2022 Is Likely To Look A Lot Different Than 2021

The environment in the coming 12 months is likely to be much more challenging for risk assets.

2021 ended on a high note overall, not surprising given that history tends to favor equities posting gains on light trading volume in the Christmas-to-New Year period. The S&P 500 gained 29% on the year, but small-caps lagged badly, demonstrating the top-heavy nature of the market today. The Nasdaq 100 finished narrowly behind the S&P 500, while long-term Treasuries lost nearly 5% on the year.

Now, 2022 is here with an environment that is likely to be much more challenging for risk assets. The Fed is likely to begin raising interest rates, possibly as early as the March meeting, and the Fed Funds rate could very well end the year at 1%. The government is expected to continue to racking up debt, which could be modestly encouraging from an economic growth standpoint depending on what it’s spent on and the level of spending, but interest expense on that debt will begin rising as rates rise, adding to existing deficits.

In the short-term, conditions look favorable for risk assets here. Volatility remains low and high yield spreads are still near lows, indicating that there are few underlying signals at the moment suggesting risks are building. Large-caps look poised to continue outperforming small-caps, although January has shown the ability in the past to reverse course on a dime. 2016 provides a road map for how equities could turn lower quickly if investors reset and rebalance in the new year. The 2018 Volmaggedon event showed what can happen if investors get complacent in an ultra-low volatility environment if there a catalyst that ignites selling pressure. I don’t see those risks as likely to present themselves early on in 2022, but it’s something to be mindful of.

One trend worth watching is the utilities, consumer staples, healthcare and real estate have all led the market higher since mid-November. Tech has shown minor leadership, but the rest of the growth and cyclical sectors have lagged. This isn’t necessarily a bearish signal in and of itself since we haven’t yet seen it accompanied by buying in Treasuries, but it is indicative that there’s some defensive positioning taking place here. Investors could be prepping their portfolios for the upcoming rate hiking cycle or could be fearing what might happen with a further surge in omicron cases. This is just one signal among many and, while it likely indicates, in my opinion, that investors are no longer putting their foot on the gas, there’s little evidence at this point that they’re starting to hit the brakes either.

Omicron is still favoring cautious conditions, but it appears it’s going to be treated more like a road bump than a road closure. Don’t be surprised to see scattered business disruptions continue to occur over the next month or two, but with expectations looking for a sharp surge followed by a relatively quick decline in new cases, investors may be taking a “let’s power through it” approach as opposed to a broader portfolio repositioning. Thankfully, omicron doesn’t appear to be causing the severe health impacts that previous variants of COVID have, but its ability to create severe staffing shortages in the near-term remains problematic.

