7 Dividend ETF Picks For May 2022

Dividend payers are outperforming the S&P 500 by 5% in 2022. That trend could be set to continue.

The S&P 500 (SPY) just had its worst month since March 2020, falling 8.8%, but other major indices had it worse. The Russell 2000 (IWM) was down 9.9% and the Nasdaq 100 (QQQ) declined 13.6%.

Dividend investors had a comparatively easier time of it. The Vanguard Dividend Appreciation ETF (VIG) and the Vanguard High Dividend Yield ETF (VYM) were only down 4-5% as defensive issues - utilities, dividend payers and low volatility stocks - all significantly outperformed the broader market. Consumer staples actually gained 2% in April.

May, however, is a new month. Given that we just saw a negative print for Q1 GDP growth and the Fed is widely expected to hike interest rates by 50 basis points in about a week and a half, I expect volatility to remain elevated. If Powell can manage to deliver a balanced message and deliver no surprises when he speaks, there’s a chance stocks stage a relief rally.

My top dividend ETF picks for May reflect that idea - maintain a defensive tilt but allow the opportunity to capture some potential trend reversals. This doesn’t look like the best time to be reaching for extra yield, but there are some attractive options out there that balance the pursuit of a higher yield within a broader defensive strategy.

Here are my top 7 dividend ETF ideas for the month of May.

VictoryShares U.S. Equity Income Enhanced Volatility Weighted ETF (CDC)

CDC is one of those strategies I just mentioned. It starts by identifying the 100 highest yielders from a universe of the 500 largest stocks that have positive net earnings. Within that group, it weights the components by the standard deviation of daily returns, or volatility, over the past 180 trading days. Lower volatilities get a higher weight.

It doesn’t end there though. CDC adds an interesting twist that most ETFs don’t. As stock prices decline, it can reduce equity exposure and raise cash. As stock prices decline further, it begins adding stock exposure back to the portfolio. Think of it as a built-in buy low strategy.

The strategy has worked too. CDC carries Morningstar’s highest 5-star rating and would be an ideal way to approach an environment that could feature higher than average volatility. Its current yield is just under 3%.

FlexShares Quality Dividend Index ETF (QDF)

I’ve favored QDF for some time now due its approach that focuses on profitability, management efficiency and cash flows. Using these metrics, it assigns a dividend quality score to each stock and overweights those with higher scores. The final portfolio construction is optimized to emphasize those names with the highest dividend quality scores while targeting a market-like level of risk and an above average dividend yield.

The quality focus is what I find most appealing here along with the quantitatively-driven approach to achieving it. With growth and non-profitable stocks getting punished at the moment, a trend which is likely to continue as the economy slows, leaning into quality dividends and balance sheets seems wise. QDF currently offers a yield of 1.9%.

WisdomTree U.S. Quality Dividend Growth ETF (DGRW)

The term “dividend growth” in DGRW’s name may be something of a misnomer. Instead of looking at histories of annual dividend growth as a selection criteria, it targets companies that demonstrate the financial health to keep paying and growing their dividends over time. According to the fund, the growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three year historical averages for return on equity and return on assets. While DGRW doesn’t necessarily target those stocks with multi-year dividend growth streaks, it holds a lot of those names by default.

The reasoning behind buying DGRW is similar to the case for QDF. When volatility is higher and the macro outlook for the global economy looks very uncertain, it’s better to own stocks that are in the financial position to withstand tougher conditions. DGRW does just that. It currently pays a dividend yield of 1.9%.

First Trust Nasdaq Technology Dividend Index ETF (TDIV)

The tech sector has pretty consistently underperformed the broader market since December of last year as the air has come out of the growth stock bubble. Why recommend a tech dividend ETF then? I think there’s a case to be made for the return of tech stocks in the near-term. The performance of tech has been tied closely to inflation. Last month’s core inflation figure ticked down slightly and raised speculation that inflation may be peaking. The new report coming in just over a week will shed more light on whether or not that’s actually the case. If core inflation ticks down again, it could get the market thinking that the worst is behind us and growth stocks are OK to reinflate. In that case, tech becomes a leader again.

