3 Dividend ETF Picks For August 2022

With the U.S. economy in recession and China threatening to invade Taiwan, now is not the time to be risking up.

After months of pain in 2022, investors finally got a reprieve in July. The S&P 500 was up 9%. Small-caps gained 10%. Even long-term Treasuries, which had been beaten down right along with stocks, returned 2-3%. Whether or not this just turns out to be a temporary bear market rally remains to be seen, but for one month at least, optimism returned.

I tend to be on the bearish side of this argument. From my point of view, inflation is still roaring, interest rates are starting to stifle growth and manufacturing, the economy just experienced its 2nd straight quarter of negative GDP growth and the housing market is starting to decline quickly. I know that the economy isn’t the market, but there’s just too much here trending in the wrong direction to make me think otherwise. The real catalyst for equities putting in a bottom is a dovish pivot from the Fed. Part of the reason risk assets rallied in July was because of the perception that the Fed may be getting close to the point of backing off on tightening conditions. As long as the Fed’s #1 goal is inflation control, however, I don’t see a reason to expect a longer-term move higher just yet.

Dividend stocks have been one of the biggest winners of 2022 and I think that outperformance trend is likely to continue throughout the remainder of the year. I don’t know if that will necessarily translate into positive returns, but it should offer at least a modest amount of downside protection in case things go south.

There are all flavors and strategies within the dividend ETF universe, but I think those that take more of a defensive approach will play better in this market. I’m going to offer up three dividend ETFs that meet that criteria, but layer a second strategy on top of that - low volatility, high yield and sector allocation.

VictoryShares U.S. Equity Income Enhanced Volatility Weighted ETF (CDC)

Dividend ETF Ranking: #11

If you’ve followed my work in the past, you’ll know that I’m a big fan of this ETF. There are a lot of things going on within this fund’s strategy, but the overall high level view is that it aims to deliver equity market returns, an above average yield, managed risk levels and downside protection.

CDC starts by pulling the 100 highest yielding stocks out of a universe of the 500 largest U.S. stocks. The weightings in the ETF’s index are based on the inverse of the daily standard deviation of returns over the prior 180 days. Additionally, the fund will pare back equity exposure during market downturns.

For example, CDC has reallocation triggers at every 8% decline in the large-cap index. At an 8% correction, the fund goes from 100% equity exposure to 25%. At every additional 8% decline, it adds back 25% equity exposure to the point where it goes a full 100% back into equities with a 32% market drawdown. Think of it as getting mostly out during the initial decline, but attempting to buy the dips as stocks fall further.

Historically, this has been a top tier ETF among those using similar strategies. It has earned a 5-star rating from Morningstar and its returns land it in the top 3% of more than 1,000 funds in Morningstar’s Large Value category.

Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

Dividend ETF Ranking: #10

SPHD’s strategy follows a similar path to that of CDC without the “enhanced” weighting strategy. As I’ve discussed with this fund in the past, it’s been either a feast or famine type of ETF. From 2017 through 2021, when growth, tech and high beta stocks were all the rage, SPHD had a really tough time. In 2022, when defensive stocks, low volatility and dividend payers have been the leaders, SPHD has shined (relatively speaking, of course, but the fund is up 1% on the year)!

SPHD starts with the S&P 500 and pulls out the 75 highest yielders, REITs included. Within that sub-universe, it targets the 50 names with the lowest realized volatility over the past 12 months and weights all qualifying components by their dividend yield. What you end up with is a portfolio that has been about 25% less volatile than the S&P 500 over the past year and offers a current yield of almost 4%.

FlexShares Quality Dividend Defensive Index ETF (QDEF)

Dividend ETF Ranking: #39

The FlexShares dividend ETFs (this one along with QDF, QDYN and the international counterparts to each) because they focus on stocks backed by healthy balance sheets, have above average yields and have the ability to continue growing their dividends over time. QDF is probably my favorite out of the bunch based on its broader approach, but QDEF is perhaps the better ETF for this moment.

It starts with a universe of 1,250 large- and mid-cap stocks and immediately eliminates non-dividend payers. Using quality and fundamental metrics, it assigns a dividend quality score to each remaining stock and avoids any one of them that lands in the bottom quintile. From there, a portfolio optimization process is used that looks to accomplish three things - maximize overall quality score, pay an above average yield and maintain a portfolio beta between 0.5 and 1.0.

The quality and low volatility aspects of this portfolio are probably the most beneficial today since the current 2.4% yield isn’t that much above average.

With that being said, let’s look at the markets and some ETFs.