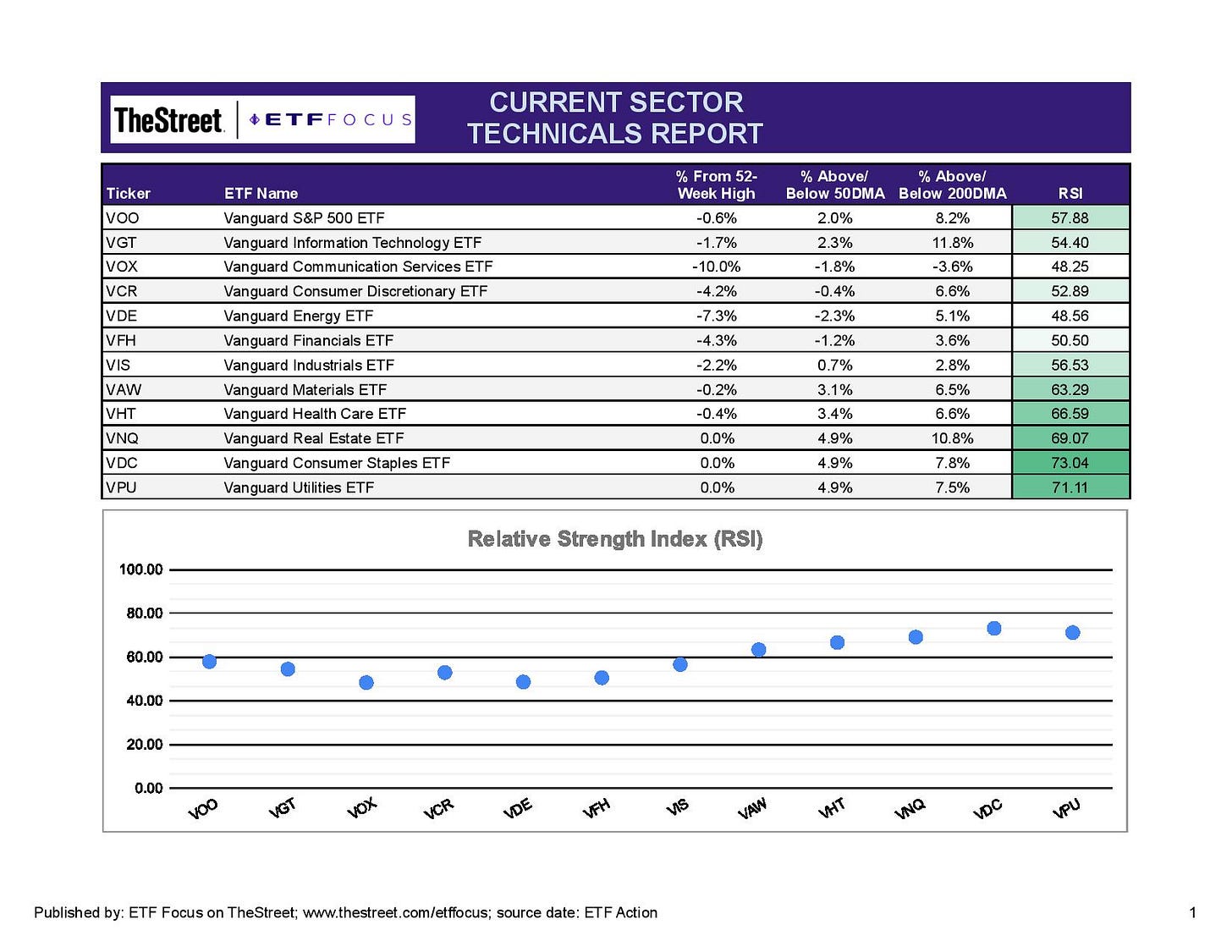

Let’s start our weekly review by taking a look at the primary market sectors.

The pivot towards defense in U.S. equities is readily apparent here looking at short-term relative strength. Utilities and consumer staples have crept into overbought territory, while real estate and healthcare are nearly there. On the growth side, tech continues to do significantly better than communication services and consumer discretionary. Communication services appears to have stopped the bleeding from its recent underperformance.

Price momentum has halted in most growth and cyclical sectors, although materials has been the main outlier. With lumber prices remaining strong and even some momentum building in gold and silver, materials is looking like the most attractive sector of the bunch. Energy has definitely lost its momentum as oil prices moderate and OPEC continues to interject in the outlook for crude. Yields are already rising on the short end of the Treasury curve, which should be a positive for the bank stocks, but the long end has mostly failed to budge despite expectations for several quarter-point rate hikes in 2022. Longer-term economic growth is still a concern here and that’s demonstrating more influence over long-term rates at the moment.

The tech sector is demonstrating perhaps the widest range of subsector results we’ve seen in a while. Blockchain, which has been a market leader as recently as a few weeks ago, is showing some of the greatest short-term weakness today. Digital infrastructure, including the 5G theme, has done very well in December as the powers-that-be in Washington continue to hammer out the omnibus spending bill. Digital payments stocks are back to neutral from oversold and could be an interesting pick in 2022.

The holiday shopping season looks like it was a success, but that hasn’t necessarily translated into higher prices for discretionary stocks. There’s some evidence that supply chain bottlenecks might finally be loosening up a bit, but there’s still a long way to go before we can say things are resembling “normal” again. Online retail stocks continue to be the weak spot, but the homebuilders continue to do well. Leisure stocks are rebounding after the initial omicron scare appears to be overblown.

