4 Attractive ETF Ideas Heading Into Summer

In the midst of the market carnage, a few potential opportunities emerge.

Quick note: Last week, I asked for ideas on the topics or ideas you’d like to see covered here and you didn’t disappoint! Some of these themes I’ll begin working to incorporate into these e-mails, including today’s. Some of the questions I may end up turning into an article that will go up on TheStreet, so be sure to keep an eye out for that as well. As always, keep the comments and questions coming! You can either comment on any of these newsletter posts or e-mail me at contact@etffocus.com. Looking forward to keeping the conversation going!

This week, we’ll start with two questions I got last week that are sort of asking the same thing.

Your thoughts on market direction and some individual stock/options recommendations would be great and very welcome. Also low priced stocks with a future.

I liked when you had actionable trade recommendations.

I’m really more of an ETF strategy guy than anything and not really a stock picker, but I’m willing to throw a few of my ideas out there. I’ll caveat this by saying that my success rate is probably about the same as anyone else’s and take these picks with a grain of salt.

The temptation out there today is run towards cash. I’ve already received multiple messages from relatives asking if it’s time to get out. This is historically speaking, one of the worst things you can do because then investors ultimately miss out on the rebound that no one can see coming. If a store is selling clothes for 30% off, that makes it more likely you’ll buy them, right?

I take the same approach to investing. Be mindful but take advantage of opportunities when they present themselves. I’m a fan of pivoting more than selling. Admittedly, I’ve made very few changes to my personal portfolio - mainly trimming some sector bets and adding some hedges.

With that being said, here’s where I see some opportunities today.

ARK Fintech Innovation ETF (ARKF)

Yes, I know that ARK and Cathie Wood have become pariahs in this market. For the record, I’m still a fan, but you certainly need to understand what you’re buying with the ARK ETFs.

Her funds are home run swings. When they work, they’re terrific. When they don’t, well, you probably already know the answer. ARK is down more than 70% from its 2021 peak and is now down since its early 2019 inception.

Here’s the way I look at it. When a fund is down more than 70%, most of the worst case scenario is already priced in. Could it still go lower? Sure, I think most of the excess has been shaken out of this sector. Its recent performance is a result of higher interest rates, high inflation, growing recession risk and the geopolitical uncertainties in Ukraine. All of these are highly negative for emerging growth stocks like the ones that the ARK ETFs own.

Fintech as a theme is going to grow by leaps and bounds over the next decade. If you’re a believer in this trend, you should probably have at least a minor exposure to it in your portfolio. Buying after it’s down 70% means you missed the worst of it and can buy when it’s much more reasonably priced. Plus, when this turns around, the ARK ETFs are probably going to rip faster than most funds. It’s a high risk play, but one that could pay off.

Disclosure: I own shares of ARKF.

iShares 20+ Year Treasury Bond ETF (TLT)

Sort of the same idea here in terms of buying after the biggest losses have already been had. Most investors are betting on higher rates here based on what the Fed is going to do and I understand that. My position is that most, if not all, of the Fed’s action is priced into the bond market. The 2-year Treasury yield has gone from 0.25% in August 2021 to 2.75% recently. That’s 10 quarter-point hikes effectively already priced in. Is the Fed going to raise more than that? Possibly, but it seems unlikely given how GDP growth and inflation are likely to fall in the 2nd half of this year.

As these risks grow, investors are going to turn towards Treasuries for safety again. Any dovish pivot likely to occur from the Fed (which I think happens in 2023 at the latest) will send yields lower again. I think there’s a distinct possibility that yields keep moving a little higher here, but I think it’s much more likely that yields start heading down than up.

Disclosure: I own shares of TLT.

iShares Biotechnology ETF (IBB)

Biotech is sort of in the same boat as ARKF in that it’s focused on next-gen technology, which is very out of favor at the moment. The selling in this group, in my opinion, is overdone.

There was a tweet recently talking about how 20% of the Nasdaq Biotech Index’s members are trading for less than the cash on their balance sheets. That’s a ridiculous number. One quote from it - “Those companies have ~$20B of cash but are worth only $11B."

When you see something like that, it could potentially be time to load up. The SPDR S&P Biotech ETF (XBI) is the equal-weighted version of the biotech sector in case you wanted to spread your bets out (although it would also overweight small- and mid-caps, so risk would go up). I’m sticking with the cap-weighted IBB due to the heavier allocations to the mega-caps that add a layer of protection.

iShares AAA-A Rated Corporate Bond ETF (QLTA)

This isn’t so much a bet on corporate bonds here as it is a better way to invest in the space. For me, junk bonds are off the table. High yield spreads are rising and, historically, when they reach the level they’re at today, they go much higher.

Investment-grade corporate bonds are a better bet, but will still be impacted by rising spreads. If you want to delve into corporate bonds for a yield boost, it’s better to stick with the highest rated debt possible.