TDIV does pretty much what it says. It targets dividend payers within the tech sector (after a few qualification screens) and weights them according to dividend value. Because of this, it leans more heavily into the “old school” tech names, such as IBM, Oracle, Intel and Texas Instruments. Its current yield is 2.1%.

Fidelity Dividend ETF For Rising Rates (FDRR)

I’m not yet convinced that interest rates are going to make the long-term move higher that many think they will, but it sure seems like the trend is higher at least in the short-term. If that’s the case, owning a fund that targets stocks with a higher correlation to rising rates makes some sense.

FDRR targets two criteria. It looks for companies that are expected to continue to pay and grow their dividends over times and have a positive correlation of returns to increasing 10-year U.S. Treasury yields. That gives the portfolio a value tilt and overweights some of the more cyclically-sensitive areas of the market. Currently, the fund’s top sector holdings are tech, financials, healthcare and consumer discretionary (although it evaluates stocks on an individual basis). FDRR currently offers a yield of 2.5%.

Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

SPHD is another ETF that’s been a long time favorite of mine and ends up getting built in much the same way that CDC does. It starts with the S&P 500 and pulls out the 75 names with the highest dividend yields over the past 12 months. Within that group, it targets the 50 names with the lowest realized volatility over the past 12 months and dividend yield weights them.

Historically, SPHD has been a feast or famine investment. It lands in either the top 5% of its peer group or the bottom 10% in any given calendar year with almost no in-between. It tends to be a bottom performer when growth/high beta stocks are in favor and a top performer when value/low volatility is in favor. Right now, we’re in that value/low volatility environment and SPHD’s performance year-to-date has been in the top 2% of its peer group. I like that trend to continue. Its current yield is 3.6%.

WisdomTree Japan Hedged Equity ETF (DXJ)

Here’s the wild card pick of the group and probably one you don’t want to consider unless you have a strong stomach. Japan is struggling right now. Its economy is teetering on the brink of recession and the yen is plummeting as the Bank of Japan institutes its yield curve control policy to prevent rates from rising.

Here’s my case for DXJ. Value stocks have outperformed growth in 2022 and Japanese equities are loaded with value opportunities. DXJ not only focuses on the higher quality dividend payers within Japan, but it also hedges against foreign exchange movements. That means those declines in the yen so far have been avoided by this fund. Japanese equities are down about 16% year-to-date, but DXJ has actually gained 2%. Its got a yield of 2.3% right now and is a riskier proposition to be sure, but there is an opportunity there.

ETF Sector Breakdown

With that being said, let’s look at the markets and some ETFs.