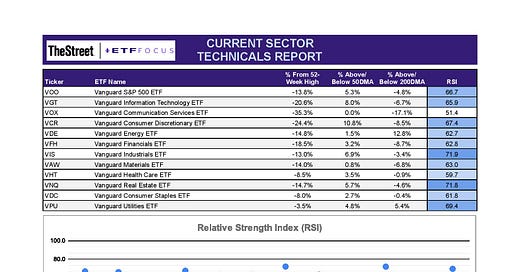

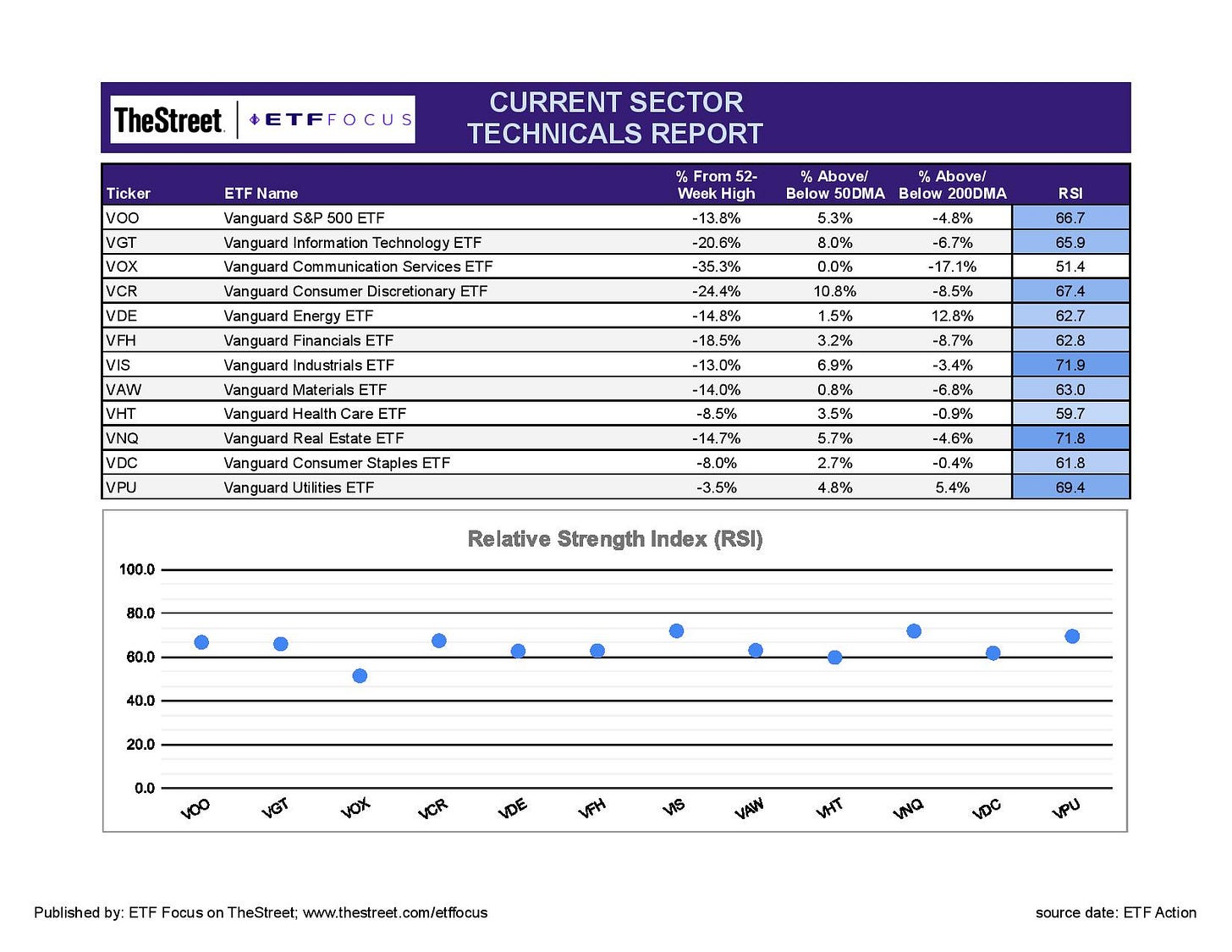

Last week’s rally pushed the relative strength readings for most sectors into bullish territory. The past couple of weeks have been dominated by growth names, specifically those in the tech and consumer discretionary sectors. It’s not surprising that whenever there’s a belief that the Fed might be nearing a more accommodative tone, risk assets tend to rally. I believe that’s the primary reason we’ve seen the markets move higher, although I’m not sure it’s entirely justified. I think this is more of a bear market rally than anything and I’m skeptical that it has any kind of longer term legs.

