AI vs. AI: 2 ETF Strategies For Adding Artificial Intelligence To Your Portfolio

There are two very different approaches - strategies that actually invest in companies developing AI and strategies that use AI to pick stocks.

With the emergence of ChatGPT over the past 6 months as a way for virtually anybody to harness the power of artificial intelligence, investors have been piling back into tech and growth stocks in 2023. The Nasdaq 100 (QQQ) is up more than 35% year-to-date and has easily become THE trade of the year.

Naturally, the begs the question of how ETF investors can jump on the trend. Issuers are usually pretty quick to get products to market once a new trend hits. We saw it with blockchain. We saw it with work-from-home. We saw it with hyperinflation. And we’re now seeing it with artificial intelligence.

ETFs that target companies engaged in the development of AI in some shape or form actually aren’t a new thing. Some of these funds go back as far as 2018.

iShares Robotics & Artificial Intelligence Multi-Sector ETF (IRBO)

First Trust Nasdaq Artificial Intelligence & Robotics ETF (ROBT)

Defiance Quantum Computing & Artificial Intelligence ETF (QTUM)

WisdomTree Artificial Intelligence & Innovation ETF (WTAI)

Global X Artificial Intelligence & Technology ETF (AIQ)

This is a group of ETFs, however, where you REALLY need to look under the hood to understand the strategy and what you’re actually buying. For example, AIQ is almost entirely large-caps, such as NVIDIA, Microsoft and Tesla. IRBO, ROBT and WTAI spread their investments across large-, mid- and small-caps. ROBT gives heavier weights to companies more directly engaged in AI. IRBO and ROBT have roughly 50% over their portfolios invested overseas, while AIQ is virtually entirely invested in U.S. stocks.

There’s a lot of nuance in these strategies and they’re far from interchangeable just because they have “artificial intelligence” in the name. There’s another big difference investors should consider when thinking about adding artificial intelligence to their portfolios - strategies that actually invest in companies developing AI and strategies that use AI to pick stocks.

I want to focus on two ETFs to distinguish the difference in these approaches - the ETFMG AI Powered Equity ETF (AIEQ) and the brand new Roundhill Generative AI ETF (CHAT).

AIEQ has been using IBM Watson technology to build out its portfolio since way back in 2017. I’m using CHAT as the comparison, even though it’s only a month old, because it’s focused on generative AI, the kind of tech that’s captured the public’s imagination. That’s not to say that there’s anything wrong with the other AI ETFs, it’s just that CHAT seems a little more true to the moment.

ETFMG AI Powered Equity ETF (AIEQ)

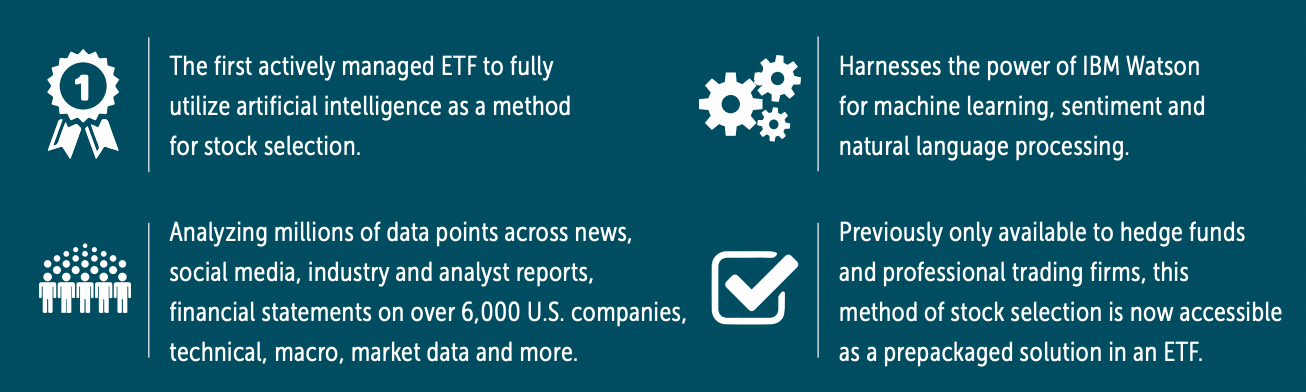

According to the AIEQ website…

AIEQ® applies AI technology to build predictive models on 6,000 U.S. companies. Each company has four underlying deep learning models: a Financial, News and Information, Management, and Macro model. Each of these four models have many underlying signals as depicted.* The models identify approximately 30 to 200 companies with the greatest potential over the next twelve months for appreciation.

The issuer boasts that one of the biggest advantages of AIEQ is that it removes human bias and emotion from the equation. Since it’s emotion that’s largely driven the market’s gains in 2023, I can certainly appreciate a strategy that focuses on the data and fundamentals. Using a combination of financial, technical and macro data allows AIEQ to approach security analysis from multiple angles and helps mitigate the risk of being overinfluenced by just one metric or factor.

While the fund uses AI to build its portfolio, it’s not necessarily focusing on AI or even tech stocks. It’s identifying the best potential opportunities in the entire equity market regardless of industry. Right now, healthcare, financials, consumer discretionary, communication services and industrials all account for between 12% and 17% of the portfolio with tech only the 7th largest sector holding at just 7%.

If you’re unhappy with the level of tech exposure, just wait a few days. For the year ending 9/30/22, AIEQ had an extraordinary 1700% turnover rate. That doesn’t leave a lot of time for stories to play out. This fund could very well just be a short-term trading opportunity ETF more than anything.

