5 Dividend ETF Picks For September 2022

This could be the month where high dividend yield ETFs and international funds pay off.

The S&P 500 fell 4% and the Nasdaq 5% in August, underscoring the negative overall sentiment that continues to hover over the markets. The summer rally, which resulted in some of the more optimistic types to call for a new bull market, turned out to be nothing more than another failed bear market rally, something that I’ve been warning about for the past few weeks. When stocks rise on an assumed but not confirmed catalyst (Fed pivot) and the economic data keeps trending worse, it looked like a trap setup for equity bulls. With equities down about 9% from their mid-August peak, the major U.S. indexes look much more fairly valued today than they were a few weeks ago.

My three dividend ETF picks from last month - the VictoryShares U.S. Equity Income Enhanced Volatility Weighted ETF (CDC), the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) and the FlexShares Quality Dividend Defensive Index ETF (QDEF) - all beat the S&P 500 in August, but so did dividend ETFs in general. Of the group, CDC performed best, losing 1.5% but making it the month’s 12th best performer out of nearly 150 funds.

I expect dividend ETFs will be lined up for outperformance again in September, but it’ll likely all come down to the August CPI report, which will get released on 9/13. The July report showed that inflation came in below expectations and helped fuel hope that conditions were easing. The data since then has been mixed with producer prices remaining stubbornly high but wage growth cooling a bit. If we get another below average reading, it could spark at least a short-term rally in risk assets on the belief that the Fed could pause rate hikes sooner rather than later. If, however, inflation proves sticky, it could be another leg down for equities and a retest of 2022 lows.

My dividend ETF picks for September still have a bit more of a defensive tilt in nature, but there’s also something there for those looking at high yielders. I’m also adding a couple of choices from some much-avoided areas of the market - international stocks.

Investing in foreign equities has mostly been an exercise in self-inflicted pain throughout 2022. Yes, Europe is dealing with an energy crisis, China’s accelerating into a real estate crisis and Latin America is experiencing huge swings in volatility. I think there’s some opportunity here though. Emerging markets dividend ETFs are trading at P/E ratios in the single digits. International stocks have outperformed the S&P 500 over the past two weeks and the dollar rally looks wildly overdone. I don’t know if any of those factors will ultimately work out in investors’ favor in September, but I do think a mean reversion is overdue.

With that in mind, here are my dividend ETF picks for September.

First Trust Morningstar Dividend Leaders Index ETF (FDL)

FDL is a fund that focuses on stocks backed by expected future earnings and dividend growth. It’s an ETF that has developed a nice solid long-term track record and is actually up about 1% during a year when most of the major indices are down double digits.

I like the fact that FDL looks forward and not back, especially in this environment. Looking back over the past year is going to lead to a wildly different set of results compared to what the coming 12 months will look like. Focusing on companies that can continue to grow earnings in what looks like is a coming recession will significantly narrow down the list of eligible stocks, but it should also yield a portfolio of defensive cash cows that should look attractive in such an environment.

Invesco S&P Ultra Dividend Revenue ETF (RDIV)

RDIV is an ETF that pulls out the highest-yielding stocks from a starting universe of large- and mid-caps. Then, as the name suggests, weights the qualifying components by the amount of revenue they generate. Revenue-weighting is a logical method for tilting a portfolio, but it’s still an unusual feature within the ETF universe. Earnings can be manipulated and dividends may be unsustainable, but revenue is a fairly good way to see which companies are making sales and which aren’t.

There is a bit of a quality component to this fund too. It scrubs out the top 5% of securities by dividend yield and excludes the top 5% of securities within each sector by dividend payout ratio. It’s a good way to help eliminate some of those red flag stocks that may have artificially high or unsustainable yields.

RDIV tilts very heavily towards cyclical & defensive sectors and, amazingly, has no tech exposure whatsoever.

Invesco KBW High Dividend Yield Financial ETF (KBWD)

KBWD is an outlier within this list in that it is an unabashed high yield grab. It tracks a dividend yield weighted index of companies in the business of providing financial services and products. Don’t think of traditional big banks or brokers here. This portfolio is full of mortgage REITs and capital markets firms engaged in lending. Its yield of 10-11% is very enticing, but it’s risky and needs the financial sector to be in favor for it to pay off.

Investors may shy away from REITs in light of what’s going on in the housing market, but this group is really tied more to rental rates than home prices. Rents remain high and vacancies are low, two factors which should both work in this ETF’s favor.

iShares International Select Dividend ETF (IDV)

With a yield of 6.7% and a P/E ratio of 6, there’s clearly value to be had in this group. The big question is whether or not that value can be unlocked. IDV holds 100 stocks from non-U.S. and non-emerging market countries that are among the highest yielding available and dividend weights the portfolio. In that way, it can be a little riskier than ETFs that focus on dividend growers or quality balance sheets, but I think this group could make a run.

