10 Best ETF Picks For 2024 In 10 Different Categories

No matter which area of the financial markets you're looking to invest in, we've got a top idea for you!

Note: In addition to the post below, I wanted to mention that I took my first stab at creating some accompanying video content for it!

If this is your preferred method for consuming content, I encourage you to check out the linked YouTube video as I provide a little more color around each of the top ETF picks mentioned here. It is my first one though and I promise they’ll continue getting better in the future!

Enjoy!

As we kick off 2024, investors are probably hoping for a repeat of 2023, which saw the S&P 500 rise by 26% and the Nasdaq 100 soar 55%. A big part of these returns came from the "magnificent 7" stocks - Apple, Amazon, Alphabet, NVIDIA, Microsoft, Tesla and Facebook. The rest of the market didn't quite enjoy that same level of success, but those who stuck primarily with the major index ETFs were probably more than happy with their results.

But 2024 is a different year and, with it, we need to look forward to it with a fresh set of eyes. The U.S. economy still looks like it's in pretty good shape. GDP growth remains quite positive, the unemployment rate is still historically low and inflation has come way down from its peak (although it still has some work to do to get back to 2% sustainably).

On the other hand, the impact of high interest rates is taking a toll on consumer spending habits and credit creation. The manufacturing sector is in a state of deep contraction and even the services sector looks like it's starting to buckle. And we can't forget that several international markets look like they might be near or actually in recession.

It's this latter piece - my concern that we're trending towards recession and how risk management should be a major theme this year - that will frame my top picks for 2024.

I've chosen 10 different ETF categories, including everything from U.S. stocks to international stocks to fixed income to thematic products, and identified my top ETF pick for 2024 in each of them. Everything will be considered - cost, portfolio positioning & index construction, the economic cycle, valuations and other factors.

No matter what piece of your portfolio you're looking to upgrade or even if you're just getting started for the first time, here are my 10 ETFs that would be a great place to start for the new year!

Large Caps: Invesco S&P 500 Equal Weight ETF (RSP)

Let's not overthink this one. I simple investment in the S&P 500, such as the SPDR S&P 500 ETF (SPY) or the Vanguard S&P 500 ETF (VOO), has worked wonders for investors over the past several years, but it won't be like that forever. The magnificent seven stocks drove a very large percentage of the index's returns in 2023, but the collective is now trading at about 30 times next 12 month's earnings, which probably makes this a less attractive entry point, especially if you believe that recession could be coming.

RSP takes the overweighting issue out of the equation and starts all 500 components out on an equal footing. You can stick with the S&P 500, but approach it in a way that tilts towards the smaller companies in the index and mitigates some concentration risk. The better value right now is clearly away from the mega-cap names and RSP helps to take advantage of that.

