5 Disruptive Tech ETFs That Aren't ARKK

You may want to abandon Cathie Wood's funds, but don't abandon disruptive tech altogether.

If there is a “rock star” in the ETF industry, it’s probably Cathie Wood. Love her or hate her, she has undeniably become not only one of the faces of the ETF space, but the poster child for disruptive tech and innovation investing.

Her investing style, however, comes with a huge amount of risk. When that style is in favor, the results can be huge. When it’s not, well, investors over the past year can probably attest to what that’s like. Since the fund’s peak in early 2021, the ARK Innovation ETF (ARKK) is down 72%. Unfortunately, that peak also coincided with the time where investors were piling into the fund, leaving many folks sitting deep in the red.

Cathie Wood is obviously a very polarizing figure. Some investors in the ARK ETFs predictably have left never to return. That doesn’t mean you should abandon the idea of investing in next-gen tech altogether. Not only are these the areas where the next decades’ big opportunities are going to come from, the huge declines over the past 18 months have worked out most of the excess and made them reasonably priced again.

If you’re out on ARKK but in on disruptive tech, you have several alternatives to consider. Some are relatively small. All are certainly less well-known than ARKK, but they do offer similar exposures in different packages.

SPDR S&P Kensho New Economies Composite ETF (KOMP)

Assets: $1.7 billion. Expense ratio: 0.20%

KOMP targets companies looking to make advancements in processing power, artificial intelligence, robotics, automation and connectedness. It does so by utilizing artificial intelligence and natural language processing to identify relative exposure to these themes and weights them according to factors, such as the Sharpe ratio. It’s using next-gen technology to identify next-gen technology companies!

The fund is heavy in tech stocks, but also has sizable allocations to industrials and healthcare where a lot of the innovation is happening. Top holdings include Elbit Systems, Teledyne Technologies and Vonage Holdings.

BlackRock Future Tech ETF (BTEK)

Assets: $13 million. Expense ratio: 0.88%

BTEK is more of a global portfolio that focuses more directly on the tech sector. It also looks for leaders in developing innovation and emerging technologies, but is actively managed by the BlackRock team. This gives BTEK a flexibility and nimbleness that some of the other index-based funds may not have.

This fund has more of a large-cap lean and contains many more recognizable names among its top holdings, including Tesla, Marvell Technology, ON Semiconductor and Samsung. It’s heavily invested in semiconductors, software and IT services.

Defiance Next Generation Quantum Computing ETF (QTUM)

Assets: $139 million. Expense ratio: 0.40%

Defiance’s lineup has a number of revolutionary tech ETFs, including those focused on 5G, hydrogen, psychedelics and the digital revolution. QTUM focuses on the themes of artificial intelligence, cloud computing and machine learning. Using AI for big data collection and customer acquisition is becoming a major theme in the global economy and this fund targets all of the big names developing these solutions. The equal-weighting methodology is a nice touch that helps spread out some risk.

QTUM is tilted a little more globally than some of its peers, but similarly invests heavily in the tech space. Semiconductors are also its primary focus and includes Advanced Micro Devices, Tower Semiconductor and IBM among its top holdings.

Amplify Thematic All-Stars ETF (MVPS)

Assets: $8 million. Expense ratio: 0.49%

MVPS is easily the smallest ETF on this list, but its strategy of targeting the best of all major market themes is really interesting. The fund targets companies engaged in disruptive technology, the evolving consumer, fintech, healthcare innovation, the industrial revolution and sustainability. Within those themes, it culls through ETF ownership data to identify the current most popular names. It’s frequent monthly rebalancing helps the portfolio stay fresh and on top of the latest market sentiment.

I like this fund for its all-in-one approach. Instead of picking specific themes or names yourself, MVPS can act as a one-stop shop for the thematic segment of your portfolio. There are a lot of familiar names at the top of this portfolio, including Tesla, Alphabet, Nvidia, Enphase Energy and SolarEdge Technologies.

iShares U.S. Tech Breakthrough Multisector ETF (TECB)

Assets: $321 million. Expense ratio: 0.40%

TECB focuses on companies engaged in robotics, artificial intelligence, cloud and data tech, cybersecurity, genomics, immunology and financial technology. As the fund’s name suggests, it does not invest globally, but focuses instead on innovation being developed domestically.