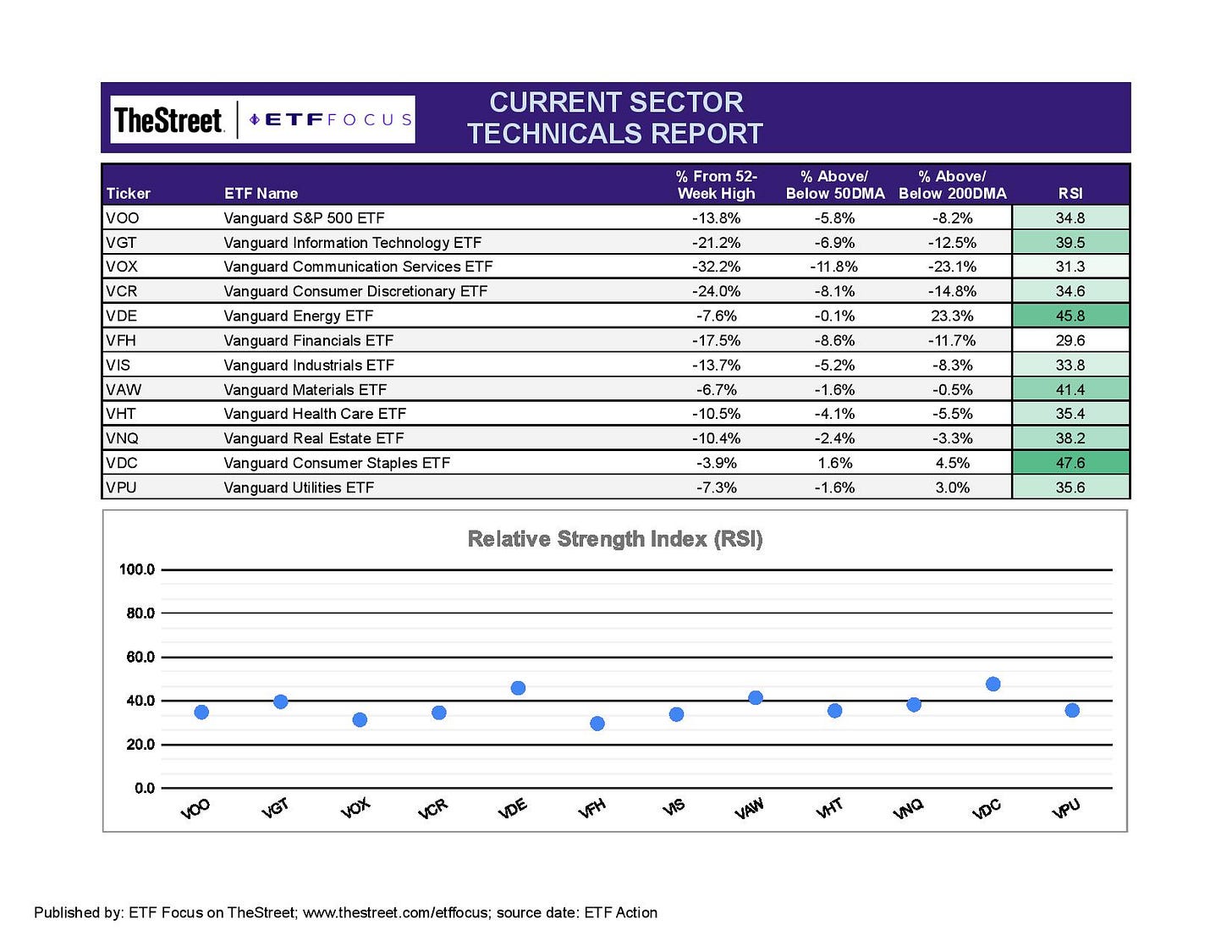

There are few, if any, pockets of strength in the market right now. Just pockets of relative strength. In that sense, consumer staples, energy and materials are about the only areas of the market that we could say are outperforming at the moment. Even utilities, which has had a nice run throughout 2022, is coming back down to earth again.

Even as the markets were declining this year, there were still areas performing well and testing new 52-week highs. Those times appear to be in the past as even stalwarts, such as energy and utilities, are both 7% below their recent highs. Consumer staples, down 4% from its high, is the sector doing best at this moment, but even that doesn’t look particularly healthy.

I’m keeping an eye on the growth sectors here. The communication services sector still looks too uncertain for me. Facebook got a nice pop last week, but the weak quarterly earnings report from Alphabet, which has consistently been a rock in this economy, gives me cause for concern. Consumer discretionary looks ready to continue trending down as the economy and the consumer weaken. Tech has some possibilities though for the reasons I mentioned above.

Again, not much to be found anywhere within the growth sectors. Telecom looks particularly oversold at the moment, but there are at least a half dozen subsectors that are right on the edge of that distinction, even if they don’t meet the textbook definition of having an RSI<30. Homebuilders had a nice week, although that looks more like an oversold bounce than an indication of a trend reversal. I certainly wouldn’t want to be holding homebuilder stocks as mortgage rates are soaring and mortgage applications are plummeting.