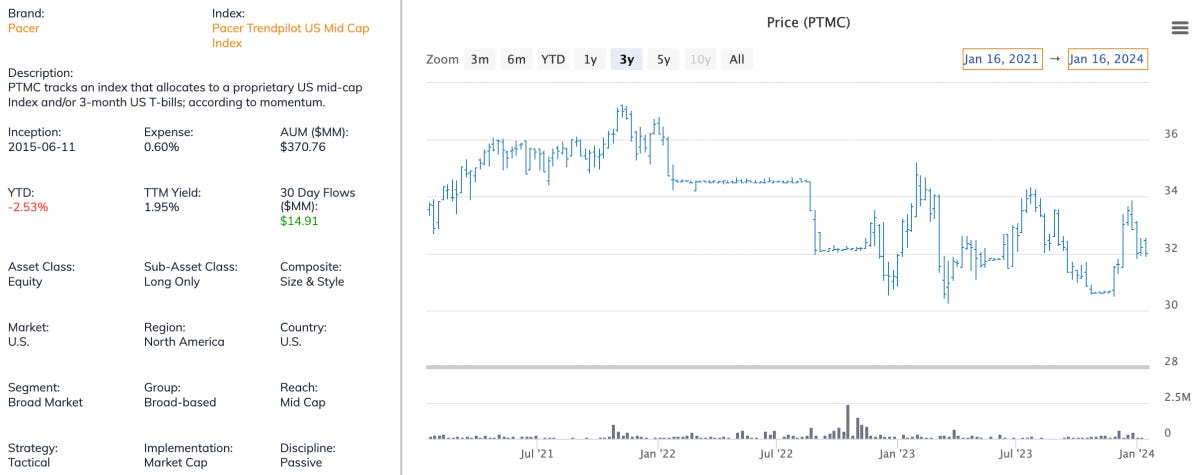

Mid Caps: Pacer Trendpilot U.S. Mid Cap ETF (PTMC)

PTMC's strategy is very simple - it rotates between the S&P 400 Mid Cap index and Treasury bills based on where the index trades relative to its 200-day moving average. There's some nuance built into the strategy, but the general idea is that when it trades above its 200DMA, it's in equities. Below it and it invests in T-bills. The basic premise of the strategy is that you capture equity gains when there's positive momentum and avoid equities when they're out of favor.

The 200-day moving average signal has been well-studied in finance circles and, generally, has a pretty good track record. It won't be infallible, especially during periods of higher volatility, but it's use in this instance, as a means of buffering some potential downside risk in a deteriorating economic environment, is likely to prove useful.

Small Caps: Innovator U.S. Small Cap Power Buffer ETF - January (KJAN)

You're probably get a sense that downside protection is becoming a theme. KJAN is part of Innovator's popular buffer ETF suite. At its core, it's an investment in the Russell 2000 index, but layers on derivatives contracts to protect against a pre-determined level of losses. In KJAN's case, it's the first 15% of losses over the entire outcome period, which is calendar year 2024. That downside protection, however, comes at a cost. Total returns during the outcome period are capped at 18.49%. In essence, you're trading some upside potential in exchange for gaining downside protection.

People often forget that a great way to generate total returns is by minimizing downside risks, not just maximizing upside potential. Buffer ETFs have become great at this. The 15% downside cushion doesn't eliminate all downside risk, although there is the Innovator Equity Defined Protection ETF (TJUL) if you want that, but it does protect against the downside that occurs in many situations. If you think equities are at risk of declining again in 2024, this is a great way to protect yourself.

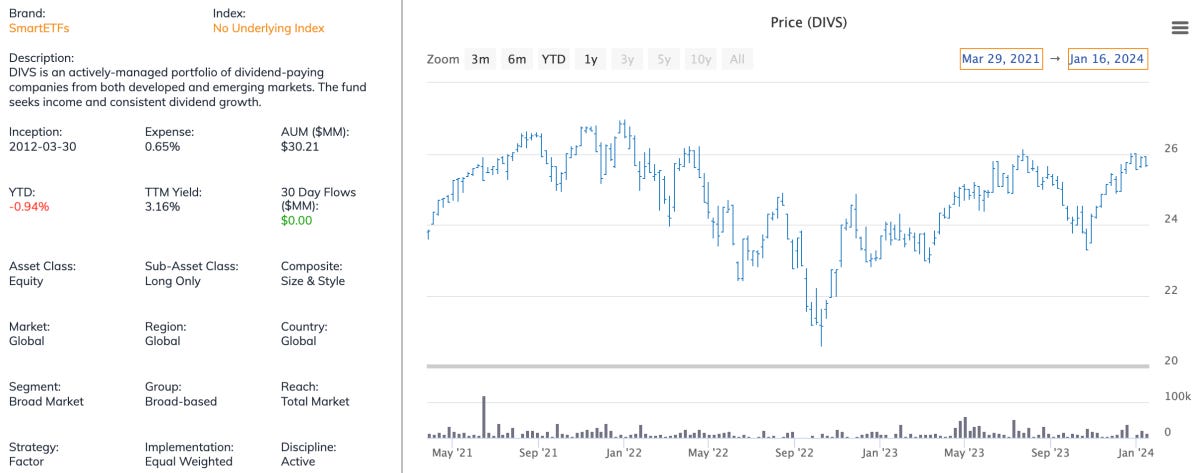

Dividends: SmartETFs Dividend Builder ETF (DIVS)

