3 Dividend ETFs With 3% Yields And A Volatility Protection Layer

Risk management should be the priority for 2022, but investors can still capture some decent yields.

The market environment for income seekers is growing more challenging. Yes, interest rates are on the rise and higher yields are a good thing, but not for existing shareholders.

Take the iShares 1-3 Year Treasury Bond ETF (SHY), for example. A year ago, it was yielding around 0.2%. Today, that yield is above 2%. Investors are finally getting at least some type of return for their invested capital.

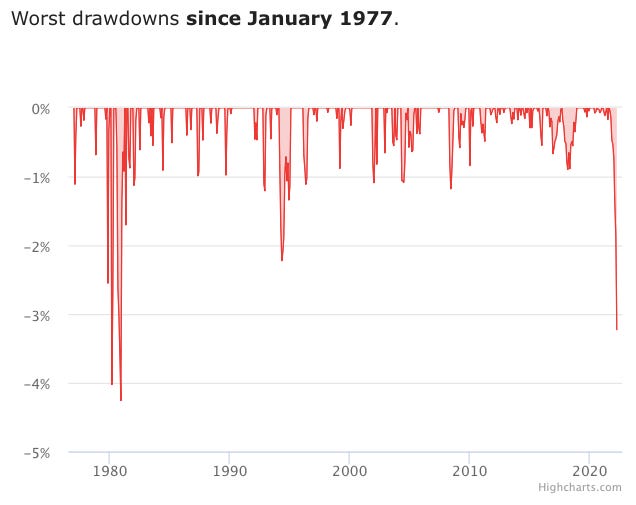

But the past year has been historically bad for Treasury bonds. During that time, SHY has lost 3.4%. To put this number into perspective, the last time we saw this type of pullback in short-term Treasuries was 1980.

Unfortunately, the story is the same no matter where you look in the fixed income market. Long-term Treasuries are down 28% from their peak. The corporate bond market isn’t in quite as bad shape, but it’s bad there too. There have been deeper pullbacks during the financial crisis, the junk bond crisis of the mid-2010s and the COVID pandemic, but the 14% correction we’ve seen over the past 6 months is among the worst in at least two decades. With the Fed set to raise interest rates sharply throughout the remainder of 2022, these numbers could get even worse.

That’s driven a lot of investors to equities for their yields. Equities are a significant step up in risk from bonds, but there’s a perception out there that in the current environment, they may actually be less risky. I don’t think that’s true, but there’s no doubt they are being sought out for income by some.

If you’re one of those people, I think you need to focus on risk management. ETFs focused on dividend growers, such as the Vanguard Dividend Appreciation ETF (VIG) are a good option, but I thinking funds that specifically weave risk management strategies into their objectives.

I want to highlight three funds, all from VictoryShares, that target high yielders but also layer on a degree of volatility protection in case things really go south. These won’t eliminate the possibility of losses altogether, but they can minimize downside risk.

All have a yield of at least 3%, so they could be worth some consideration in today’s market. Let’s run them down.

Victory Shares U.S. Large Cap High Dividend Volatility Weighted ETF (CDL)

This fund tracks the Nasdaq Victory US Large Cap High Dividend 100 Volatility Weighted Index. The targeting method of the fund is fairly straightforward. It starts with a universe of up to the 500 largest publicly traded U.S. stocks (with a few additional filters, most notably that they must have positive net earnings over the trailing 12 months). From there, it selects the top 100 highest yielding securities from that group of 500.

The component weights within the index are determined by the inverse of the daily standard deviation of returns (volatility) over the last 180 trading days. Stocks with a lower demonstrated level of volatility get higher weights within the index and vice versa. Real estate is excluded.

The portfolio looks like you might expect. Utilities and consumer staples comprise a combined 40% of the fund. Financials are #2 at 18% as the only other sector with a double digit allocation. Healthcare is next at 9%. This is clearly a very defensive-tilted portfolio. During typical times, CDL has been about 10-20% less volatile than the S&P 500, but actually become slightly more volatile during the COVID bear market. It experienced a deeper drawdown than the S&P 500 (41% vs. 33%) due to its overweights in financials and energy. It has since resumed its spot as the lower volatility option.

Since its 2015 inception, CDL has outperformed its benchmark, the Russell 1000 Value index, by a 126% to 88% margin, but trailed the S&P 500’s return of 140%.