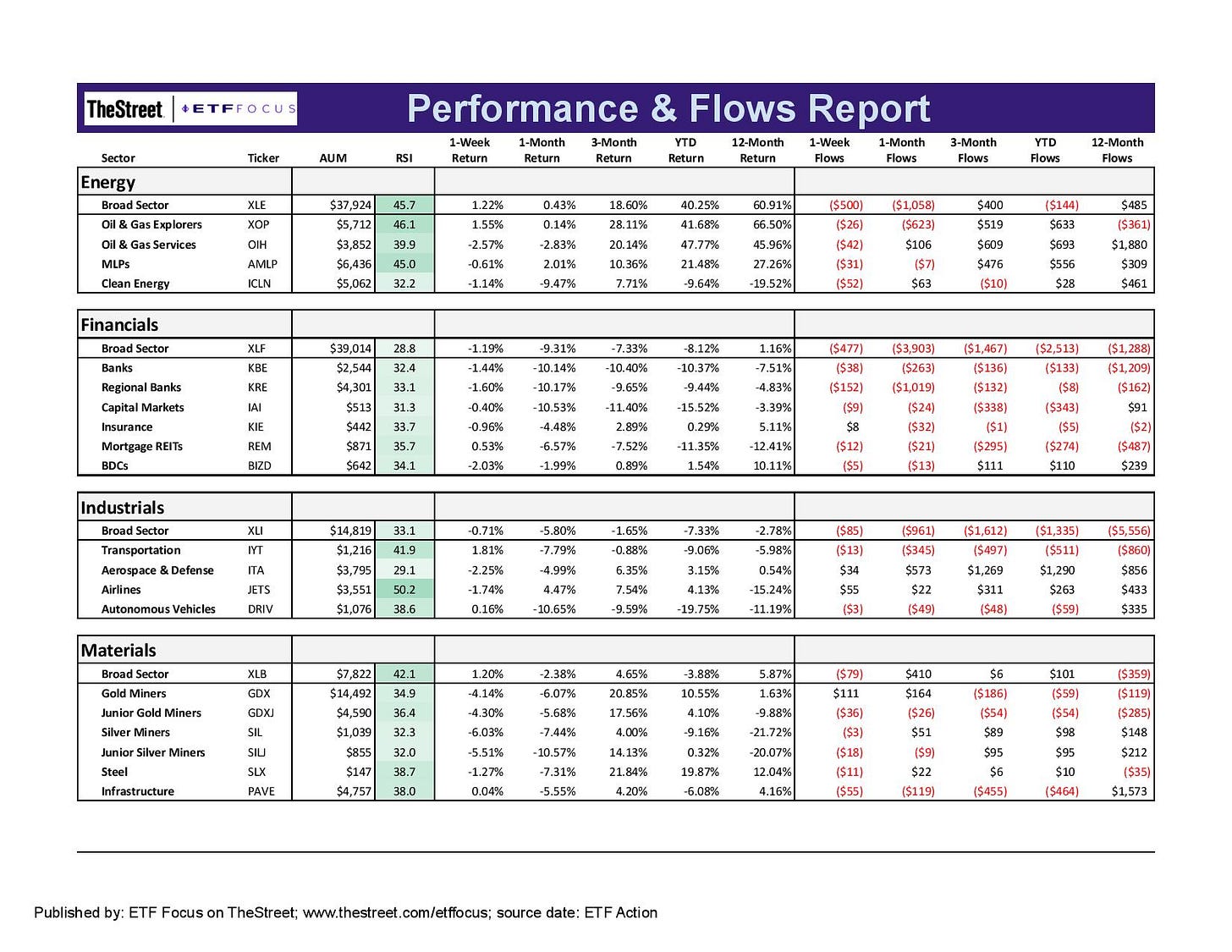

The net flows numbers look interesting. Billions have been flowing out of the consumer discretionary and communication services sectors, but interest in tech stocks has been steady. Certain subgroups are bleeding assets, but broader sector ETFs and cybersecurity are still doing relatively well. If there is to be a rebound in tech stocks over the next few months, asset flows suggest there is a level of support there.

The party may finally be ending for energy stocks. The sector has been flat for the past month and it looks like oil prices may finally be settling down after weeks of soaring higher. The narrative of economies undoing their reliance on Russian energy will likely prevent crude oil prices from declining too far, but it looks like the worst fears have already been priced in.

Financials, especially banks, still look rough here. The RSI for the broad sector slipped into oversold territory and, while there might be an opportunity for a quick bounce, I’d be hesitant to commit too much here. Lending conditions were tight even when the recovery was in full swing. Rising mortgage rates and 8% inflation aren’t going to help with lending demand at all. I expect the big banks to look to alternative revenue streams to keep bottom line numbers up, but regional banks might not have the same ability. Either way, worse lending conditions equal harder times for banks.