With tech & growth stocks dominating in 2023, there wasn't much room for dividend stocks to have a moment, but that could be getting ready to change. Large-caps, especially growth stocks, have gotten overvalued and the global economy has already slowed in many parts of the world, which opens the door for traditionally durable and defensive dividend payers to regain leadership.

DIVS is a great fund because it's actively-managed and focuses on a very specific set of criteria dealing with balance sheet quality and dividend growth potential to fill out its portfolio. The resulting portfolio is fairly concentrated, but it's a high conviction portfolio and uses equal weighting to help spread out some risks. At 0.65%, it's far from cheap to own and that's a drawback, but this could be one of those environments where having an active manager oversee and react to conditions proves beneficial.

Treasuries: WisdomTree Floating Rate Treasury ETF (USFR)

I'll be honest. I really have no idea which direction interest rates are going to go. They've been volatile for at least the past couple of years. They could head lower in a flight to safety trade if the economy breaks down or they could go higher if the Fed rejects current market expectations and keeps rates higher for longer. A wide range of possibilities is on the table. So why not remove duration risk from the equation and just focus on the income component?

USFR's use of floaters essentially turns it into a Treasury bill fund from a risk perspective at least. The yield will fluctuate along with changes to the yield curve, but the share price will fluctuate very little. The choice of whether rates are going higher or lower largely becomes irrelevant. With short-term yields of 5% or more still available, it's a great income component to a portfolio.

Corporates: iShares AAA-A Rated Corporate Bond ETF (QLTA)

Keeping with the theme of risk mitigation, QLTA deviates from the traditional strategy of many investment-grade corporate bond funds by avoiding the BBB-rated category. Many funds hold a high percentage of BBB debt in their portfolios because it gives them the highest yields while still maintaining investment-grade status. The problem is that a lot of these BBB's will end up behaving more like BB's or worse when conditions turn bad. Sticking with just the AAA-A tiers ensures that you're maintaining a high quality fixed income portfolio.

Honestly, this is a great fund to hold regardless of the environment. You're giving up a little yield in exchange for the better credit quality profile, but it's not much. QLTA's current 30-day yield of 4.80% is only slightly less than the 5.03% yield of the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD). This year, I think I'd much prefer the credit quality advantage over a measly extra 23 basis points of yield.

Thematic: ETFMG Prime Mobile Payments ETF (IPAY)

I'm not a big fan of tech stocks in 2024, so the inclusion of an ETF that's a quasi-tech portfolio may seem counterintuitive. Sometimes, however, there's an investment case to be made for an industry regardless of the fundamental macro background. For IPAY, the investment case is simple. People use their credit cards to pay for everything and they probably will for the foreseeable future. If companies, such as Visa or Mastercard take a small cut of every credit card transaction, they're probably cash cows, right? Who wouldn't want to own companies that are money-printing machines?

IPAY goes beyond just the credit card companies and includes mobile payment providers as well, such as Square and PayPal. Add in the infrastructure companies and you've got a broad coverage of a lucrative sector. Right now, wage growth is high and the labor market is tight, so consumers have income to spend. Retail sales are still strong. The backdrop for this sector is solid, even if the portfolio is a little pricey.