While I offer this up as a potential option, it may not be the best one. The fund’s top 10 holdings are Apple, Microsoft, Alphabet, Amazon, Salesforce, Facebook, Nvidia, Gilead Sciences, Visa and IBM. That looks a whole lot like the S&P 500 to me, only you’re paying 40 basis points for the portfolio instead of 3. It’s got the tech exposure, just not the next-gen tech exposure you’d get with the others.

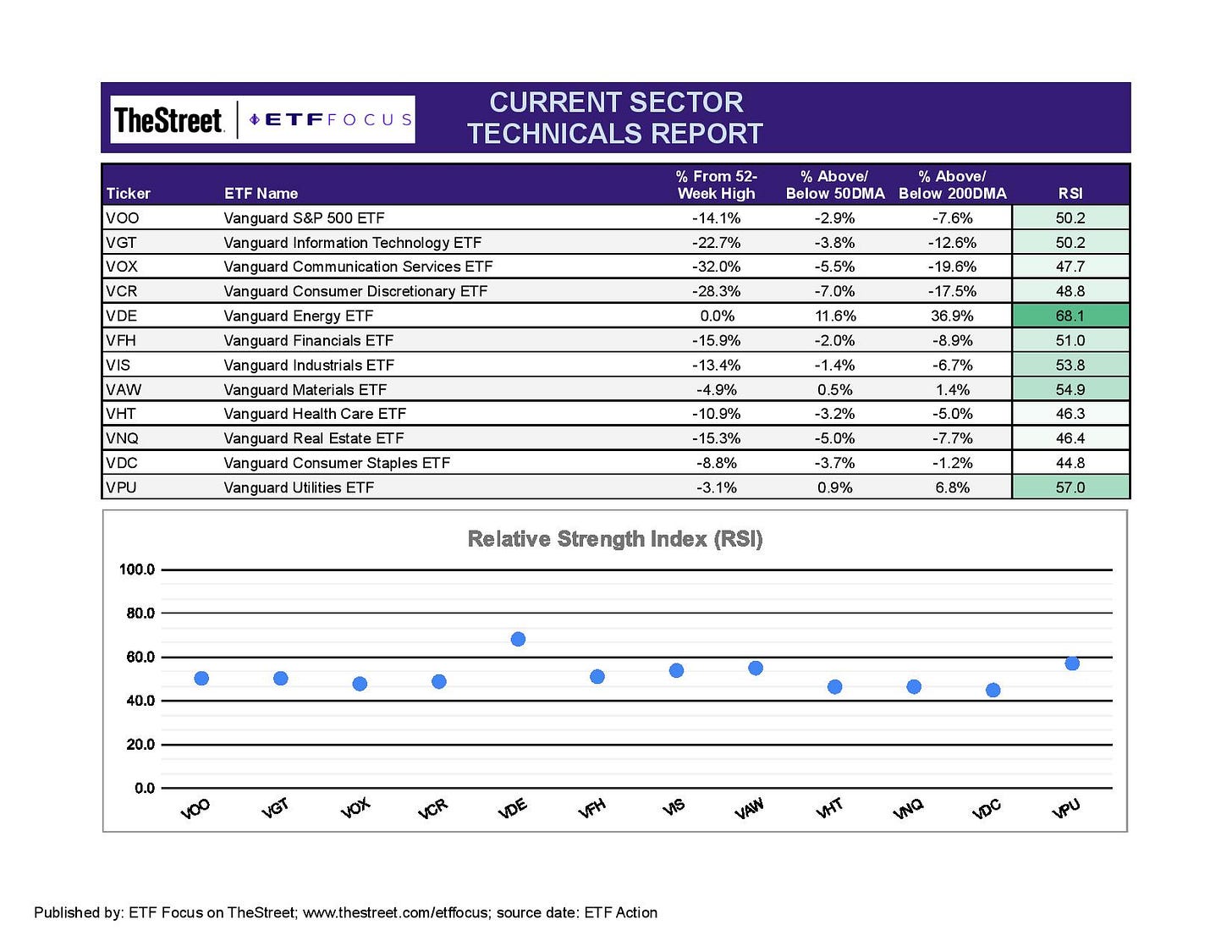

ETF Sector Breakdown

With that being said, let’s look at the markets and some ETFs.