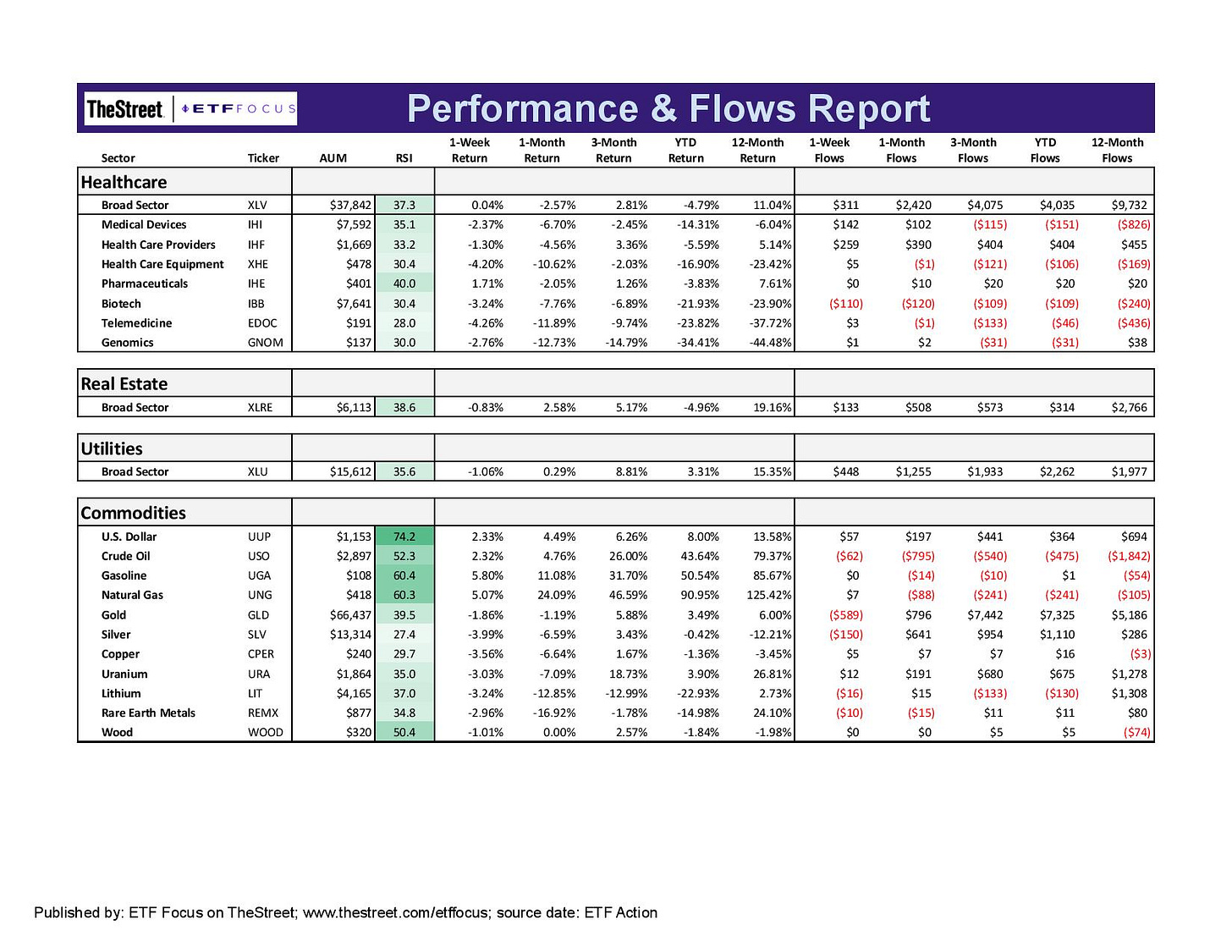

The only asset class displaying real strength in this market is the U.S. dollar. Virtually every major global currency is in oversold territory right now having fallen 4-5% over just the past month against the greenback. The yen has dropped 12% over the past three months and shows no signs of abating as long as the BoJ maintains its current policies.

Lumber prices have rallied somewhat lately. Natural gas prices are still elevated. Overall, however, this looks like a broad market pullback. Stocks in Indonesia, Saudi Arabia and Kuwait have done well over the past month, but sentiment is negative almost anywhere you go.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!