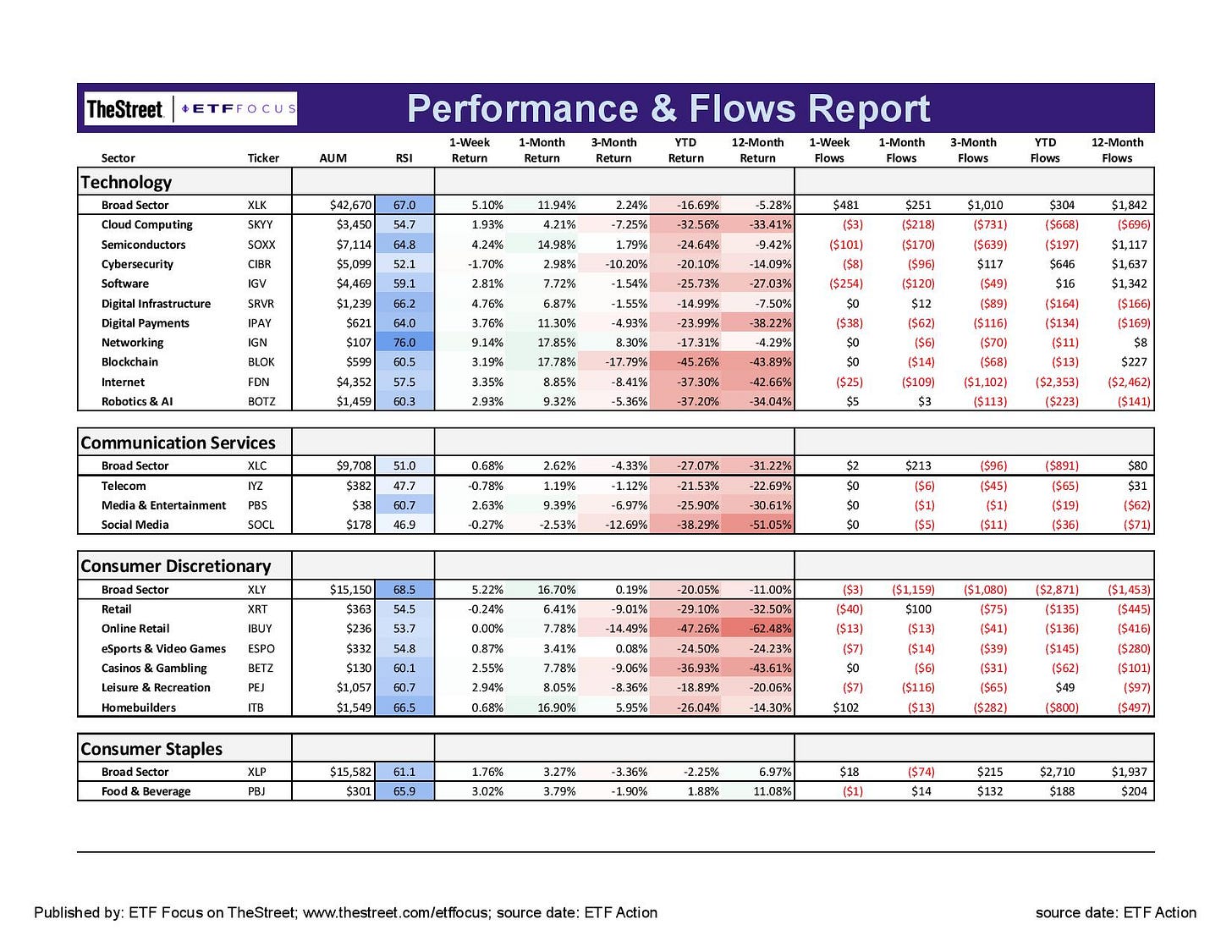

The consumer discretionary sector at a high level has been rallying hard lately, but there’s weakness below the surface. The retail names continue to get battered, as evidenced by the results from Target and Walmart. Homebuilders are hanging on, but they’re about to face a much tougher environment. The leisure and recreation sector has already seen dampened enthusiasm due to high inflation and higher energy costs.

The tech sector is where the real action has been happening. With the exception of cybersecurity stocks, the gains have been pretty broad. Semiconductors have been making a comeback, but networking, blockchain and digital payments stocks are also up double digits in the past month. This is the first time that the tech sector has regained leadership since the 4th quarter of last year, but whether it lasts remains unclear.

Cyclicals have staged quite a rebound lately and it’s the mostly forgotten industrial stocks that have performed best. Most of oxygen in the room gets sucked out by the energy sector narrative, but the manufacturing-heavy companies have actually been doing better. While growth rates in factory activity remain in positive territory, the trend is heading towards negative growth and is likely to hit that mark before the end of the year. From a macro perspective, there’s not a lot to get too excited about despite the recent run.