VictoryShares U.S. Equity Income Enhanced Volatility Weighted ETF (CDC)

CDC is effectively the same fund as CDL with one big exception. It adjusts its allocation to stocks based on market returns. It can remain 100% invested in the index when stocks are not in the midst of a “significant market decline”, which VictoryShares defines as a pullback of at least 8%. If it breaks through that level, the fund can reduce its equity exposure to as little as 25%.

Here are the guidelines for determining exposure:

Index decline of 0-8% - 100% index exposure & 0% cash

Index decline of 8-16% - 25% index exposure & 75% cash

Index decline of 16-24% - 50% index exposure & 50% cash

Index decline of 24%-32% - 75% index exposure & 25% cash

Index decline of 32%+ - 100% index exposure & 0% cash

The idea is fairly simple. It’s essentially a “buy the dip” strategy built on top of an already volatility-weighted portfolio. It makes an immediate 100% to 25% equity exposure pivot at the 8% level because corrections of that magnitude tend to get deeper over time. Therefore, it reduces most exposure immediately. It then begins adding equities back as losses deepen. Essentially, CDC is buying as volatility is high and losses more extreme. The research paper I co-authored confirmed this strategy finding that the best time to buy is when the VIX is high.

Over the past five years, CDC’s strategy has done a great job of producing superior risk-adjusted returns. It’s outperformed CDL by 2% annually and the Russell 1000 Value index by 4% annually during that time while doing so with about 17% less volatility. It carries the highest possible 5-star rating from Morningstar.

VictoryShares U.S. Small Cap High Dividend Volatility Weighted ETF (CSB)

CSB is essentially the small-cap version of CDL. Instead of targeting the 500 largest companies, it starts with a universe of stocks with a market cap of under $3 billion. The same weighting criteria applies.

CSB measures itself against the Russell 2000 Value index and has similarly been able to outperform with lower volatility. It’s beaten the index by 3% annually over the past five years with 10% less volatility.

High Yields

All three funds offer yields in the 3-4% range. That’s the area where a lot of the safe higher yielders reside, but don’t get into the area of speculative yield. Above 4% you start getting into the area where there’s the risk of yields looking artificially high due to share price declines. The overweights to utilities, consumer staples, financials and energy support the notion that these are more cash-rich companies that are paying these dividends.

CDC and CDL offer a current yield of 3.4%, while CSB is at 3.3%

If 2022 is going to be all about risk management, which I think it should be, all three of these funds offer good ways to moderate your equity exposure. CDC, in my opinion, is the best of the bunch due to the addition of the asset class rotation strategy. Backing off of equities during the early stages of a decline, but adding back exposure as declines deepen has been a strategy proven to work over the long-term.