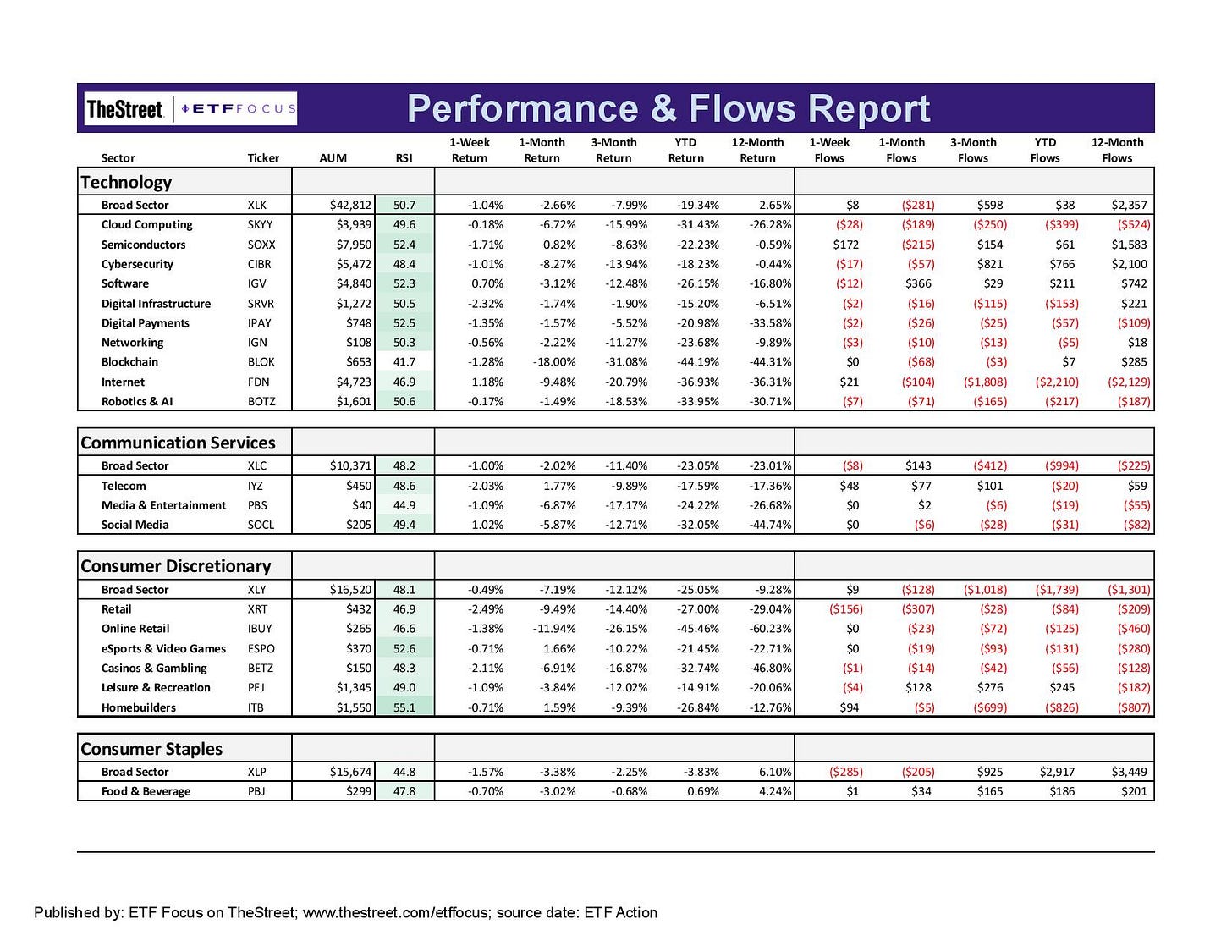

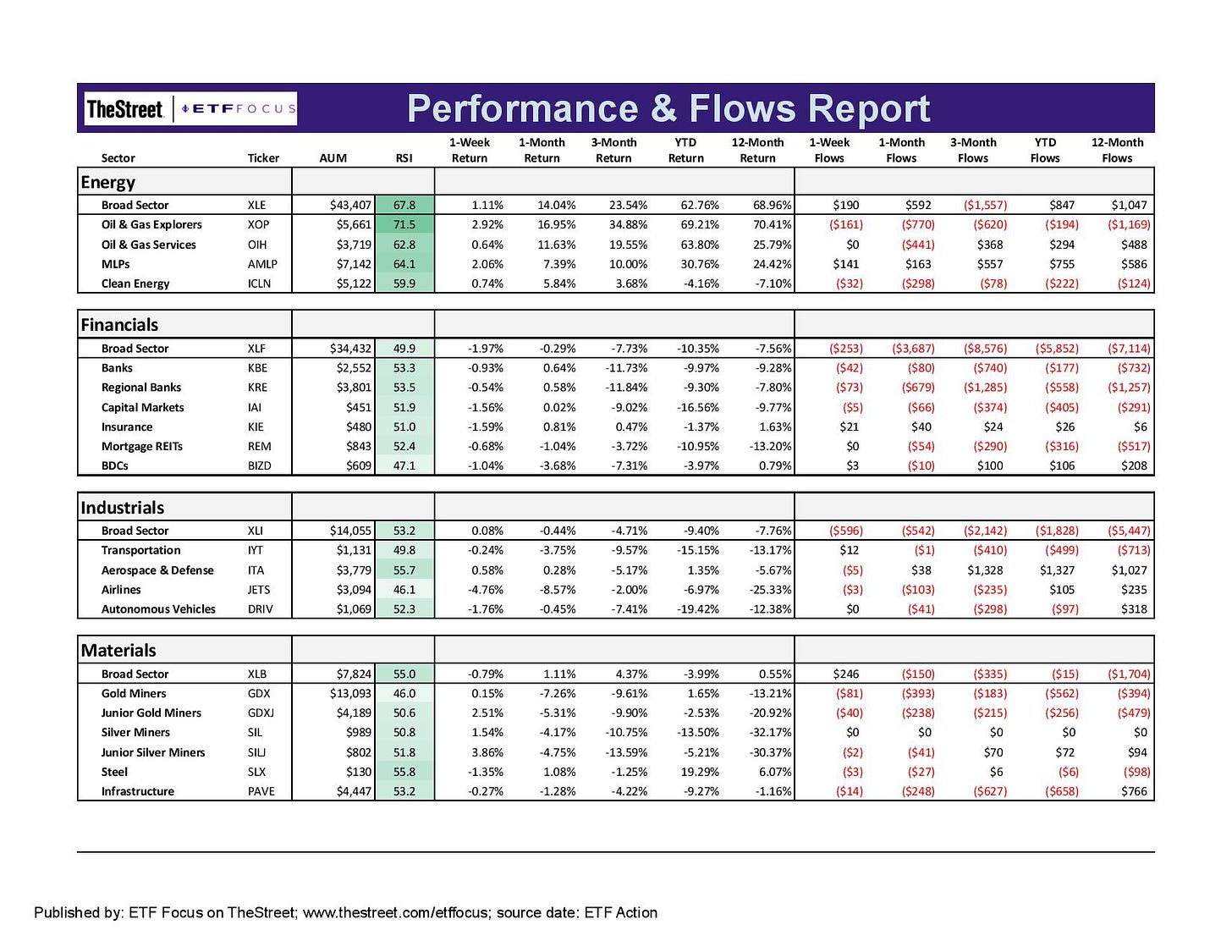

It sounds like a broken record at this point, but once again it’s the energy sector leading the way with everything else scrambling for 2nd place. Defensive issues, such as utilities and consumer staples, had been providing leadership pretty consistently throughout 2022, but appear to be falling back in the near-term. The past couple of weeks have seen a rebound in growth sectors, especially consumer discretionary. Target’s recent profit warning, the 2nd in just the past several weeks, should give investors some pause.