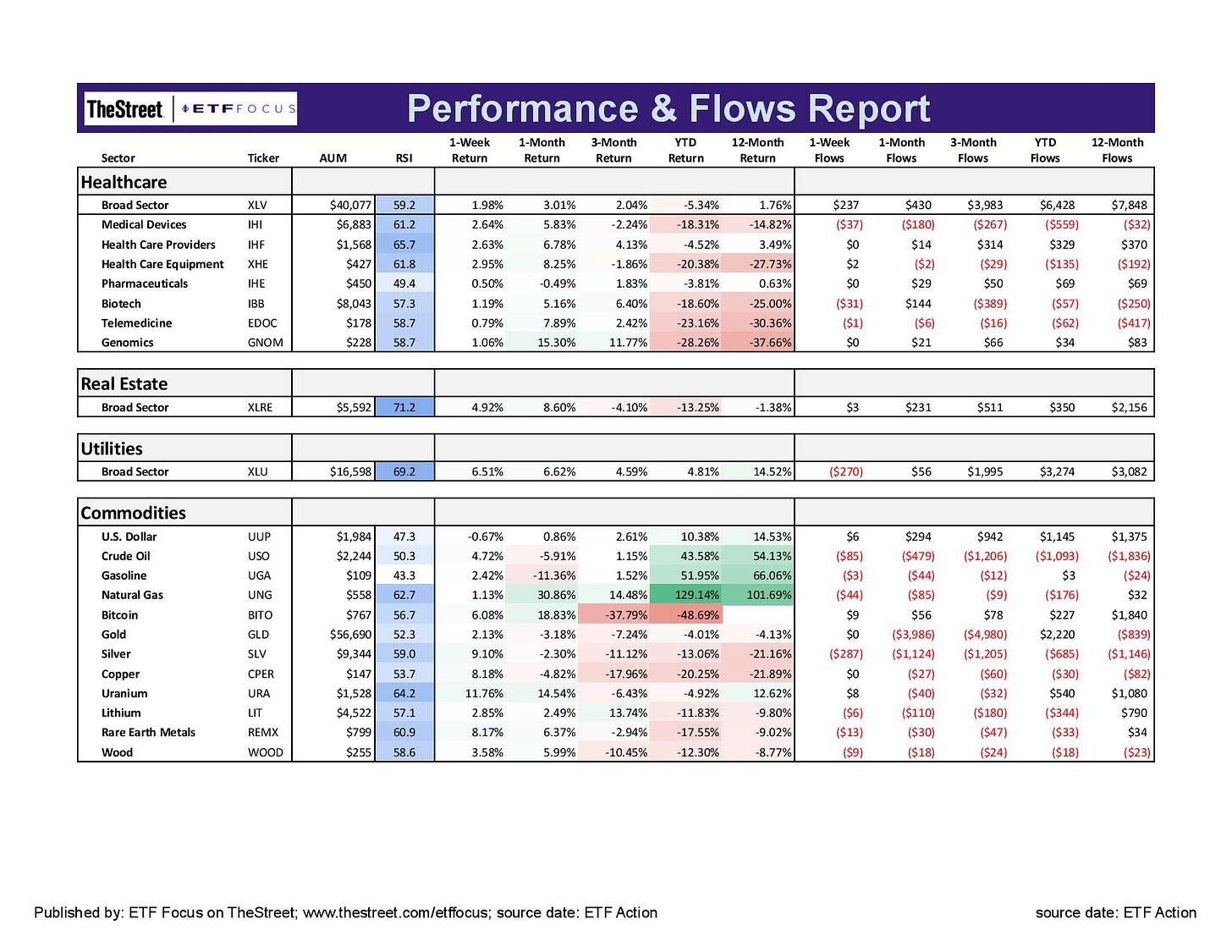

Speaking of energy, clean energy stocks had one of their best weeks in recent memory. Traditional oil sector names also did very well in the hopes that the central bank will soon come to the rescue, but that may be premature. Oil prices, while off of their highs, remain pretty resilient here and that’s been adding some support to energy stocks, in general. The materials sector, including the miners, finally had a good week following what’s been a miserable 3-month run.

The healthcare sector has cooled considerably from its 2022 outperformance. Utilities and consumer staples are hanging on, but it’s the real estate sector that’s been the star among the defensive sectors. I find it a little curious given how mortgage demand and new home sales prices have plummeted in light of much higher mortgage rates. This is a trend that probably isn’t going away any time soon and I think we’ll see a reversal in the near future.

The dollar looks like it finally may be getting ready to halt its climb. Lower long-term yields are going to be a headwind to dollar demand and we’re seeing many foreign currencies regaining ground on the greenback.

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!