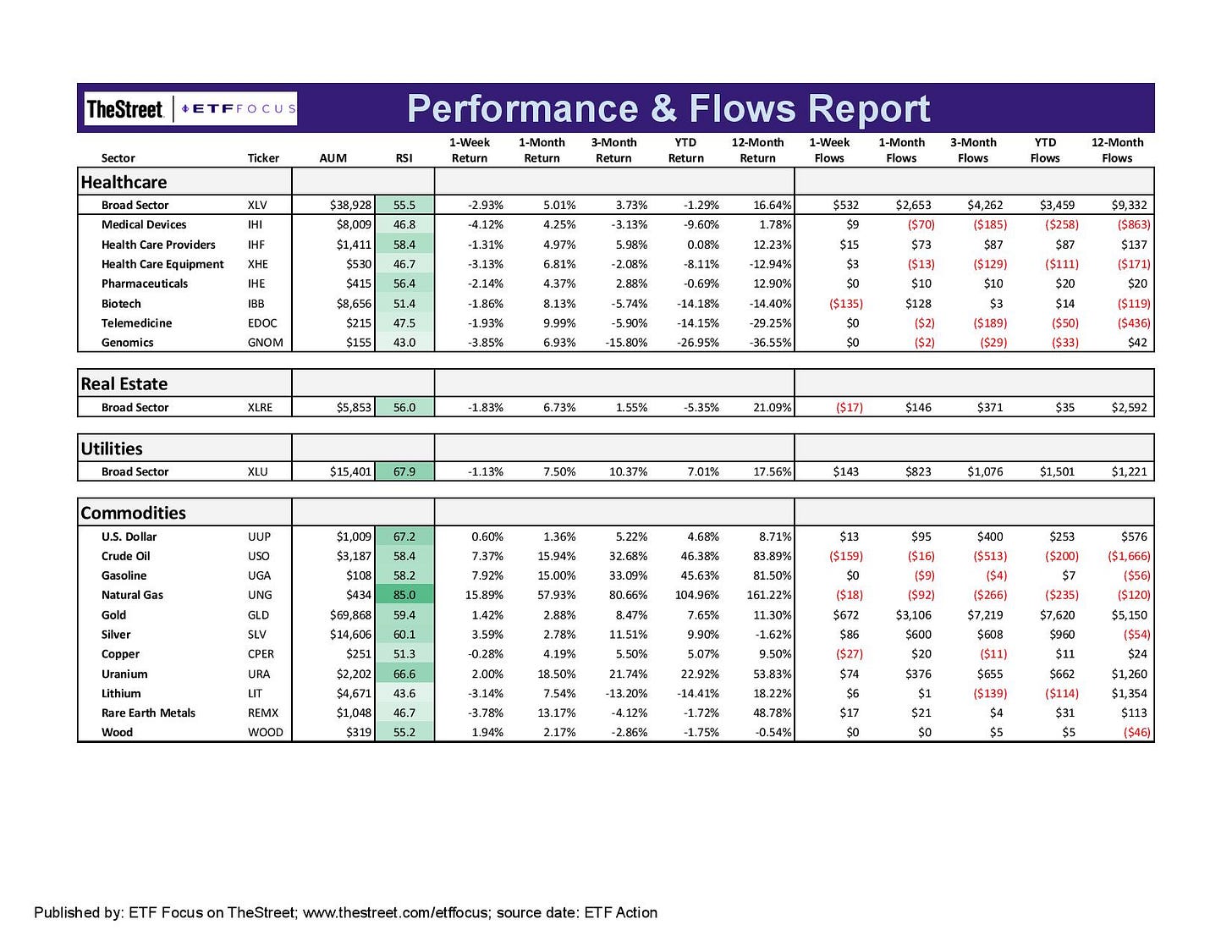

ETF Sector Breakdown

With that being said, let’s look at the markets and some ETFs.