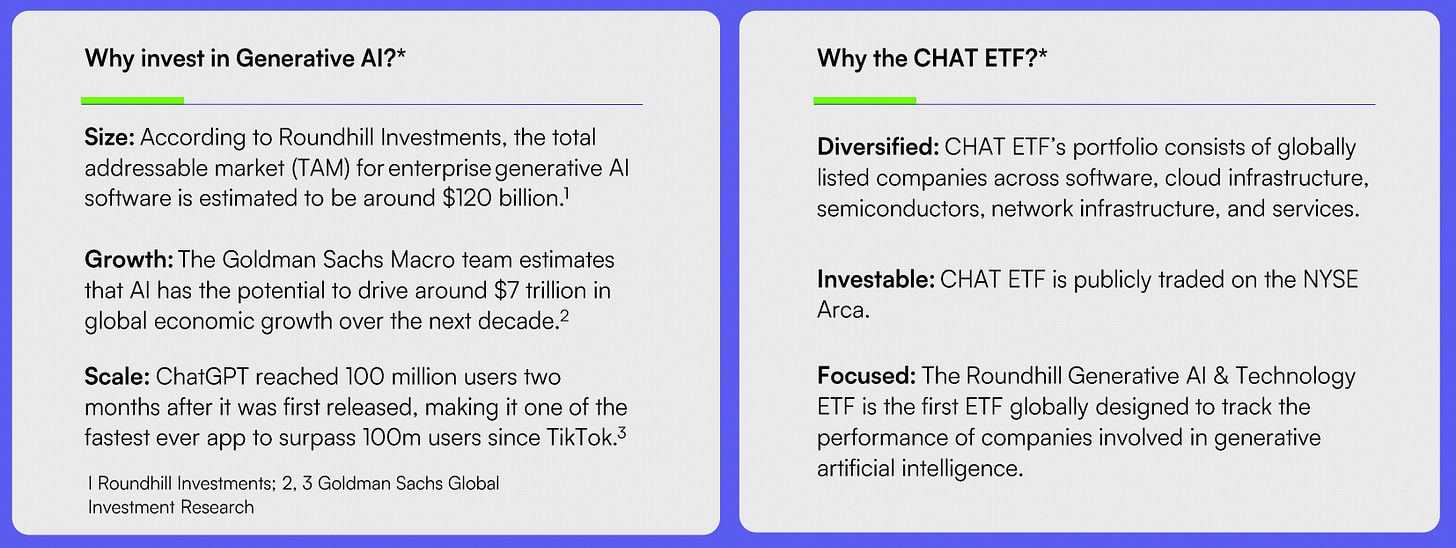

Roundhill Generative AI ETF (CHAT)

CHAT is designed to track the performance of companies involved in generative artificial intelligence, which includes those developing platforms, infrastructure, enterprise & consumer software. It typically provides exposure to…

Large cap tech companies developing and/or investing in B2C generative AI applications, such as Microsoft, Alphabet, and Baidu.

Pure-play artificial intelligence companies, including iFlyTek, C3ai, and Sensetime.

Semiconductor providers focused on high-end performance AI chips, such as Nvidia and AMD.

Right now, CHAT is quite concentrated, holding just 29 names overall. Large-caps currently account for about 3/4 of portfolio assets and the United States representing about 2/3. There’s a sizable allocation to Chinese companies, which should be expected if you’re looking to capture some of the high potential AI developers.

As is the case with any nascent technology, gaining pure play exposure to AI is going to be difficult because there are just so few names out there. Right now, NVIDIA, Microsoft and Alphabet are CHAT’s top 3 holdings, each with roughly a 7% weighting. Those companies are certainly developing AI-related technologies, but you get much more than that holding these stocks. Over time, I’d expect the AI industry to develop similarly to how cybersecurity, blockchain and cannabis have grown - a number of smaller entrants & few pure plays eventually turning into several more developed players beginning to control the marketplace.

AIEQ vs. CHAT

I’m guessing that most people reading this are looking to invest in artificial intelligence itself. There are too many differing strategies with the ETFs I mentioned earlier to go through them one by one, but I think CHAT is probably set up to be more directly exposed to what’s being developed in AI right now. It’s obviously a very new ETF with no history to work with, but structurally the fund makes sense. It’s already at $67 million in assets, which is a really encouraging start, and that trend should continue as long as the AI rally doesn’t go completely bust. With blockchain and cybersecurity ETFs, we saw a rapid build-up of assets in ETFs before performance turned negative and assets topped out. AI ETFs could end up following a similar path.

Does AI-driven investing have the potential to become a new big trend? AIEQ has been around for more than 5 years and has accumulated just $116 million. Part of that is due to a lack of performance. Since inception, AIEQ has returned 41% compared to an 89% return for the S&P 500. The fund roughly kept pace with the S&P 500 up until the end of 2021, but 2022 was a mess. The fund fell more than 30% and is trailing the S&P 500 again in 2023. Since its inception, AIEQ has never finished in the top half of its Morningstar peer group in any calendar year.

Investing using AI may have a future, but we don’t really have the evidence yet to suggest that it can be viable long-term. AIEQ has operated in an environment with narrow leadership dominated by large-caps and tech. Perhaps when fundamentals matter a little more and tech mania cools down again, using AI for security selection might have a better chance of success.