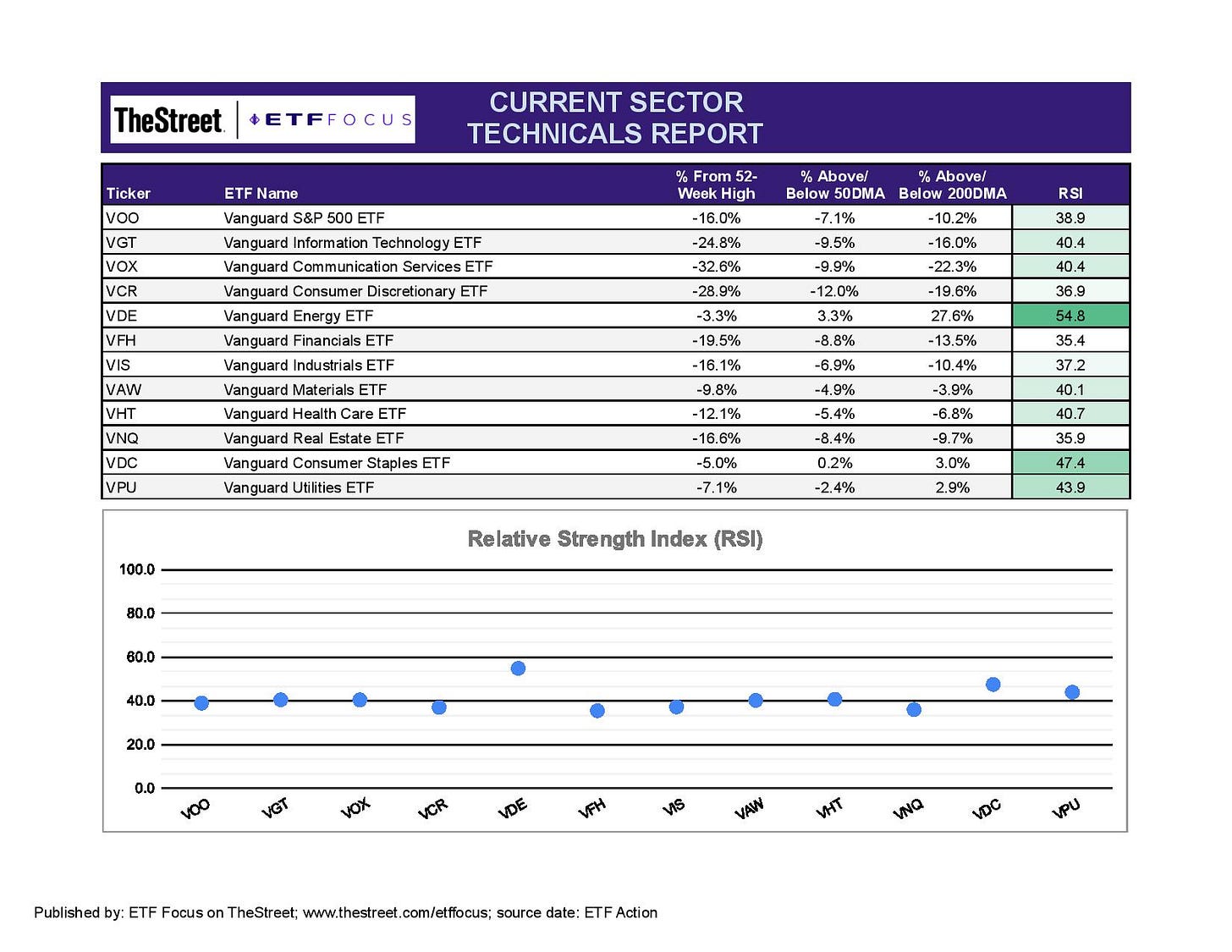

ETF Sector Breakdown

With that being said, let’s look at the markets and some ETFs.

The energy sector is still the only one really holding on here. Consumer staples was the only sector to post positive returns last week. The rotation into defensive sectors - staples, utilities, low volatility and dividend payers - is still firmly in place overall. Real estate has dropped off the radar over the past two weeks and has completely disconnected from its defensive counterparts. Tech continues to struggle to gain momentum and could likely continue to do so until we see some kind of catalyst that reduces market volatility.

There’s really not much delineation in market performance within the growth sub-sectors lately. Blockchain remains highly volatile and subject to wide swings without much firm direction either way. The positive sentiment around cybersecurity stocks, which peaked in the early days of the Russian invasion of Ukraine, appears to have dissipated for the time being. Homebuilders have had a decent month, relatively speaking, but keep in mind that they were hammered prior to this. This looks like an oversold bounce and not much more because the housing market will slow down considerably in the second half of this year.

There’s still some relative strength in the energy sector, but the biggest outperformance recently is being enjoyed by the mega-cap names, such as ExxonMobil and Chevron. Bank stocks haven’t been able to take advantage of higher interest rates as the focus remains on the impact of slowing growth ahead and plummeting mortgage demand. The materials sector also looks like it’s finally cooling off some. It has been one of the market’s leaders throughout 2022 on the heels of the bull market in commodities, but that could be ending. Gold and silver miners, falling 10% each, were among the market’s worst performers over the past week.

The dollar just absolutely refuses to give up any ground. The dollar index is now sitting at two decade highs. Both precious and industrial metals continue to back off and could be an early sign of sentiment shifting in the commodities space. Lumber prices also fell considerably.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!