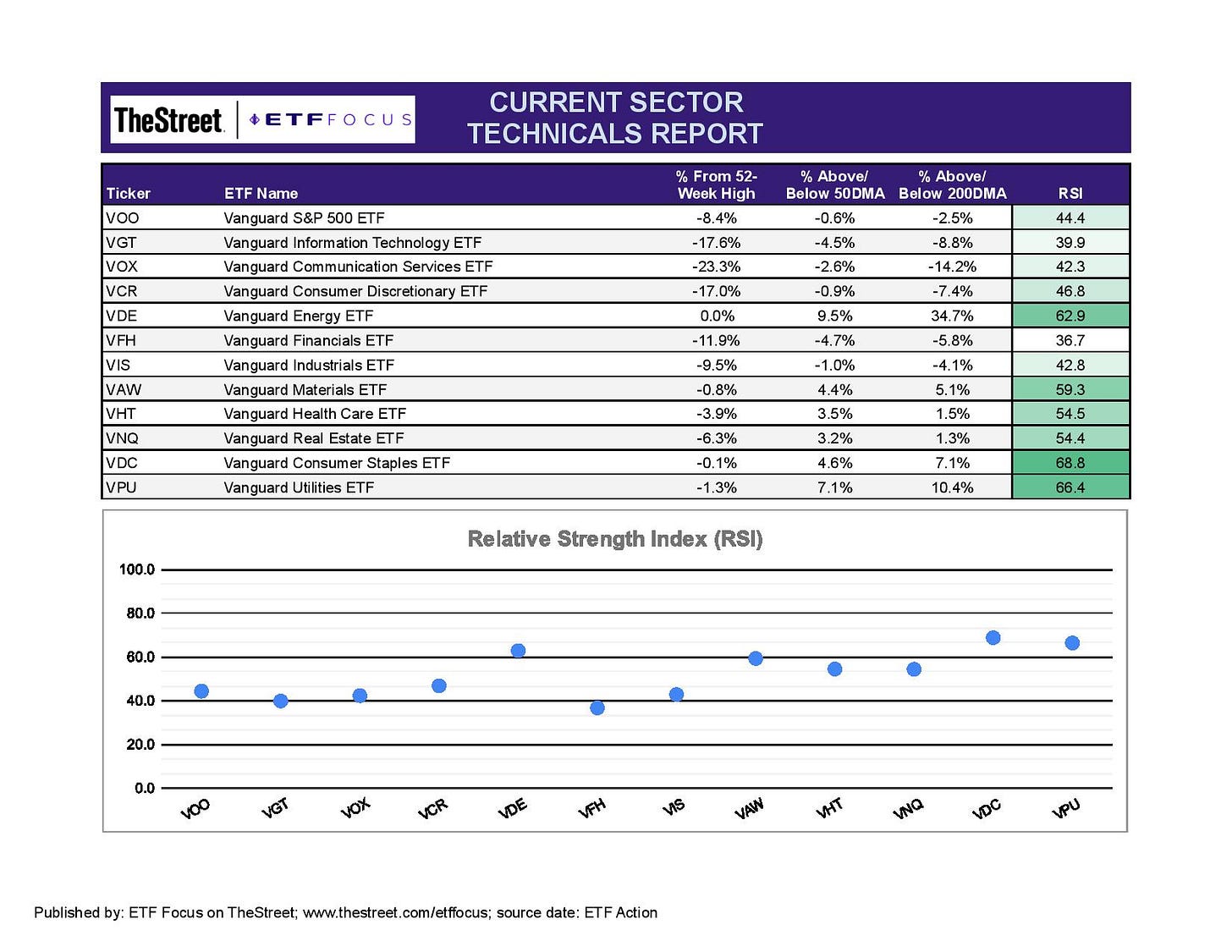

Defensive sectors are still in control here, although some of them backed off a bit last week after a strong run. Healthcare was the one laggard last week, but utilities, consumer staples and real estate all added to recent outperformance. Utilities and consumer staples performing so well for nearly a month straight now indicates that investors are indeed positioning themselves more conservatively in light of deteriorating conditions. Utilities, in particular, have been signaling this for a while now and it appears that signal is strengthening. The timing of a broader move down, of course, is uncertain, but the support for a further decline I feel is building. The S&P 500 is still only 8% below its all-time high, which doesn’t feel like it’s enough given where the economy is headed.