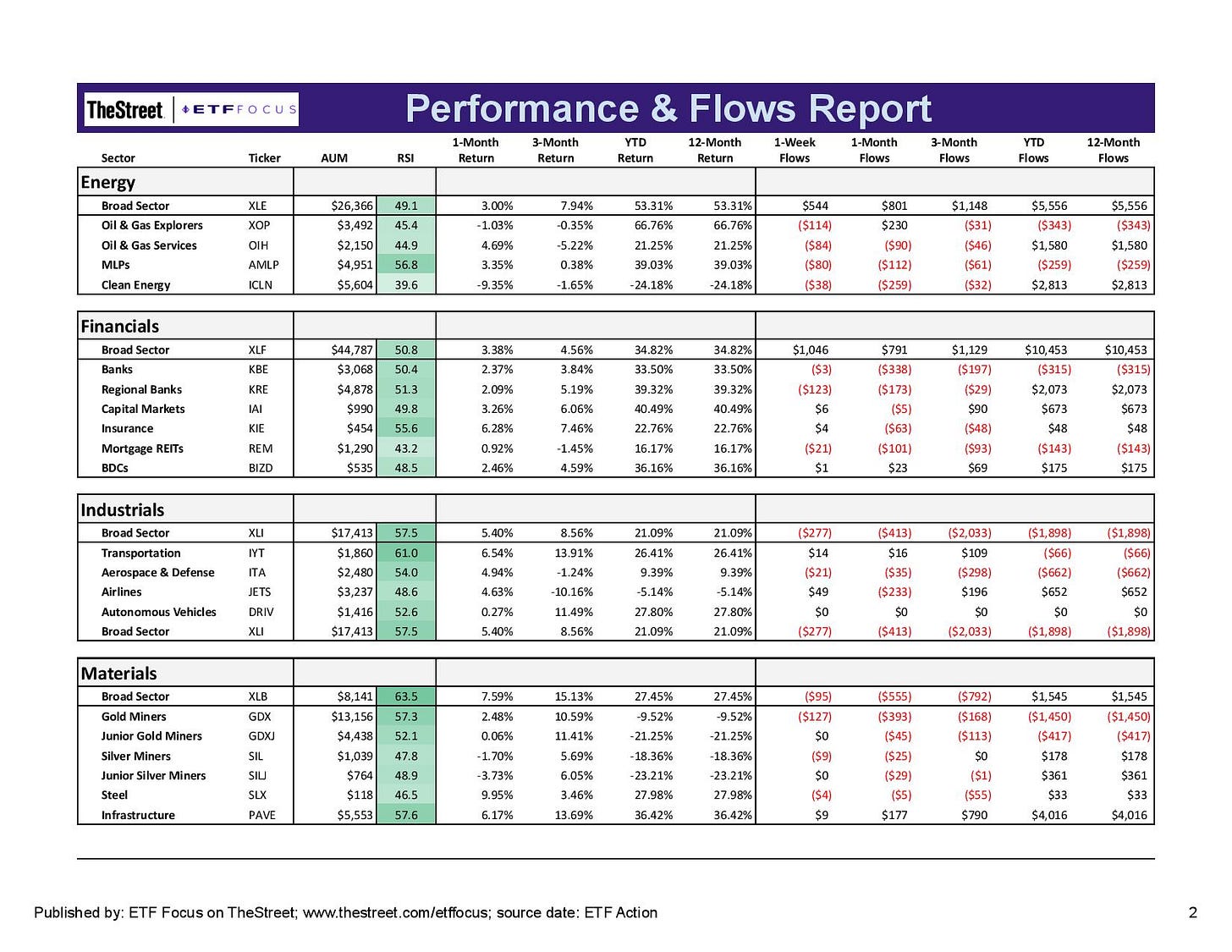

MLPs were the best-performing group last week, gaining about 4%, and could be an interesting yield play in 2022, but the group remains a laggard within the broader sector. The broad energy sector ETFs continue to pull in money, especially considering that energy was the best-performing sector of 2021, but the subgroup ETFs are showing no such buying interest. The explorers and servicers continue to see steady outflows, while the clean energy group, once a market darling, has done a complete 180.

Financial stocks have lost momentum over the past month with no particular strength being shown in any one group. Interestingly, European banks have done very well relative to U.S. banks over the past several weeks despite international stocks, as a whole, underperforming. Industrials look particularly uninteresting here. This sector has underperformed the S&P 500 almost non-stop since last May.

Materials are looking better here, as mentioned earlier, and are being led by the infrastructure stocks and gold miners. The sentiment for cyclicals, in general, should remain cautious unless we get an uptick in growth expectations, something that seems unlikely in the current environment. The gold and silver miners could look interesting as the economy cycle matures later this year.

The traditionally defensive sectors are still looking particularly strong here. Healthcare, real estate and utilities have all returned 9-10% in the past month and I think that’s an indication that the growth trade is finally starting to get tired. From a pure valuation standpoint, it’s easy to make a case for one of these groups and the comparatively higher dividend yields could become a more attractive feature in a potentially low-return year. If I’m making a pick within healthcare, I’m still leaning towards the potential of biotech, although it’s certainly been disappointing over the past year.

The dollar index has been pretty flat since Thanksgiving, hovering around the 96-97 level. The direction of the dollar here is likely to depend on central bank policy relative to the rest of the world. With the ECB unlikely to tighten to any meaningful degree in 2022, I’d expect to see the euro struggle, while the pound and franc could do comparatively well. If the Fed’s action manages to lift long-term rates, a run to 100 for the dollar index isn’t out of the question.

Precious metals miners have done fairly well recently as gold & silver try to build a little momentum. I see some more difficulties from this group in the near-term, but the 2nd half of the year could be really positive. Lumber has been perhaps the top-performing commodity over the past couple months, but the short-term momentum is likely to wane soon. OPEC’s decision on February oil production could move crude and gasoline prices later this week.

Read More…

Top 7 Dividend ETF Picks For 2022

200 Large Cap ETFs Ranked For 2022

Top 6 Semiconductor ETFs For 2022

Time To Be Bad! Alcohol & Drugs ETF Launches

68 High Yield Bond ETFs Ranked For 2022

138 Small Cap ETFs Ranked For 2022

Top 6 Blockchain ETFs For 2022

144 Dividend ETFs Ranked For 2022

87 Technology ETFs Ranked For 2022

Questions, Ideas, Thoughts?

Feel free to reach out by replying to this e-mail or commenting below. Your question or idea might be used in a future newsletter!

Lots of good information here. Thanks.