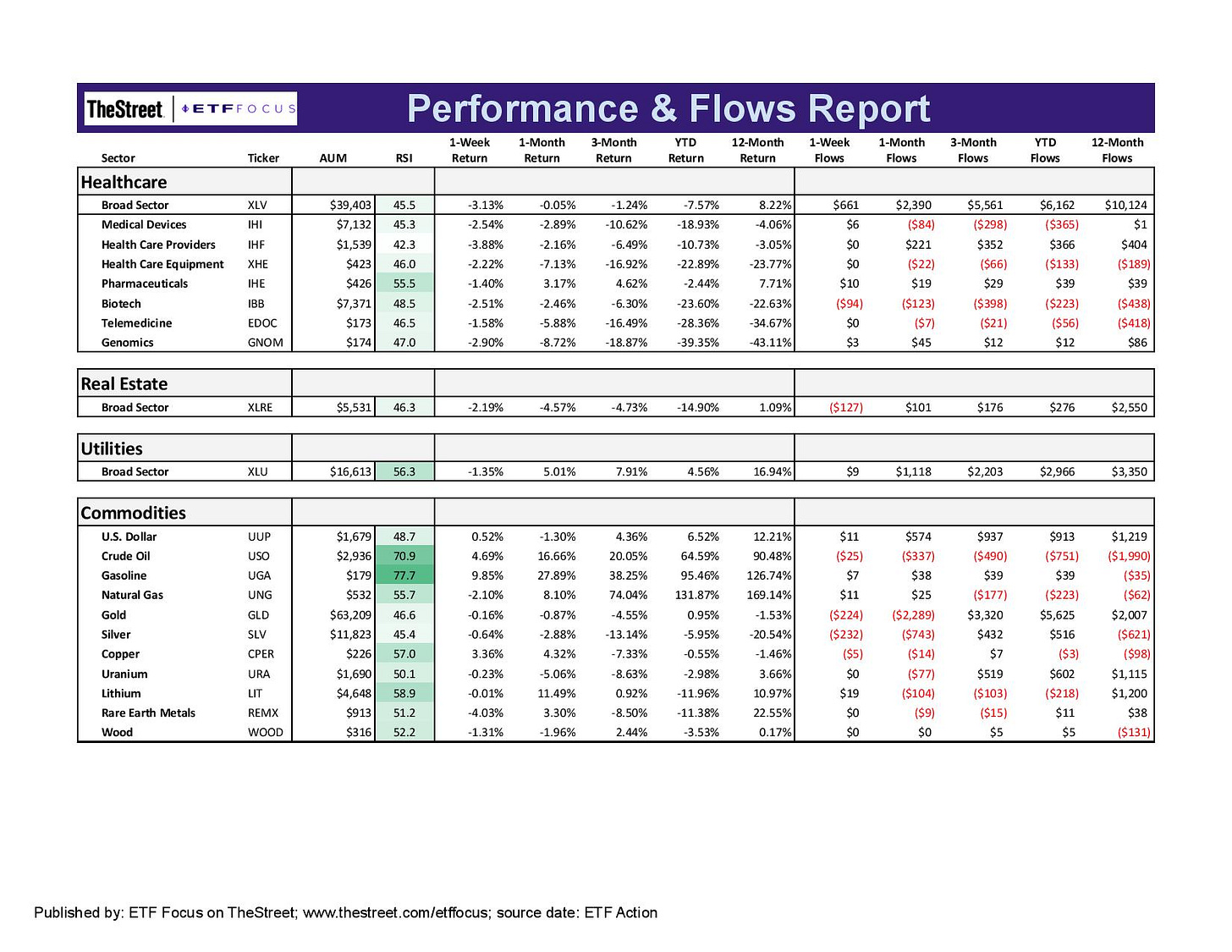

Even though the labor market still looks healthy, the trend in both retail and housing is heading down and that’s going to determine a lot in where the economy heads next. That means a return for defensive equities, including dividend payers. These types of bear market rallies aren’t unusual following a period where stocks have declined sharply. I feel like we could retest recent lows sometime this summer.

Just about everything on the list above is sitting firmly in neutral territory with nothing either leading or lagging. Tech had a comparatively good week, but there’s still an overarching negative sentiment hanging over this sector that’s been tough to shake. Within discretionary stocks, online retail has been incredibly volatile in recent weeks and is likely to remain so. The Amplify Online Retail ETF (IBUY) has done nearly a round trip since the pandemic low. It bottomed out around $35 a share before briefly hitting $140 a little over a year ago. Today, it’s all the way back to $50.

Energy is still in the dark green on the heels of high oil, gas and natural gas prices. I’m not sure how much higher fuel prices move from here, but it’s also tough envisioning a scenario where they move back down significantly absent a major catalyst, such as the end of the Russia/Ukraine conflict. Margins on oil production and refining are as high as they’ve been in years and figure to add a further level of support to energy stocks here. Materials have performed comparatively well throughout this year, although they look like they’re cooling now. Many industrial commodities are well off of their recent highs and could put pressure on stock prices.

Healthcare has spent the past two weeks retracing the outperformance of the month prior. This is another that feels like a good bet to rebound once this current rally runs its course. Utilities is still hanging on here, but is also losing some of its steam. The dollar looks like it could soon pick up again. It fell back once the markets had priced in the top of Fed rate hike expectations. Now that inflation and the possibility of more aggressive Fed action is back on the table, the greenback could very well resume another leg higher again.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!