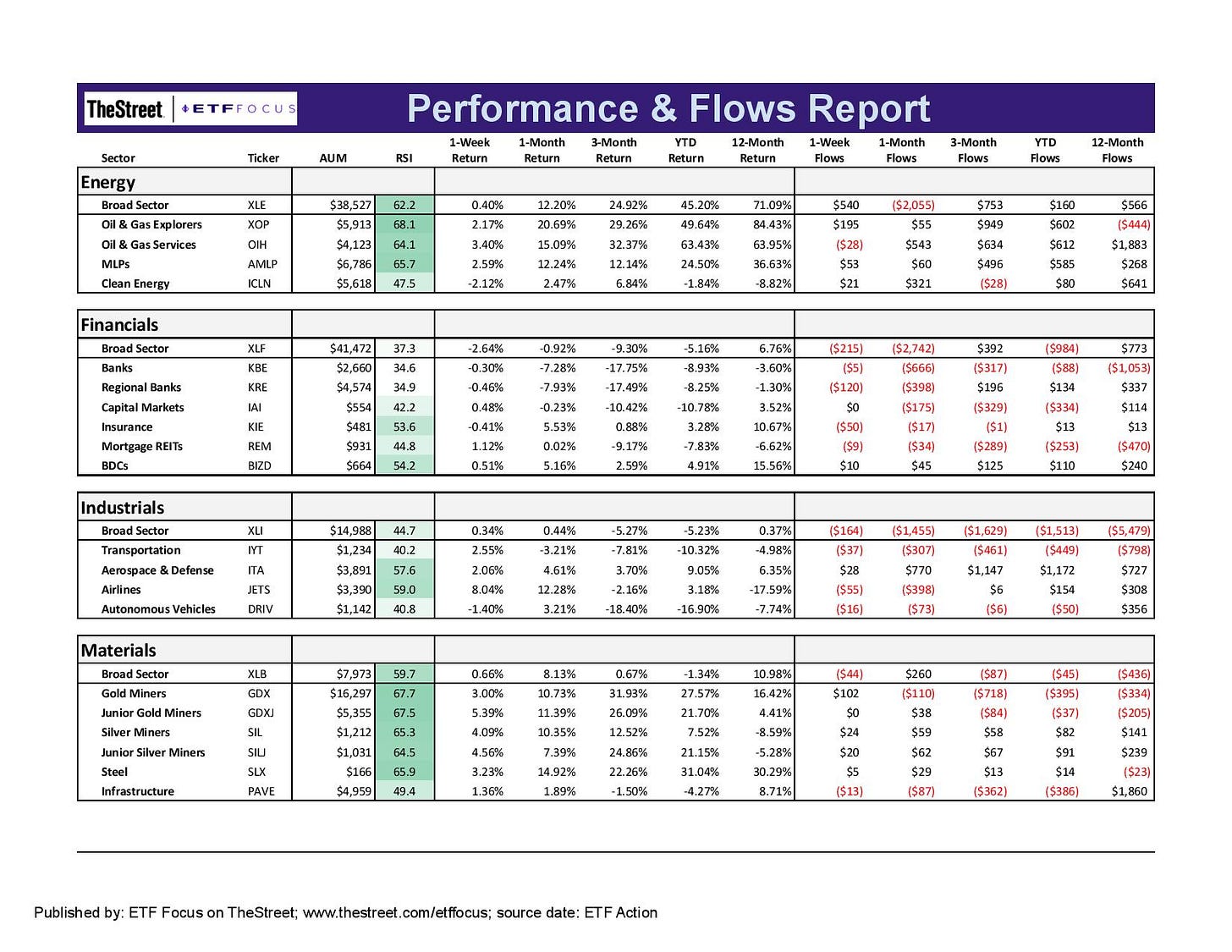

Energy and materials continue to outperform on the heels of the surge in commodity prices. It looked like crude oil prices had been topping out, but WTI is now up 6% in April and natural gas is soaring. Copper, steel and rare earth metals prices are also still climbing and the situation in China will likely only put more pressure on the upside. Growth sectors are still looking particularly weak again as anything with a higher valuation is getting sold off. Banks are among the weakest performing groups in the market right now and will likely struggle to find an upside catalyst as long as mortgage rates are rising and demand is cooling.