Foreign equities have done relatively well recently and this week’s rate decision from the ECB could be the catalyst that puts a top in for the dollar. A declining dollar would be a benefit for international stocks and deep value names could do particularly well.

WisdomTree Emerging Markets High Dividend ETF (DEM)

Here’s essentially the emerging markets equivalent of IDV. The case for DEM for is essentially the same, although the matching P/E of 6 and yield of nearly 10% is perhaps even more attractive. It’s very concentrated, though, with 2/3 of the fund’s assets going to China, Taiwan and Brazil. All three countries are political hotspots and undergoing significant challenges - China with the real estate market, Taiwan and its relationship with China and Brazil with double digit inflation and political risk. It’s a home run swing that could potentially pay off.

With that being said, let’s look at the markets and some ETFs.

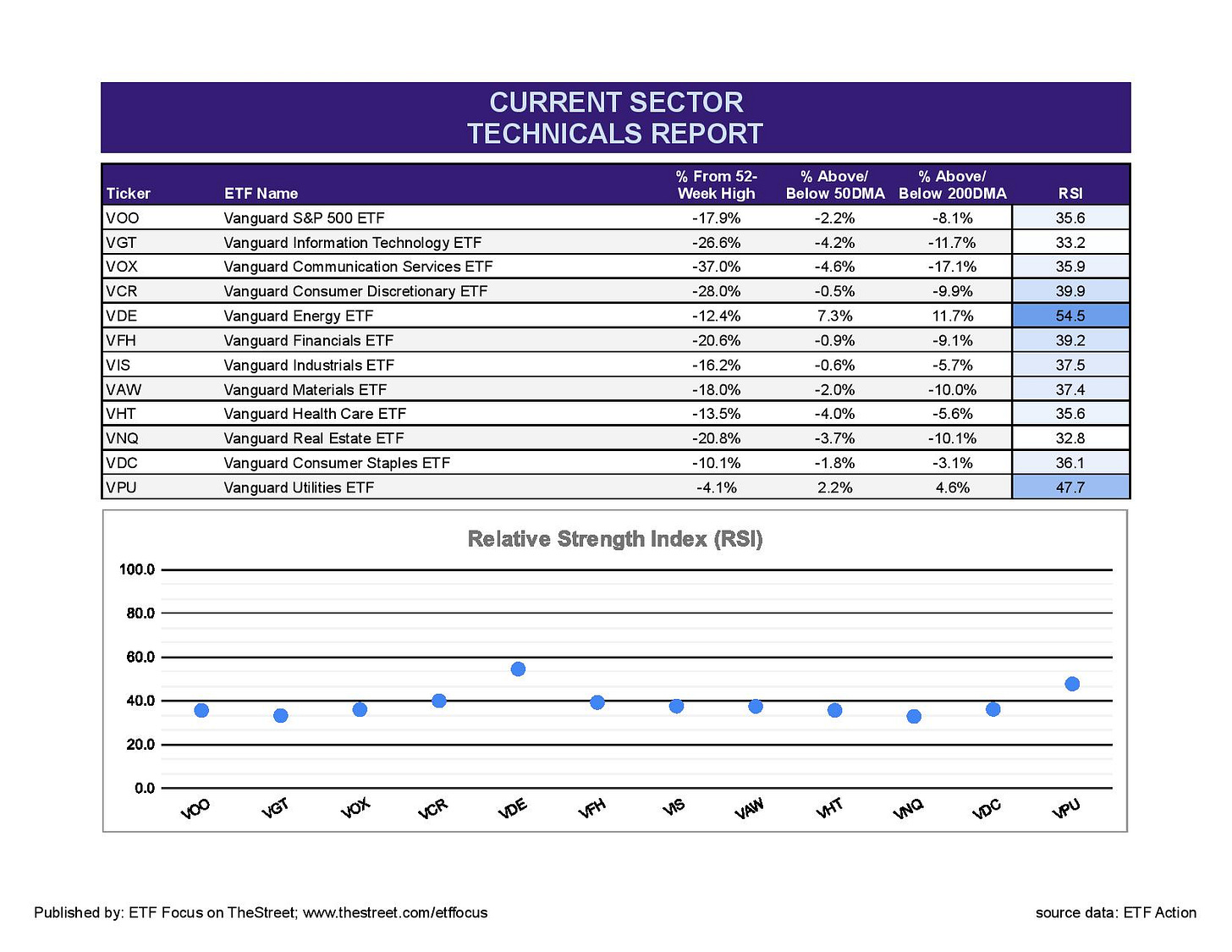

Most of the market is in near oversold territory with the only real exceptions being energy and utilities. The latter has extended its outperformance streak to more than a month and has been the one sector signaling the bearish tone of equities. Energy remains highly volatile, but has enjoyed a resurgence following its dive early in the summer. Tech has given back nearly all of the outperformance it had built up this summer and has turned into one of the market’s weakest groups. The overall tone is very bearish, but could rebound with a long weekend for investors to regroup.

