.

Where JEPI really resonated with investors was in 2022 when it was posting a double-digit yield during a 20%+ correction in both stocks and bonds.

In general, investors are suckers for 10%+ yields, but the fact that it topped the S&P 500 by 15% last year and ended up losing very little was wildly attractive to yield seekers and income investors alike. Even against relatively comparable peers, such as the Global X S&P 500 Covered Call ETF (XYLD), the performance gap was huge.

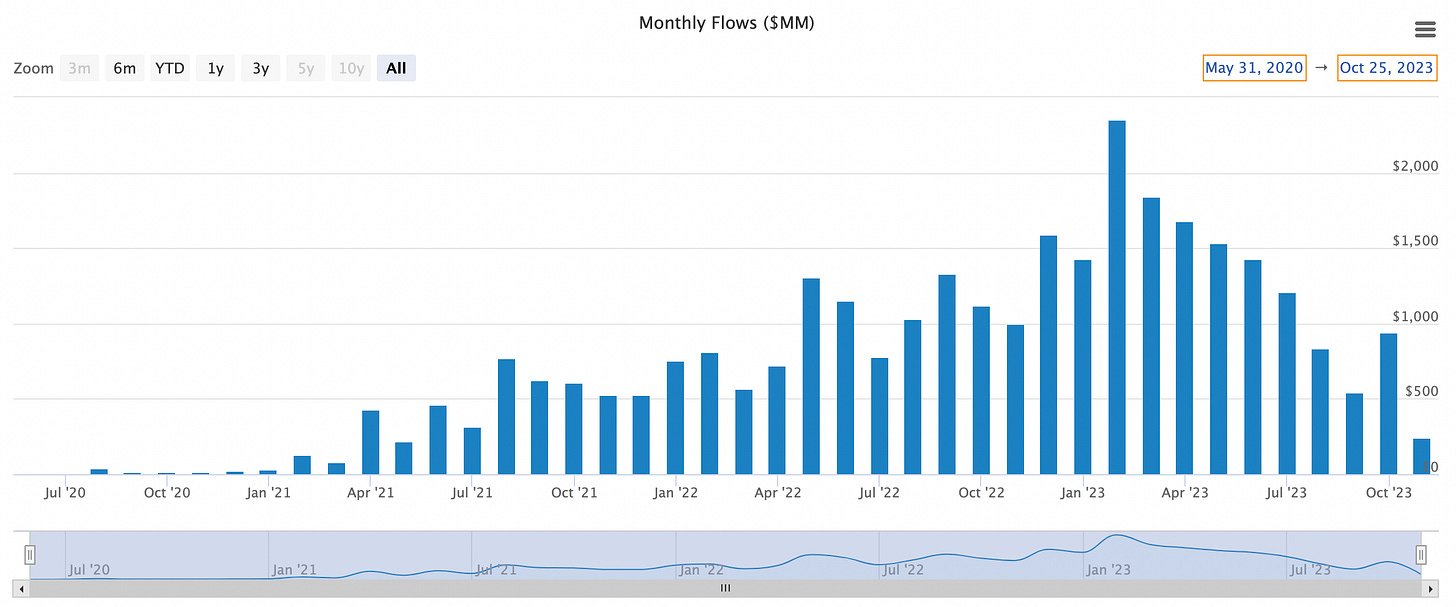

And, boy, did the money flow in!

In the case of broad index covered call ETFs, such as XYLD, the performance gap in down markets is usually (very roughly) the yield difference between the fund and the index. In 2022, the gap was around 6%+, which likely made XYLD shareholders quite happy. The fact that JEPI nearly doubled that number put it near the top of the heap.

Flash Forward To 2023

The momentum of 2022’s carried forward into 2023 and translated into huge net inflows. For the calendar year as a whole, JEPI still has the 6th largest inflow among all ETFs.

Unfortunately, performance hasn’t carried through. Investors are starting to learn the hard way that, while covered call ETFs can outperform in down markets, they usually lag in up markets.

The S&P 500 jumped more than 8% to kick off the year when the data started confirming that the U.S. economy was more resilient and in better shape than originally anticipated. JEPI lagged the index almost immediately and has never recovered. At its worst, JEPI trailed the S&P 500 by more than 13% and XYLD by 4%. It’s managed to recover somewhat over the past three months as stocks have corrected again, but it’s no doubt been a disappointing year for shareholders, especially new ones, who probably expected much better.

Now, shareholder patience may be wearing thin. If you go back to that AUM chart I showed you earlier, it shows that the fund’s total assets have stagnated over the past three months. Part of that is due to share price declines, but if you break down the net asset flow, you can see that investors are starting to lose interest.

Most of the new money showed up in the first quarter of the year and has been steadily declining since. It hasn’t turned into net outflows yet, but that may not be far off into the future.

It’s a similar trajectory to the one that the ARK Innovation ETF (ARKK) followed back in 2020-2022 (although to a much less volatile degree). Net assets in that ETF swelled from $1.8 billion at the beginning of 2020 to $28 billion at its peak in February 2021. Unfortunately, that date also marked the peak of performance. By May 2021, ARKK was down 35% from its peak and inflows turned into outflows. Net inflows have been essentially flat over the past 2 1/2 years and the fund is back down to about $6.3 billion in AUM. It’s still 76% below its all-time high.

I seriously doubt that JEPI is on the same trajectory, but I wouldn’t be at all surprised to see net monthly outflows even before the end of the year. Perhaps the one interesting footnote to the ARKK story is that even after the fund was up more than 60% year-to-date in 2023, asset flows never returned. It’s as if a large segment of investors have written off the fund and are unlikely to return. It’s very likely that we’ve passed peak positive sentiment with JEPI and we could see flows stagnate for a while.

Covered Call ETFs Tend To Underperform Over The Long-Term

It’s important to understand what to expect from JEPI going forward. Since equity markets tend to rise much more often than they decline, equity covered call ETFs should probably be expected to underperform the S&P 500 over the long-term. It doesn’t have anything to do with JEPI or XYLD or any other covered call ETF specifically. It’s simply a function of the return profile of these products.

Covered call ETFs can be useful for income seekers who want to add a high yield to a more traditional fixed income portfolio. As a long-term S&P 500 substitute, they’re likely to disappoint. Funds, such as JEPI, will always have their moments, as it did in 2022, but 2022’s are likely to be the exception, not the rule.

JEPI is for people like me, retired, living on passive income, who prioritize income over having to harvest portfolios. I'm prepared for a 100 basis points performance drag versus the S&P 500, because I get lower volatility.