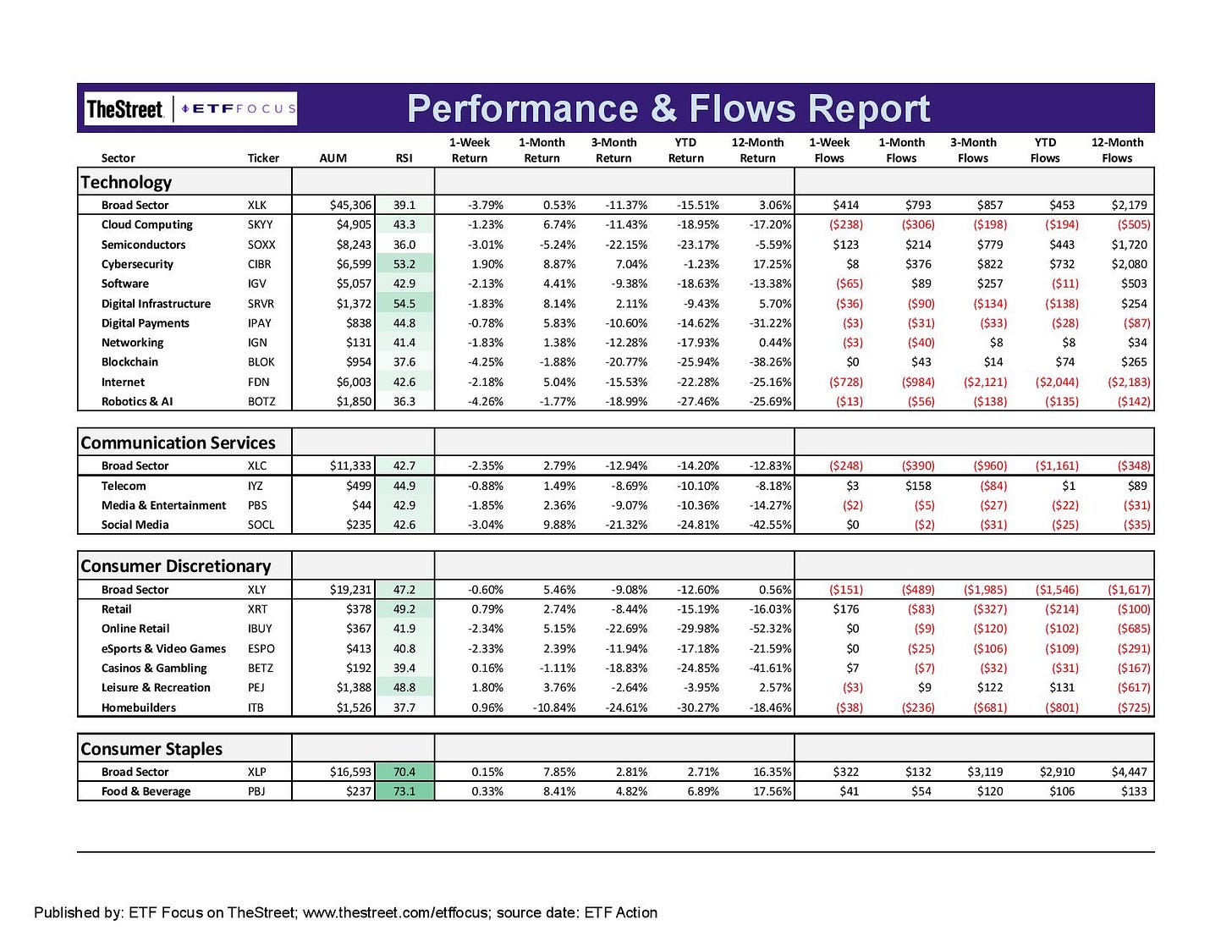

There’s really nothing in the three major growth sectors that indicating any particular strength, although there’s nothing really threatening to move into oversold territory. Semiconductors continue to sell off after a stellar 2021. We’ll see if additional supply chain issues coming down the pike thanks to China will drive chip prices and semiconductor prices higher again, but it’s looking like investors won’t be doing that here. The higher interest rate environment is outweighing any potential upside due to a supply squeeze. Cybersecurity has done the best recently due to the unrest in Ukraine, but even that group looks like it’s slowing somewhat.

Homebuilders are continuing to get hard here, although last week was a pretty good week. The narrative here is pretty clear as I mentioned slowing demand and higher rates already. Online retail stocks took a hit following a March retail sales report that indicated a 6% slowdown. It looks like more consumers are returning to in-person shopping. Social media stocks look stuck again as the Twitter/Elon Musk development failed to inspire a boost for the sector. I think this story is more headline than anything and probably shouldn’t be weighed into any investment decision.

Energy stocks remain strong as they have throughout the past several months, but it’s worth noting that flows seem to be slowing. The commodities surge could be impacting the performance of clean energy stocks. Many of the industrial components that go into electric vehicles use metals whose prices are surging.

Metals miners continue to surge even though gold prices haven’t been making a lot of progress. Gold miner stocks tend to be strong cash flow generators, so the shift to companies with healthier balance sheets has probably been contributing to the bounce.

Not much to like here about the financials as the implications of the Fed’s actions heading into an economic slowdown continue to weigh. At best, investors should be picky in this sector, but I still think there’s more downside ahead.

Utilities and consumer staples are still the clear leaders among equities. Even though healthcare underperformed last week, investors are treating it like a defensive sector, so this seems like it could still be a good bet.

Natural gas is way into overbought territory as the short-term returns get nuts. It’s already doubled in price just this year, so be careful about jumping in trying to chase old returns. The dollar is the other big winner here. The dollar index just passed through the 100 level for the first time since early 2020. There’s still a demand here for dollar-denominated assets, so the greenback could hold on to these gains, especially if Japanese monetary keeps causing the yen to dive.

Read More…

VTI vs. SPY: How Total Market ETFs Measure Up Against The S&P 500

Are Long-Term Treasuries About To Become One Of The Best Trades Of 2022?

ETF Battles: DEMZ vs. MAGA - Which Politically Driven Stock ETF Is Best?

Recession Watch Is On! 5 ETFs To Protect Your Portfolio Today

Best Performing Dividend ETFs For Q1 2022

Best Performing ETFs For Q1 2022

ETF Battles: ARKK vs. FBCG vs. GK - Which High Growth Stock ETF Is Best?

Using Covered Calls To Turn 2% Yields Into 12% Yields

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!