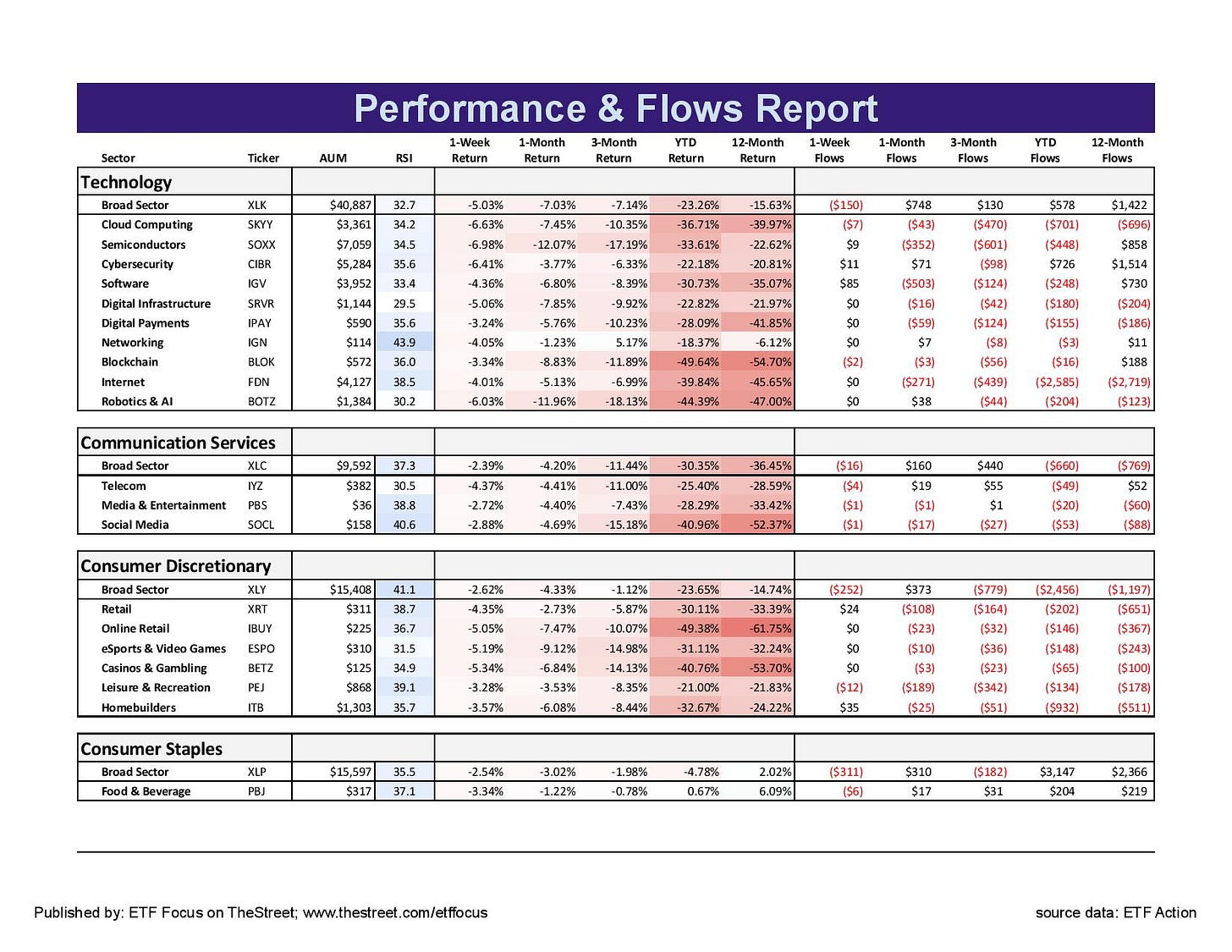

Not much positive to be found just about anywhere within the growth sectors. Consumer discretionary is managing to hang in the better than its peers, but the overall negative sentiment surrounding the retail space and other discretionary spending sectors is preventing too much optimism. Net flow data shows that investors continue to abandon the sub-sector ETFs within this group, although the broad sector ETFs, such as XLK, continue to draw interest. This seems to be a market driven by defensives and cyclicals for the time being, so I’m not expecting a short-term turnaround here.