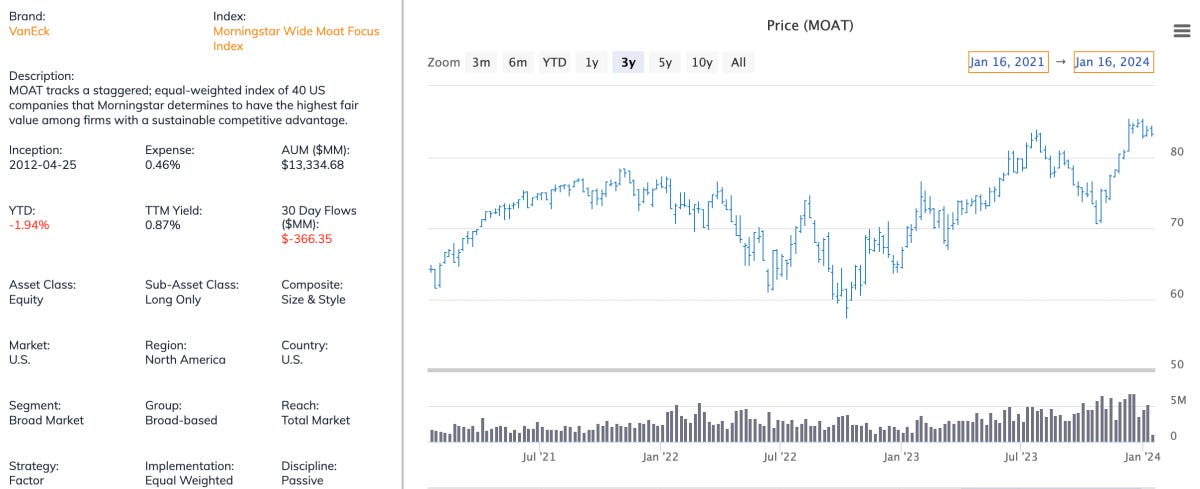

Factor: VanEck Morningstar Wide Moat ETF (MOAT)

MOAT is one of those ETFs that just makes sense to buy and hold forever. This fund targets companies that Morningstar has determined has a "moat", or a sustained competitive advantage. These companies, it's believed, can use these advantages to produce better financial results and better returns for shareholders. MOAT provides exposure to roughly 40 of these companies in equal allocations.

This ETF feels a little under the radar even though it has more than $13 billion in assets. It's been out of the spotlight with investors focusing on the hot tech companies, but its returns have held up very well with those sectors over the past several years. It also comes with Morningstar's highest 5-star rating.

International: Schwab International Dividend Equity ETF (SCHY)

If you're a big fan of the Schwab U.S. Dividend Equity ETF (SCHD), you'll probably love SCHY too. It's essentially the international version of it. Its selection criteria is essentially the same as SCHD's in that it focuses on companies with long track records of paying dividends, solid balance sheet fundamentals and high yields. It also layers on a volatility screen and eliminates REITs from consideration as added risk mitigation measures. It's a relatively newer fund, but its 0.14% expense ratio is VERY competitive within the international equity ETF space.

I've mentioned how I feel that dividend and value stocks have a good chance of coming back into favor in 2024, but I think a similar argument could be made for international stocks as well. The relative value compared to the S&P 500 is certainly there and foreign equities are long overdue for an extended stretch of leadership. Non-U.S. global economies are having a much rougher time right now than the United States, so it might take longer for sentiment to turn, but there's a lot of built up value here if you're willing to take the time to let the narrative play out.

Emerging Markets: Freedom 100 Emerging Markets ETF (FRDM)

Emerging markets ETFs can with some unique considerations. The biggest one is that many of them are dominated by China and China isn't really known as a shining example of capitalism. Many companies are state-run enterprises and aren't in business to necessarily make money for shareholders. The ones that are don't always have the best track record of business integrity and human rights. FRDM looks to eliminate the bad apples and targets companies with strong "freedom scores".

The fund's quantitative model looks at various civil, political and economic freedom criteria, such as human rights, rule of law, freedom of the press, access to international trade and the size of government. All of these are believed to create a pro-business environment that not only rewards companies, but rewards shareholders as well. In addition to the "feel good" impact of focusing on companies operating in better circumstances, FRDM has also developed a pretty solid track record of risk-adjusted returns.