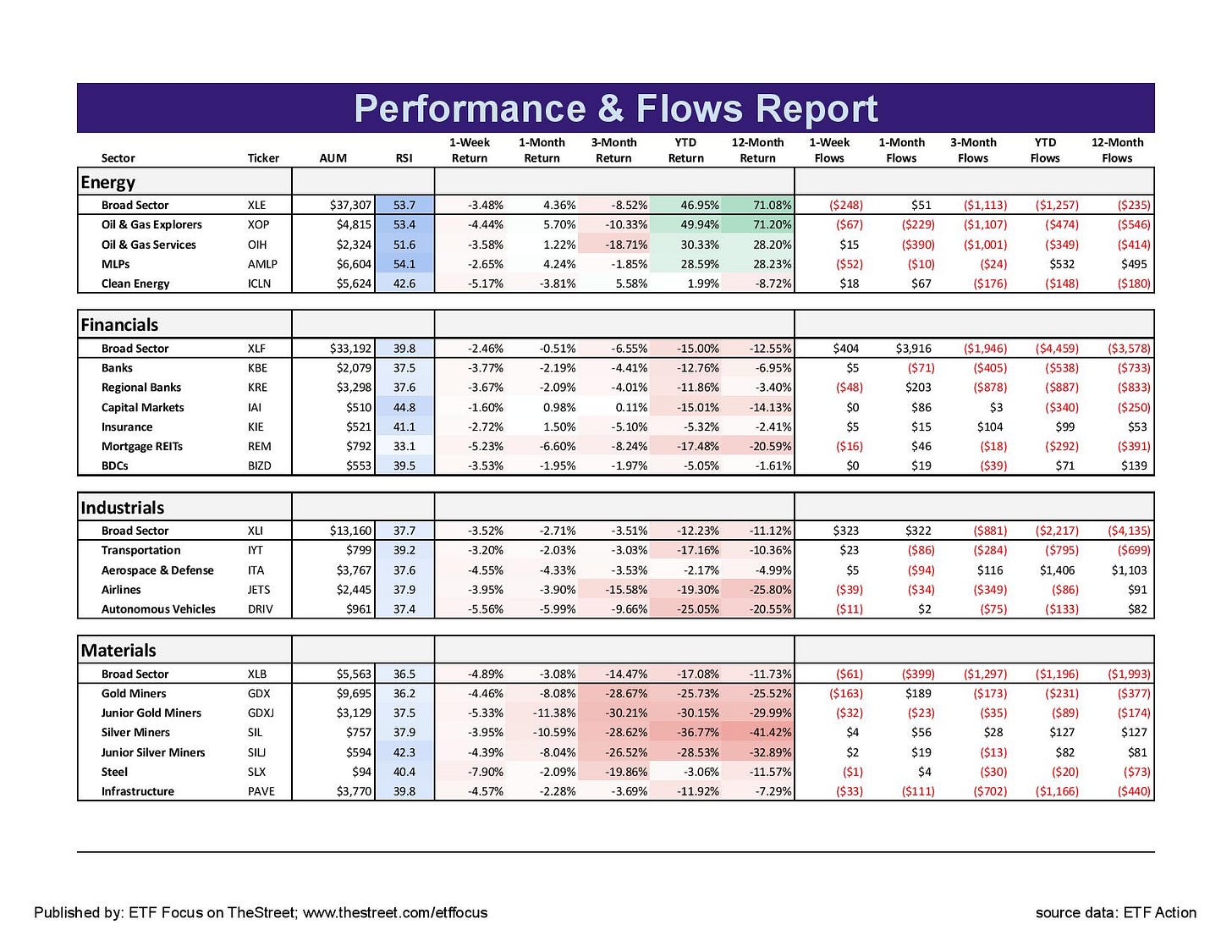

Cyclicals have actually looked a bit interesting here despite a macro backdrop that isn’t providing much support. The biggest outperformance recently continues to come from the energy sector, but financials have finally started holding up better. The lending environment sure looks ugly, but higher interest rates are finally starting to translate into higher stock prices. I don’t think this trend is sustainable, but I do think this is a relative outperformance streak that is overdue.

The dollar is still king, but central bank meetings in Europe, Australia and Canada could halt the greenback’s progress. Aggressive rate hikes, especially from the ECB, could draw some interest back to non-dollar currencies and put the brakes on what looks like a far overdone rally. Gold continues to fail at gaining any traction and remains a huge disappointment to those looking at it as inflation protection over the past year.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!